The Solana price has staged a sharp recovery after a steep decline inside a falling channel. After slipping toward the lower part of that structure, $SOL found strong support near $67 in early February and rebounded over 30%. The bounce was fueled by dip buying, possibly by the most hopeful crowd.

At first glance, the rebound looks convincing. But the $SOL price is still trapped below major resistance, and on-chain data shows mixed conviction. The market now faces a critical test: whether buyers can turn this bounce into a sustained recovery, or whether selling pressure will return and drag the price lower again.

Dip Buyers Defended Key Support Zone

Solana’s rebound began before the price reached the bottom of its falling channel. Instead, buyers stepped in early near the $67 zone, which acted as an internal support level while the price was still sliding lower.

On February 6, $SOL printed a long lower wick on the daily candle near $67. A long lower wick shows that buyers aggressively absorbed selling pressure and rejected lower prices. This type of candle often appears when demand suddenly strengthens during panic phases.

This behavior was reinforced by the Money Flow Index (MFI). MFI combines price and volume to measure whether money is flowing into or out of an asset. Rising MFI during falling prices usually signals dip accumulation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Between December 18 and February 6, Solana’s price trended lower, but MFI trended higher. This bullish divergence showed that capital was steadily entering the market despite the downtrend. In simple terms, buyers were active even while the price was falling.

This early defense of $67 prevented Solana from sliding straight to the channel’s lower boundary. It created the base for the 30% rebound. But early dip buying alone is not enough to sustain a trend. To understand whether this support is durable, we need to see who is holding after the bounce.

Long-Term $SOL Holders Are Returning, But Conviction Remains Limited

After the dip, attention shifted to long-term investors.

For this, we look at Hodler Net Position Change (30-day). This metric tracks whether wallets holding $SOL for more than 155 days are accumulating or distributing. These investors usually provide the backbone of long-term trends.

On February 6, long-term holders were adding around 1.88 million $SOL. By February 8, this figure had risen to roughly 1.97 million $SOL. That represents an increase of about 5% in net accumulation.

This shows that conviction holders have started to return after the crash, aligning with the dip buying strength. That is a constructive signal, because sustainable recoveries rarely happen without their participation.

However, the pace remains slow. In strong recovery phases, long-term accumulation usually accelerates rapidly. Here, buying is cautious and incremental. This suggests that investors are testing the rebound rather than fully committing to it.

Because long-term conviction is still developing, the rebound remains vulnerable. That makes the behavior of short-term traders even more important.

