Bitcoin slid under the $68,000 level in U.S. morning hours Thursday, extending a week-long selloff that has tracked weakness across global risk assets and deepened concerns about near-term downside.

Crypto liquidations crossed $1 billion over the past 24 hours, wiping out about $980 million million in bullish leveraged bets as the slide forced traders to close positions they could not keep funded.

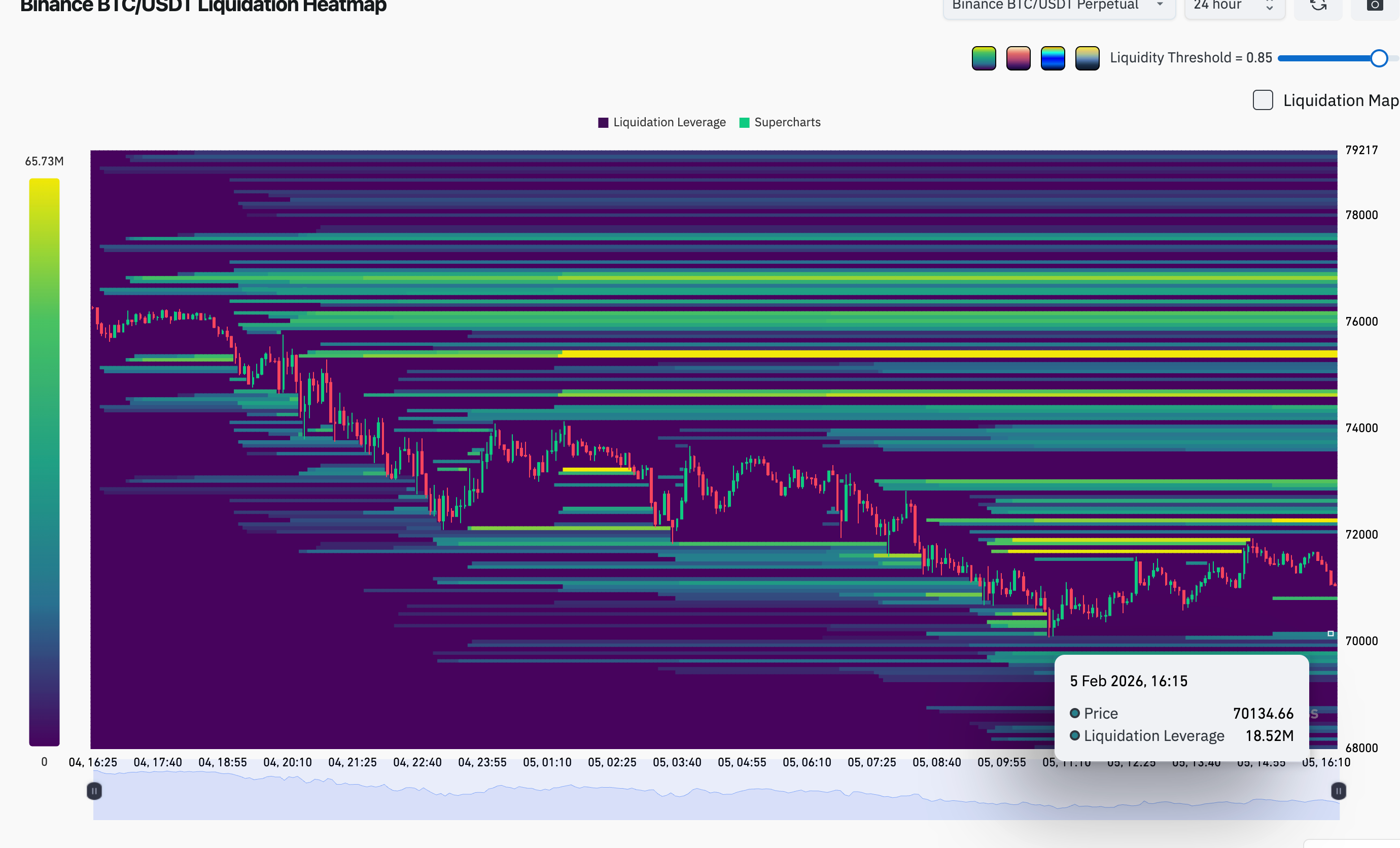

Price fell under $70,000 earlier in the day, with liquidity heatmaps pointing to further downside.

Liquidity thins out quickly until just under $70,000, per Coinglass data, where another smaller cluster appears. That makes $70,000 a mechanically important level. If price pushes cleanly through it, there’s less forced buying from liquidations to slow the move, raising the risk of a faster flush toward the high $60,000s.

A liquidation heatmap is a map of where leveraged traders are most likely to get forced out. Bright bands mark price levels with lots of estimated liquidation points, which can act like short term magnets for price moves. Traders use it to spot crowded zones and likely volatility pockets, not exact turning points.

