Shiba Inu faces renewed price pressure as massive liquidation and a brutal death cross fuel the prospect of further price declines.

Notably, Shiba Inu has printed another bearish indicator, this time on lower timeframes. This comes as the token remained under pressure following a broader weakness.

Despite a 4% rebound today, the $SHIB remains well within bearish territory, having recorded its third straight day of decline on Thursday. Meanwhile, yesterday’s 15% crash sparked a massive liquidation spree over the past 24 hours.

Key Points

- Shiba Inu faces renewed price pressure as massive liquidation and a brutal death cross fuel the prospect of further price declines.

- On the 30-minute chart, Shiba Inu confirmed a classic “death cross,” where the 50-period moving average drops below the 200-period moving average.

- Typically, this setup reflects fading short-term momentum and often appears during extended selloffs.

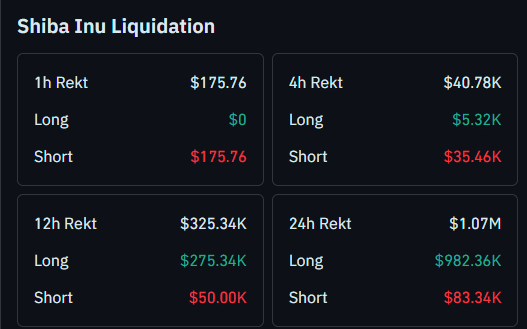

- Across the crypto sector, over $2.59 billion in liquidations occurred in the last 24 hours, with $SHIB accounting for $1.07 million.

- From a technical standpoint, $SHIB still looks weak.

$SHIB Death Cross Signals Short-Term Weakness

On the 30-minute chart, Shiba Inu confirmed a classic “death cross,” where the 50-period moving average dropped below the 200-period moving average. Typically, this setup reflects fading short-term momentum and often appears during extended selloffs.

Earlier on February 3, Shiba Inu showed rebound momentum, which pushed its 50-period MA briefly above the 200-period MA. However, the golden cross did not last long, as a death cross followed yesterday, indicating the ongoing correction could continue.

Notably, the earlier golden crossover formed as $SHIB continued to print lower highs but was invalidated with $SHIB’s Thursday lower lows, reinforcing the bearish structure.

Although shorter time frames can produce false signals, the alignment with broader market weakness adds weight to the pattern. As a result, buyers may maintain caution until price action shows clear stabilization above key averages.

Liquidations Add to Selling Pressure

Meanwhile, derivatives markets show that forced position closure accelerated during the downturn. Across the crypto sector, over $2.59 billion in liquidations occurred within the past 24 hours, wrecking leveraged traders.

Long positions accounted for the bulk of the losses, with $2.14 billion wiped out, compared with $455.7 million in shorts. When bullish bets unwind this quickly, it often amplifies declines by creating tension in the market.

While Shiba Inu is not among the assets with the largest liquidation, traders also lost a considerable amount of money. In the past 24 hours, a total of $1.07 million in positions were liquidated, with bulls accounting for $982,360.

What Could Follow for Shiba Inu?

From a technical standpoint, $SHIB still looks weak. Even though it has rebounded considerably today, it has failed to sustain this in recent instances. This eventually forms a lower high before the next leg down.

However, Shiba Inu trades near a key support level, and the current bounce might be bulls stepping in to defend the area. Notably, $SHIB has never broken the current support level at around $0.0000051, highlighting its importance.

Therefore, while a short-lived bounce is positive, sustaining it remains key. Moreover, the broader market needs to stabilize for $SHIB to have any chance of reversing the bearish trend. In the meantime, sellers continue to control the market’s direction, with Shiba Inu trading near $0.00000596.

coindesk.com

coindesk.com