Short-Term Selling Has Eased, But Loss Pressure Has Not Cleared

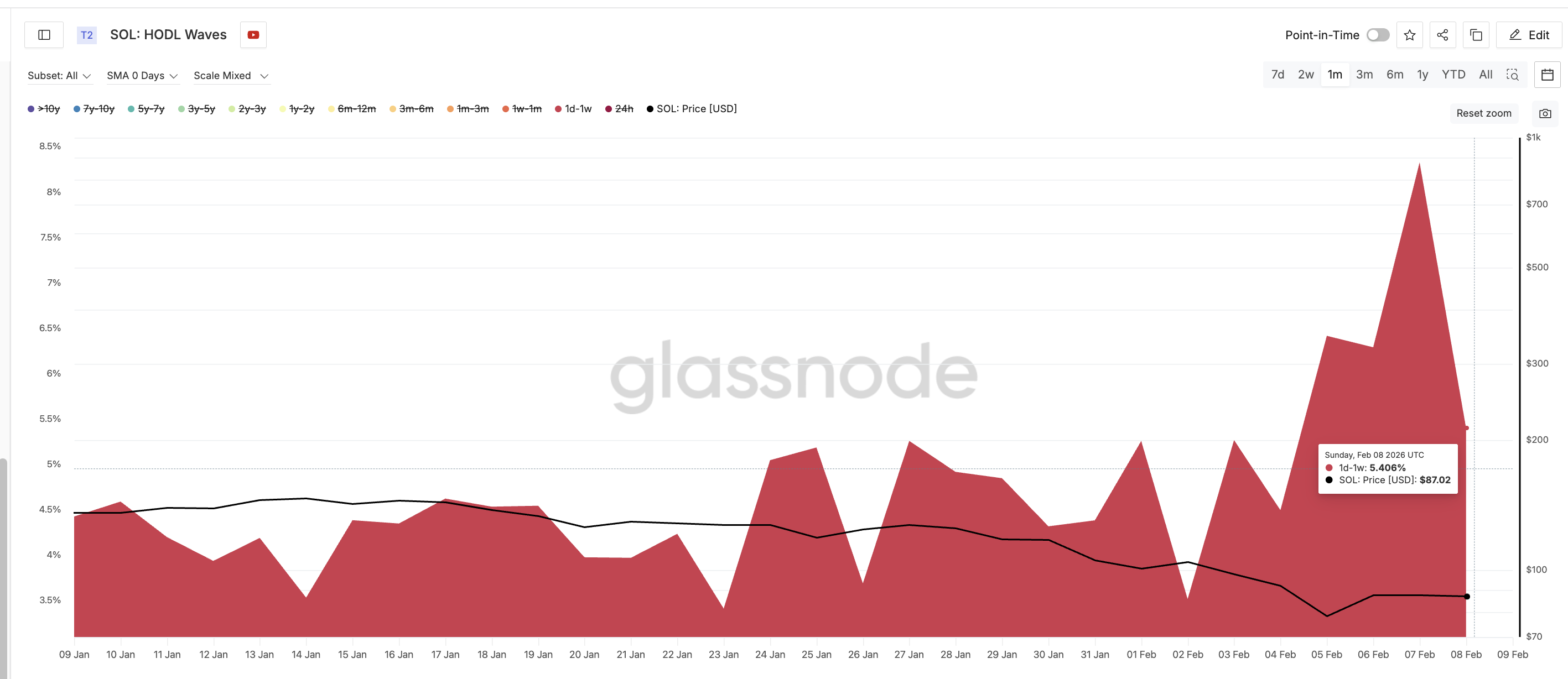

The 1-Day to 1-Week Holder Cohort, which represents highly reactive wallets, began selling into the bounce. On February 7, this group held about 8.32% of the $SOL supply. By February 9, that share had fallen to around 5.40%. This is a nearly 35% decline in just two days, as shown by the HODL Waves data.

This metric segregates $SOL wallets based how long coins have been held.