Silver’s renewed plunge and broader deleveraging across macro trades have added to risk-off positioning, with crypto increasingly trading as part of the same liquidity-driven complex.

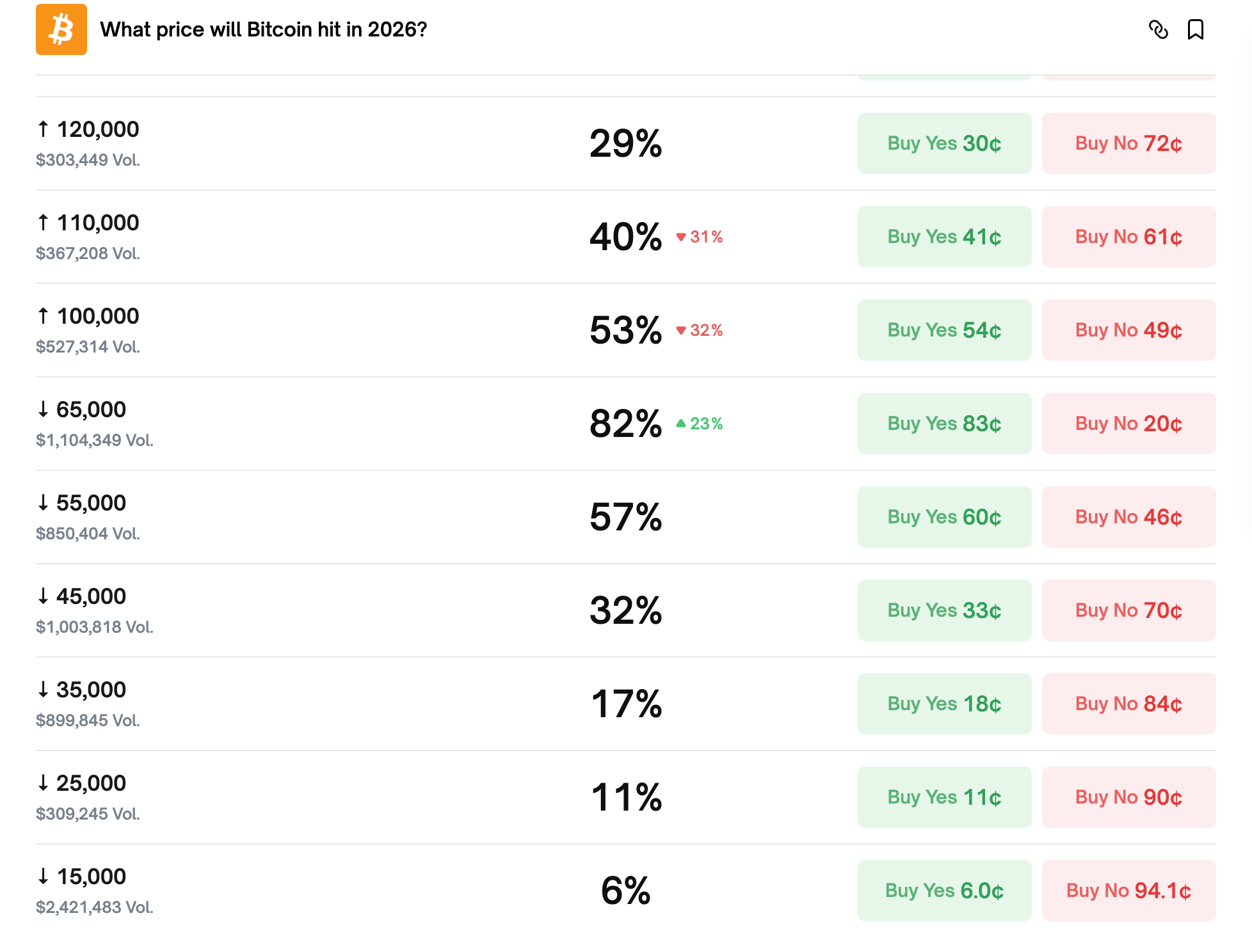

Meanwhile, prediction markets are also signaling a shift in sentiment. On Polymarket, contracts tied to bitcoin’s 2026 price outcomes now skew toward lower levels, with traders assigning the highest probability to prices at or below $65,000.

Odds for deeper drawdowns into the mid-$50,000 range have climbed in recent days, while expectations for six-figure prices have faded sharply from January highs.

Flows data points to similar caution. US-listed spot bitcoin ETFs have logged net outflows this week, while activity in perpetual futures has thinned as leverage is reduced.

Some market participants still view the $68,000 to $70,000 zone as a key technical area, citing heavy prior trading activity and long-term holder cost bases clustered nearby.

A sustained break below that range could open the door to a deeper consolidation phase, echoing prior post-rally drawdowns.

newsbtc.com

newsbtc.com

en.cryptonomist.ch

en.cryptonomist.ch