By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin's $BTC$76,020.66 bear market feels brutal and could deepen. Analysts are suggesting potential Fed interest-rate cuts and crypto-specific regulatory breaks are required to turn the tide.

But beneath the surface, something as simple as two behavioral biases may play a pivotal role: anchoring bias and regret aversion.

Last year's bull market didn't feel like a bull market. Absent was the frenzied retail and institutional stampede of 2020-21 or 2017. Spot ETFs sucked in billions, but mostly as a result of arbitrage bets, not outright bullish positioning. That's possibly due to the anchoring bias, a mental shortcut where people fixate on one piece of information, like a reference price, and skew their judgment of value.

Investors may have been swayed by bitcoin's $100,000 price tag, and then balked: "That's way higher than typical tech stocks, even Nasdaq doesn't trade that high; must be overpriced." In other words, they could have anchored on familiar benchmarks, decided $BTC was too costly and sat on the fence.

Fast forward to today: Bitcoin trades at $76,000, well off its peak. If it drops under $60,000, a 50% discount to its October high, last year's holdouts have every reason to pile in long and strong. That's regret aversion: fear of missing future gains after sitting out, driving aggressive dip-buying in assets with proven upward trajectories.

While behavioral biases offer one compelling theory for a snapback there's still the possibility that macroeconomic influences and regulatory developments could call the shots.

For now, the crypto market has stabilized, with bitcoin bouncing to $76,000 from overnight lows near $73,000 amid oversold signals from technical indicators. Ether $ETH$2,242.16, solana SOL$96.06 and $XRP $XRP$1.5960 also rose, but are being overshadowed by more substantial gains in monero XMR$388.96, WLFI and other smaller tokens.

Onchain data shows that profit-taking by long-term holders, or wallets with a history of holding coins for over five months, has slowed, according to Tagus Capital.

Still, the risk of a deeper selloff prevails if Wall Street's tech-heavy index, the Nasdaq 100, extends Monday's selloff and Treasury yields rise further. Key U.S. data due for release today — the ADP employment and ISM services — could add to market volatility. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Nothing scheduled.

- Macro

- Feb. 4, 7 a.m.: U.S. MBA 30-year mortgage rate for week ending Jan. 30 (Prev. 6.24%)

- Feb. 4, 10 a.m.: U.S. ISM Services PMI for January (Prev. 54.4)

-

Earnings (Estimates based on FactSet data)

- Feb. 4: CME Group (CME), pre-market, $2.74

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Feb. 4: Stacks to host a townhall meeting.

- Unlocks

- No major unlocks.

- Token Launches

- Feb. 4: THORChain Solana mainnet is expected to debut.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 4 of 4: Web Summit Qatar (Doha, Qatar)

Market Movements

- $BTC is down 0.14% from 4 p.m. ET Thursday at $76,051.11 (24hrs: -2.75%)

- $ETH is down 0.98% at $2,607.45 (24hrs: -1.75%)

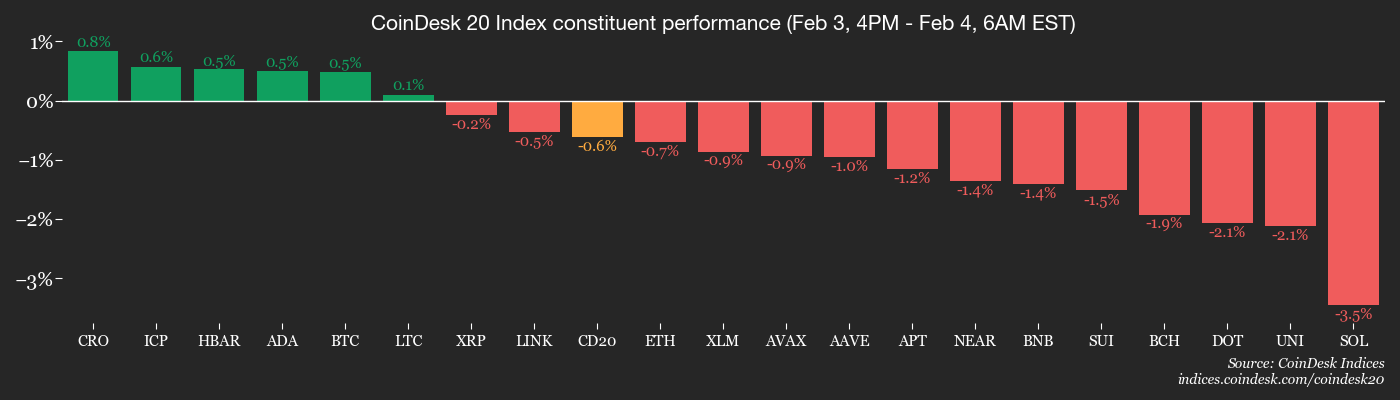

- CoinDesk 20 is down 0.73% at 2,230.96 (24hrs: -1.9%)