$SOL Holders Dumping">

$SOL Holders Dumping">

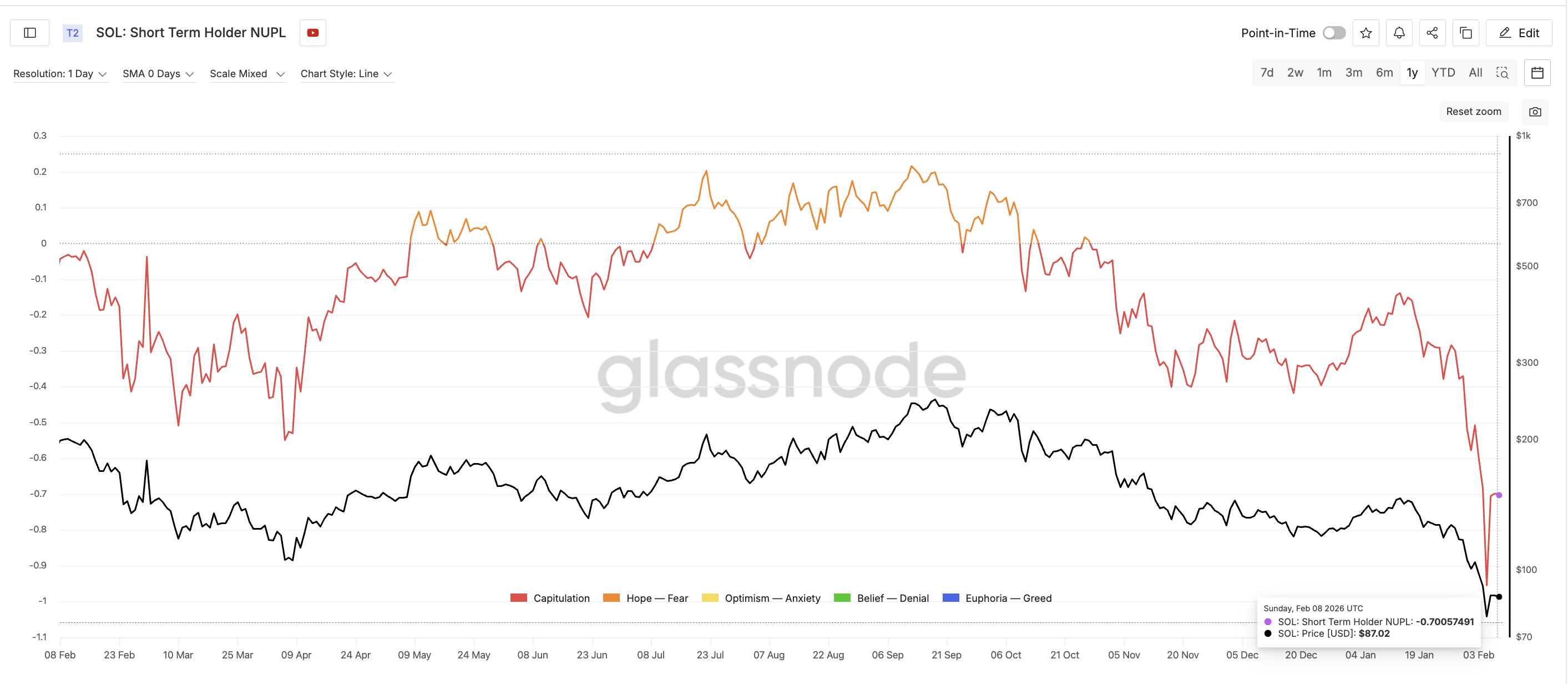

Despite this selling, the price held most of its gains. This shows that dip buyers, possibly the longer-term investors, absorbed the exits. That is a positive sign. However, another risk remains visible in Short-Term Holder NUPL, which measures whether recent buyers are in profit or loss.

On February 6, NUPL dropped to around -0.95, reflecting extreme losses and panic. After the rebound, it improved to roughly -0.70. That is an improvement of about 26%.

Losses have eased, but short-term holders are still deeply underwater. Historically, early NUPL recoveries often lead to unstable bottoms. Losses have eased too early. If price fails to move higher soon, remaining short-term holders may sell again to avoid deeper drawdowns. That could trigger another wave of pressure. This brings the focus back to the price chart.

Why $96 Will Decide Whether the Solana Price Bounce Survives or Fails

All technical and on-chain signals now converge around the same area.

Since the rebound, Solana has been trapped between roughly $80 and $96. This range reflects hesitation from both buyers and sellers.

As long as the price stays above $80, the rebound remains intact, despite possible short-term selling. But if $80 breaks, the next major zone sits near $67–$64. A loss of that area would reopen the path toward $41, which represents roughly a 50% downside from current levels and aligns with the broader channel projection.

This is the structural risk that still hangs over the market.

On the upside, $96 remains the most important level, the key test. It acted as strong support before the early February breakdown and now functions as major resistance.

A sustained break above $96 would signal renewed confidence. From there, Solana could target $116 and potentially $148. Without reclaiming this level, bounces are likely to stall. Right now, the price is still below this barrier.

Long-term buying is cautious. Short-term losses have eased too early. Until $96 is reclaimed with strong participation, the rebound lacks confirmation.

The post Solana’s 30% Bounce Faces a Critical Test — Where Is the Price Headed Next? appeared first on BeInCrypto.

invezz.com

invezz.com