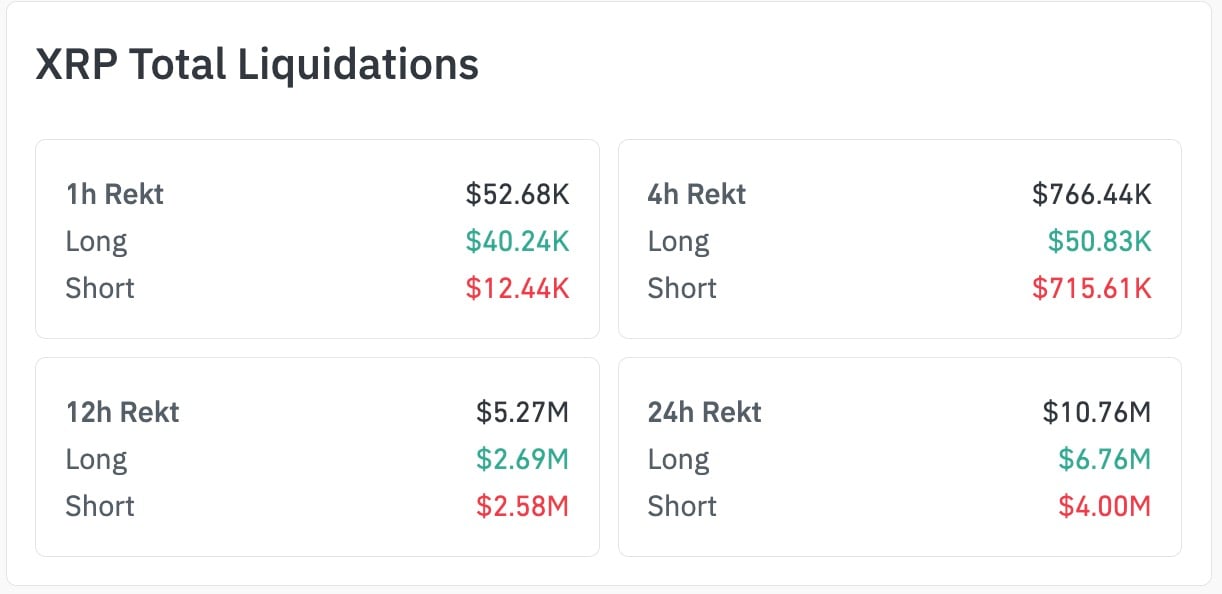

It is not just another red candle; $XRP just had one of its most distorted liquidations at the start of February. Short positions got hit hard, with CoinGlass showing a $715,610 short liquidation versus just $50,830 in longs over a four-hour window — a wild imbalance of 1,407%.

This liquidation spike was not an isolated event. It followed a rough few weeks in late 2025 that took $XRP from above $3 down to $1.53, before a slight recovery to $1.63. But that bounce might have just been enough to trigger forced closures for short-sellers, who were overleveraged and betting on a steeper flush below the $1.50 zone.

Even across the 24-hour period, $4 million in shorts were liquidated versus $6.76 million in longs — a rare pattern reversal after a weekend of bearish dominance. The four-hour print is still the most surprising; it could be an isolated whale trap or algo-induced short squeeze.

What about $XRP price?

The $XRP price is up 2.9% today, but the overall downward trend is still running. $XRP is still below its December low, and it is not even close to hitting the key resistance at $1.89 or $2. If the squeeze was just mechanical and not fundamental, there is plenty of downside risk still.

The technical setup does not offer much comfort. $XRP managed to hold onto a local support level, but the next target is looking like it will be around $1.45. Higher time frame charts still show a bearish trend.

Thus, we have one question to answer here: was this imbalance a reversal signal or a liquidation echo? History shows that short-side wipes usually only result in temporary relief, and they rarely lead to a full cycle bottom.

If $XRP does not bounce back above $1.80-$2 soon, it might be a sign that the market is overreacting.

For now, the 1,407% liquidation gap is just a one-time thing, but if the bulls cannot build on it, it will be seen as a short-term, costly misstep by those who are too pessimistic.

coindesk.com

coindesk.com

finbold.com

finbold.com

newsbtc.com

newsbtc.com