Solana ($SOL) is under pressure as its price continues to decline.

The cryptocurrency is currently trading at $119.27, down 5.2% in the last 24 hours.

This drop has underperformed the broader crypto market, which fell by 4.77% in the same period.

The weekly picture is also bleak, with $SOL down 7.36% over the last seven days.

Analysts point to a combination of macroeconomic risk aversion and internal network challenges as key drivers.

Validator exodus raises concerns

Copy link to section

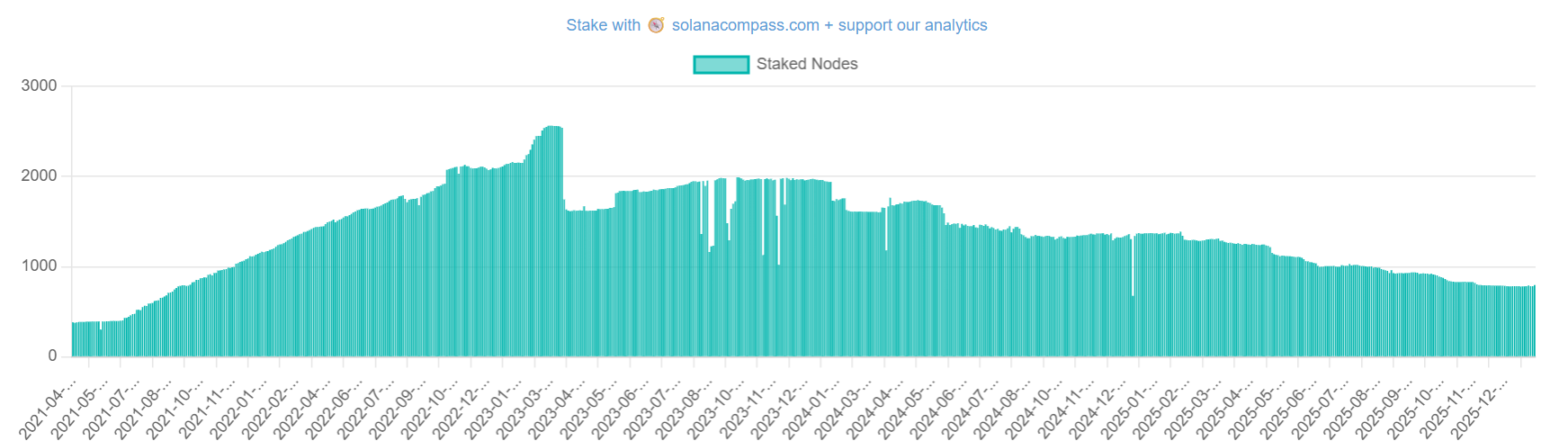

Solana’s validator count has dropped sharply.

The network has lost approximately 68% of its validators since March 2023 according to data obtained from Solana Compass.

It fell from around 2,560 active validators at its peak to roughly 795 today.

Validators are crucial for Solana’s proof-of-stake consensus.

They produce blocks, verify transactions, and maintain the security of the network.

Rising operating costs have forced many smaller validators to exit.

Validators must now commit at least $49,000 worth of $SOL for their first year of operations, on top of hardware and server expenses.

Daily voting fees, which can reach up to 1.1 $SOL, add further financial strain.

Competition from large validators offering zero-percent commission also squeezes smaller operators out.

Some of the decline reflects inactive or “zombie” nodes leaving, but experts say this does not explain the full extent of the drop.

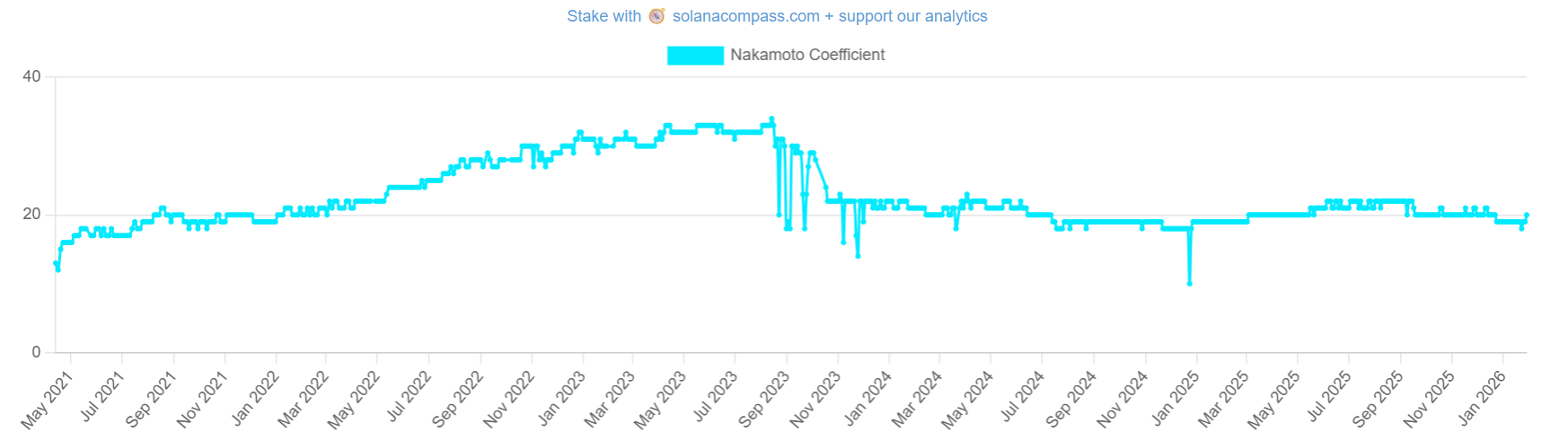

The reduced validator count has had a measurable impact on Solana’s decentralization.

The network’s Nakamoto Coefficient has fallen from 31 to 20, signaling a concentration of power among fewer validators.

This raises concerns about the network’s long-term security and resilience.

$SOL price also under pressure from macro factors

Copy link to section

Solana’s price decline has also been driven by market-wide risk aversion.

A selloff in global equities and precious metals triggered a crypto downturn.

On January 29, 2026, the Nasdaq fell over 2%, led by Microsoft shares dropping about 11% after disappointing earnings.

High-beta altcoins like $SOL are particularly sensitive to these shifts in market sentiment.

When investors reduce exposure to volatile assets, crypto is often the first to see selling pressure.

The decline has been amplified by leveraged position unwinds.

Data shows over $800 million in crypto liquidations in the past 24 hours, with nearly $700 million from long positions.

Forced selling creates a feedback loop, pushing prices lower and triggering additional margin calls.

Technical factors are also at play.

$SOL has already broken past the critical support at $118, with a swing low of $117.58.

The daily RSI of 36.30 indicates bearish momentum, while the MACD histogram at −1.70 confirms the strengthening downtrend.

Reclaiming $118 could stabilize the price and attract bargain hunters.

However, a break below $115 would likely open the door to a further decline toward $112.

newsbtc.com

newsbtc.com

u.today

u.today