As the price of $XRP continues to face volatility, cryptocurrency prediction markets suggest that the token is likely to remain below the crucial $2 level by the end of February.

Indeed, $XRP has been weighed down by the broader market correction, with some analysts warning that the asset could potentially crash to $1 if key support zones fail to hold.

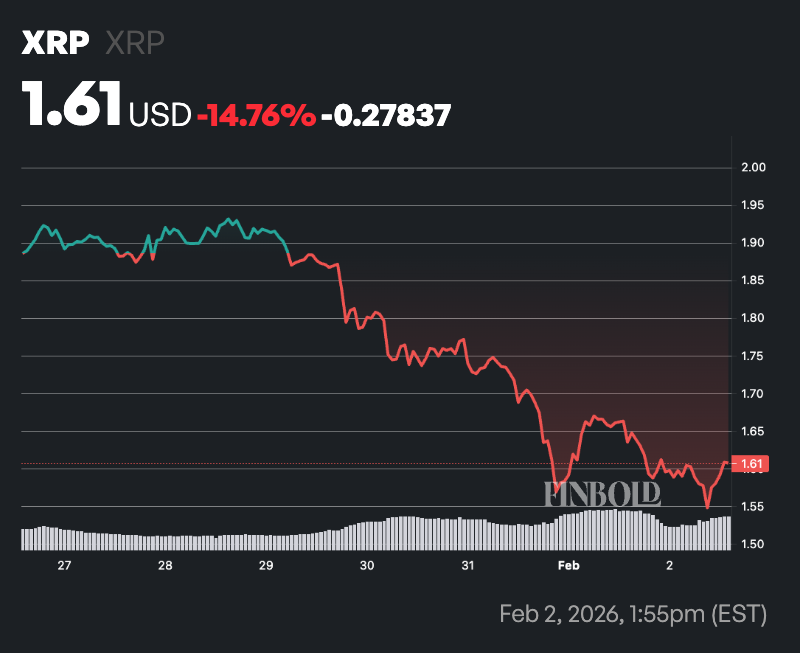

As of press time, $XRP was trading at $1.61, having plunged by over 2% in the past 24 hours, while on the weekly timeframe, the digital asset remains in the red by nearly 15%.

Regarding the price outlook, insights from the cryptocurrency prediction platform Polymarket are weighing several scenarios for the asset.

$XRP price prediction

Data from Polymarket’s betting pools on $XRP’s February price targets, retrieved on February 2, offer a cautiously optimistic outlook centered on moderate gains.

The highest implied probability, at 53%, is assigned to $XRP reaching or exceeding $1.80, suggesting bettors view this as the most probable peak or closing level for the month.

Close behind is a 48% chance of surpassing $1.40, indicating strong confidence in avoiding severe declines while anticipating some upward momentum from current levels.

Higher ambitions appear more tempered, with only 27% odds of topping $2 and slimmer chances for loftier thresholds, such as 11% for $2.20 and 6% for $2.40.

On the downside, the market assigns minimal weight to sharp declines, with just a 6% probability of dipping below $1 and even lower odds for sub-$0.80 levels.

$XRP ideal February price

This distribution points to a consensus that $XRP will likely stabilize or climb modestly by month’s end, with the bulk of trading activity concentrated around mid-range outcomes such as $1.80, reflecting a balanced outlook amid ongoing corrections.

Beyond prediction markets, historical data adds a note of caution, showing February as a typically weak month for $XRP, with median returns of around -8%, potentially pushing prices toward $1.45 or even $1.24 if bearish trends persist.

However, bullish catalysts remain in play, including ETF inflows surpassing $1.3 billion year to date and Ripple’s ongoing developments in cross-border payments, which could support a rebound.

Featured image via Shutterstock

beincrypto.com

beincrypto.com