By Omkar Godbole (All times ET unless indicated otherwise)

They said bitcoin has a dual appeal: first, as a gold-like digital token with a capped supply of 21 million, and second, as a decentralized technology that allows anyone to move money transparently without intermediaries.

As of now, it's failing to hold up as both a store of value and a payments infrastructure. Bitcoin's underperformance relative to gold, silver and other precious metals is well documented.

Equally disappointing is the slowdown in onchain activity to levels last seen in mid-2025. For instance, the 30-day average of daily confirmed payments processed on the Bitcoin blockchain has dropped to 748,368, the lowest since mid-July, according to data source Blockchain.com. The tally peaked at over 884,000 in September. A payment means the recipient(s) receive funds via an on-chain transaction.

The monthly average of the number of confirmed transactions shows a similar decline in network usage. The mempool, or "memory pool," where unconfirmed transactions wait for miners to verify them, has dried up too. It's stuck at just a few thousand unconfirmed transactions per day, a trend that's dragged on since late 2025.

"On-chain signals point to a market in consolidation rather than accumulation. Network activity has softened. The reduced institutional and retail conviction can be seen in lower active addresses and subdued transaction volumes," Vikram Subburaj, CEO of the India-based Giottus exchange, said in an email.

A token's price is tied to the active user adoption of its parent network, and the recent decline in activity at least partially explains $BTC's dull price performance in recent months.

Bitcoin, the leading cryptocurrency by market value, has fallen back to $87,500 after hitting highs above $90,000 ahead of Wednesday's Fed meeting. The central bank kept interest rates unchanged, as expected. The accompanying policy statement and Chairman Jerome Powell's press conference suggested policymakers could be more cautious about rate cuts in the coming months.

With $BTC's turn lower, standout sectors from early this week are now deep in the red. For instance, the CoinDesk Memecoin Index (CDMEME) has declined by more than 9% over the past 24 hours. The Metaverse Select (MTVS) and Culture and Entertainment indexes are down over 5% each.

Meanwhile, gold tokens PAXG and XAUT traded higher, drawing strength from the continued rally in spot gold prices. Worldcoin's WLD rose 5%.

In traditional markets, oil prices rose to four-month highs on both sides of the Atlantic, threatening to inject inflation into the global economy. A renewed energy-led inflationary impulse could make it even harder for the Fed to reduce rates next time. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Jan. 29, 2 p.m.: CFTC Chairman Mike Selig to join SEC Chairman Paul Atkins to discuss harmonization in the crypto era.

- Macro

- Jan. 29, 8:30 a.m.: U.S. balance of trade for November (Prev. $331.4B)\

- Jan. 29, 8:30 a.m.: U.S. initial jobless claims for week ending Jan. 24 (Prev. 200K)

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Jan. 29: Helium to host a Deployer Roundtable community call.

- Jan. 29: Alchemy Pay to host a community Ask Me Anything (AMA) session on Discord.

- Beefy DAO is voting on whether to reallocate protocol revenue to a new “Protocol Coverage Fund” to finance Nexus Mutual coverage that benefits Beefy users. Voting ends Jan. 29.

- Sushi is voting to execute the migration of ~$57M in legacy liquidity to V3 protocol-deployed positions. Voting ends Jan. 29.

- Unlocks

- No major unlocks.

- Token Launches

- No major token launches.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 2 of 4: WallStreetBets Live (Miami, Florida)

Market Movements

- $BTC is down 1.67% from 4 p.m. ET Wednesday at $87,798.68 (24hrs: -2.39%)

- $ETH is down 2.5% at $2,941.84 (24hrs: -3.59%)

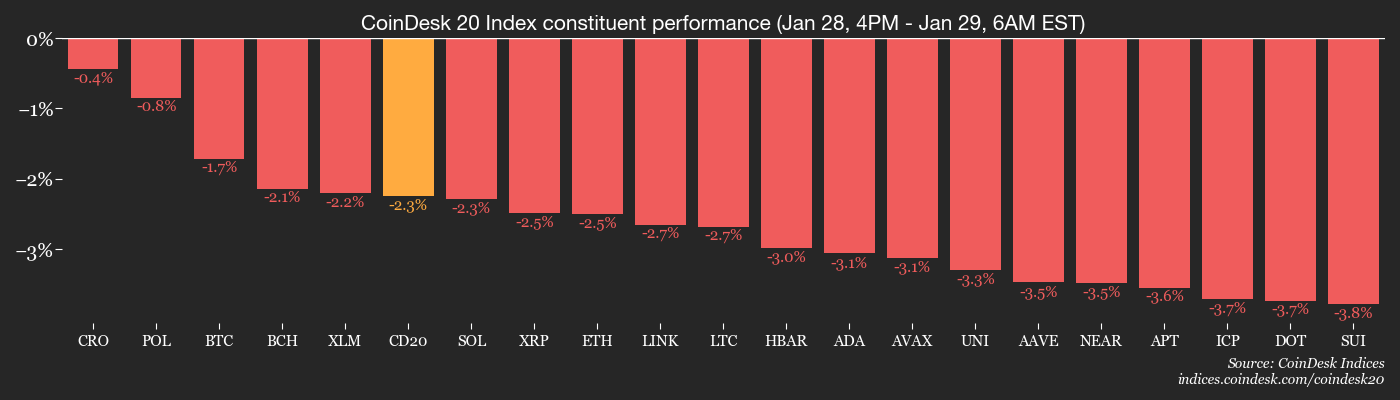

- CoinDesk 20 is down 2.13% at 2,679.82 (24hrs: -2.9%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.81%