- Ether CESR Composite Staking Rate is down 17 bps at 2.83%

- $BTC funding rate is at 0.0028% (3.0748% annualized) on Binance

- DXY is unchanged at 97.53

- Gold futures are up 2.81% at $5,073.50

- Silver futures are up 7.99% at $89.96

- Nikkei 225 closed down 0.78% at 54,293.36

- Hang Seng closed unchanged at 26,847.32

- FTSE is up 1% at 10,417.96

- Euro Stoxx 50 is up 0.21% at 6,008.14

- DJIA closed on Tuesday down 0.34% at 49,240.99

- S&P 500 closed down 0.84% at 6,917.81

- Nasdaq Composite closed down 1.43% at 23,255.19

- S&P/TSX Composite closed up 0.64% at 32,388.60

- S&P 40 Latin America closed up 2.89% at 3,761.64

- U.S. 10-Year Treasury rate is up 0.7 bps at 4.28%

- E-mini S&P 500 futures are up 0.13% at 6,950.50

- E-mini Nasdaq-100 futures are unchanged at 25,455.00

- E-mini Dow Jones Industrial Average Index futures are up 0.28% at 49,486.00

Bitcoin Stats

- $BTC Dominance: 59.63% (-0.02%)

- Ether-bitcoin ratio: 0.02966 (0.61%)

- Hashrate (seven-day moving average): 880 EH/s

- Hashprice (spot): $33.97

- Total fees: 3.3 $BTC / $254,499

- CME Futures Open Interest:115,185 $BTC

- $BTC priced in gold: 15 oz.

- $BTC vs gold market cap: 5.06%

Technical Analysis

- The chart shows $XRP's price swings in candlestick format.

- Prices have penetrated support at $1.60. This is the level where buyers stepped in during the April selloff, arresting the slide.

- A drop lower, therefore, indicates significant weakening of demand, suggesting potential for a deeper decline toward $1.00.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $179.66 (-4.36%), -0.19% at $179.32 in pre-market

- Circle Internet (CRCL): closed at $56.16 (-4.59%), -0.32% at $55.98

- Galaxy Digital (GLXY): closed at $21.98 (-16.87%), +0.18% at $22.02

- Bullish (BLSH): closed at $27.64 (-3.93%), -0.14% at $27.60

- MARA Holdings (MARA): closed at $9.05 (-0.77%), -0.99% at $8.96

- Riot Platforms (RIOT): closed at $15.34 (+0.13%), -0.46% at $15.27

- Core Scientific (CORZ): closed at $17.74 (-0.73%), unchanged in pre-market

- CleanSpark (CLSK): closed at $11.36 (+2.90%), -0.97% at $11.25

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.30 (+1.94%)

- Exodus Movement (EXOD): closed at $10.47 (-6.35%), unchanged in pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.26 (-4.56%), -0.68% at $132.36

- Strive (ASST): closed at $0.68 (-5.67%), -3.08% at $0.66

- SharpLink Gaming (SBET): closed at $7.66 (-1.67%), -1.57% at $7.54

- Upexi (UPXI): closed at $1.55 (-4.32%)

- Lite Strategy (LITS): closed at $1.15 (+0.88%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$272 million

- Cumulative net flows: $55.28 billion

- Total $BTC holdings ~1.28 million

Spot $ETH ETFs

- Daily net flows: $14 million

- Cumulative net flows: $12.02 billion

- Total $ETH holdings ~5.9 million

Source: Farside Investors

While You Were Sleeping

- Tether scales back $20 billion funding ambitions after investor resistance: FT (CoinDesk): Tether pulled back from plans to raise as much as $20 billion in fresh capital after facing investor resistance to a proposed valuation.

- Stocks waver after AI scare as gold hits $5,000 (Bloomberg): Stocks fluctuated after a selloff in software shares, while gold reclaimed the $5,000-an-ounce mark. Economically sensitive shares were Wednesday’s biggest gainers.

- US and Iran to seek de-escalation in nuclear talks in Oman, regional official says (Reuters): The U.S. and Iran are due to hold talks in Oman on Friday, as a build-up of U.S. forces in the Middle East raises concerns of a confrontation.

thecryptobasic.com

thecryptobasic.com

beincrypto.com

beincrypto.com