While its weekly losses are still hanging over it, silver is again going up on Friday, February 6, gaining more than 8% on the daily chart.

At press time, the commodity was trading at $76/oz, and although this past week’s patterns suggest heightened volatility, an artificial intelligence (AI) model argues the precious metal is ultimately more likely to skew bullish toward February 28.

ChatGPT predicts silver price for the end of February 2026

Specifically, Finbold consulted OpenAI’s flagship algorithm, ChatGPT, about where silver might find itself on the last day of the month.

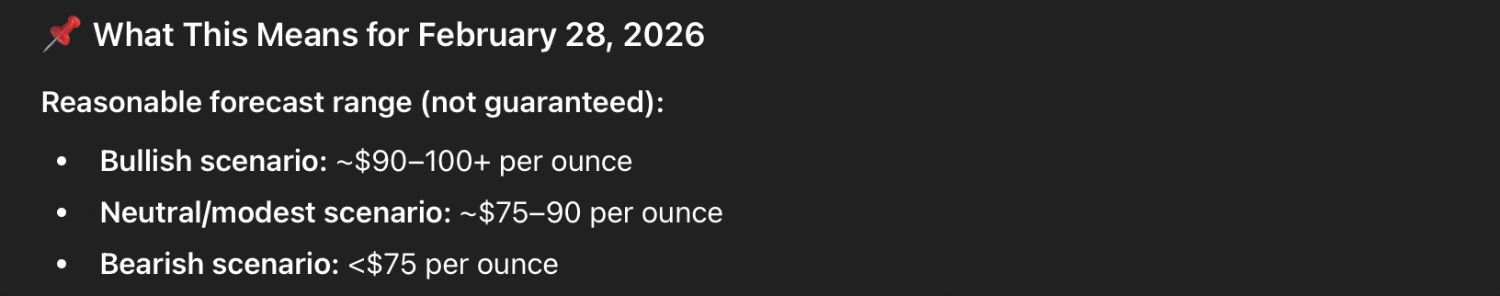

The chatbot prefaced its forecast with a warning that sharp swings could be likely, but it concluded that the base-case scenario could see silver changing hands at $75–90/oz.

In a decidedly bullish development, the metal would trade at $90–100/oz, or above, provided it can be supported by softer U.S. dollar pressure, easing rate expectations, and strong industrial demand.

Conversely, a bearish outcome could sink the price below $75 if waning momentum or renewed risk-off flows weigh down on it.

Asked to narrow the range down or pick a more specific figure, ChatGPT said its final call would be around $86.

Silver prices can go up, but volatility will remain

However, the large language model insisted on reiterating the idea that the ride toward any upside would not be smooth but choppy, marked by volatility spikes.

This implies the currently observable chart patterns are not going anywhere, as, for example, silver plunged nearly 10% earlier in the session and was down over 19% in the previous trading day.

While this could be due to silver’s vulnerability and exposure to speculative positioning and industrial demand, analysts understandably remain cautious on the near-term outlook.

The long-term outlook, on the other hand, appears largely positive, with commodities experts predicting that precious metals are most likely to flourish in 2026.

Featured image via Shutterstock

cointelegraph.com

cointelegraph.com