- $BTC funding rate is at 0.0073% (7.9628% annualized) on Binance

- DXY is unchanged at 96.44

- Gold futures are up 3.1% at $5,505.70

- Silver futures are up 2.46% at $116.32

- Nikkei 225 closed unchanged at 53,375.60

- Hang Seng closed up 0.51% at 27,968.09

- FTSE is up 0.44% at 10,198.87

- Euro Stoxx 50 is up 0.39% at 5,956.17

- DJIA closed on Wednesday unchanged at 49,015.60

- S&P 500 closed unchanged at 6,978.03

- Nasdaq Composite closed up 0.17% at 23,857.45

- S&P/TSX Composite closed up 0.24% at 33,176.07

- S&P 40 Latin America closed up 1.17% at 3,751.00

- U.S. 10-Year Treasury rate is up 0.4 bps at 4.255%

- E-mini S&P 500 futures are unchanged at 7,011.50

- E-mini Nasdaq-100 futures are up 0.1% at 26,181.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 49,137.00

Bitcoin Stats

- $BTC Dominance: 59.65% (0.1%)

- Ether-bitcoin ratio: 0.03335 (-1.07%)

- Hashrate (seven-day moving average): 872 EH/s

- Hashprice (spot): $39.24

- Total fees: 2.87 $BTC / $256,633

- CME Futures Open Interest: 113,020 $BTC

- $BTC priced in gold: 15.9 oz.

- $BTC vs gold market cap: 5.88%

Technical Analysis

- The chart shows bitcoin's daily price swings since November.

- The price has turned lower after facing rejection at the resistance of the bullish trendline, a technical analysis term for steady a uphill path.

- That has shifted the focus to support first at $86,000 followed and then, if it falls through, at $84,445.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $209.43 (-0.66%), -0.9% at $207.54 in pre-market

- Circle Internet (CRCL): closed at $72.84 (+4.12%), -0.91% at $72.18

- Galaxy Digital (GLXY): closed at $31.90 (-3.86%), -0.85% at $31.63

- Bullish (BLSH): closed at $34.33 (-1.35%), -0.17% at $34.27

- MARA Holdings (MARA): closed at $10.37 (-1.43%), -1.16% at $10.25

- Riot Platforms (RIOT): closed at $17.55 (+0.00%), -0.4% at $17.48

- Core Scientific (CORZ): closed at $19.49 (-2.26%), +0.15% at $19.52

- CleanSpark (CLSK): closed at $13.45 (+1.36%), -1.49% at $13.25

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $51.37 (+0.92%)

- Exodus Movement (EXOD): closed at $14.33 (-7.43%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $158.45 (-1.94%), -0.71% at $157.33

- Strive (ASST): closed at $0.80 (-2.20%), -0.51% at $0.80

- SharpLink Gaming (SBET): closed at $9.97 (-0.2%)

- Upexi (UPXI): closed at $1.96 (-1.01%)

- Lite Strategy (LITS): closed at $1.31 (-0.76%), +0.76% at $1.32

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$19.6 million

- Cumulative net flows: $56.32 billion

- Total $BTC holdings ~1.29 million

Spot $ETH ETFs

- Daily net flows: $28.1 million

- Cumulative net flows: $12.41 billion

- Total $ETH holdings ~6.04 million

Source: Farside Investors

While You Were Sleeping

- Trump warns Iran to make nuclear deal or next attack will be 'far worse' (Reuters): President Donald Trump urged Iran to make a deal on nuclear weapons or the next U.S. attack would be far worse. Tehran replied threatening strikes on the U.S., Israel and those who support them.

- Brent Crude Hits $70 a Barrel as Trump Ramps Up Iran Threats (Bloomberg): Brent crude futures hit $70 a barrel for the first time since September. The global oil benchmark rose as much as 2.7%. West Texas Intermediate topped $65.

- First gold and silver, now oil is starting to rally and that's bad news for bitcoin (CoinDesk): Rising oil prices risk stoking inflation, reducing chances of near-term Fed rate cuts and pressuring bitcoin, which has struggled as macro forces tilt against risk assets.

- Gold Shows No Signs of Slowing, Silver Hit New Records; S&P Futures Gain (Bloomberg): Gold futures neared $5,600 an ounce for the first time and silver contracts hit record highs. Copper, platinum and palladium futures rallied, too.

newsbtc.com

newsbtc.com

u.today

u.today