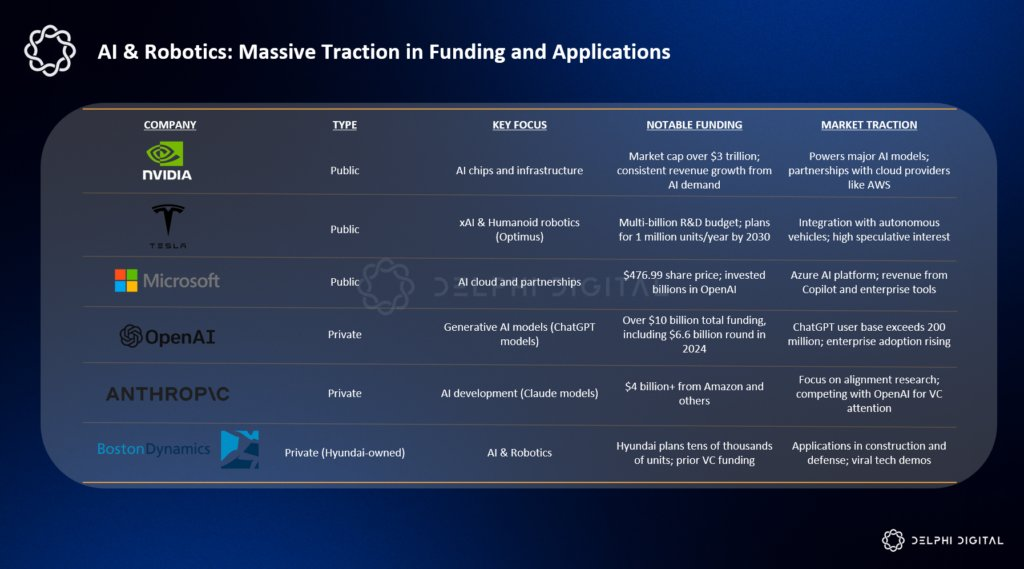

Speculative capital is increasingly flowing out of cryptocurrency markets and into other emerging technologies such as artificial intelligence and robotics, according to research company Delphi Digital.

Last year’s underperformance of most altcoin sectors shows that crypto is no longer the “default destination” for speculative capital seeking higher-risk opportunities, wrote Delphi Digital in a Wednesday X post.

“Crypto isn't just competing with other crypto anymore. It’s competing with every exponential technology narrative vying for speculative dollars.”

The trend illustrates that emerging tech opportunities may continue limiting investment into the wider cryptocurrency space, specifically from risk-hungry investors looking for the sectors with the highest risk-to-return profile.

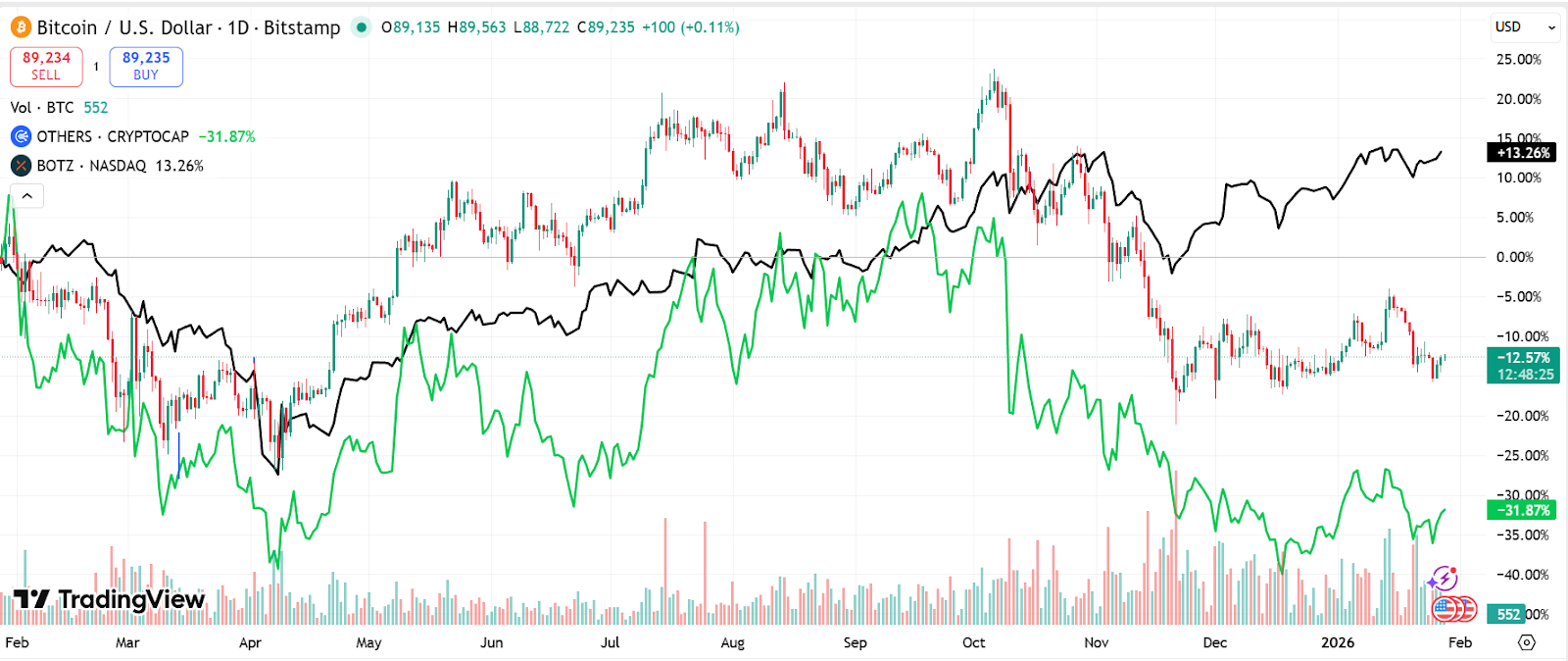

Market data supports the trend. While Bitcoin ($BTC) has declined about 12% over the past year, the Global X Robotics and Artificial Intelligence ETF has gained roughly 13% over the same period, according to TradingView. Altcoins outside the top 10 tokens have fallen more sharply, down more than 30%.

Related: Web3 revenue shifts from blockchains to wallets and DeFi apps

While crypto investor capital is rotating into AI applications, the underperformance of the sector can also be attributed to uncertainty regarding monetary policy and cryptocurrency regulations, according to Aurelie Barthere, principal research analyst at crypto intelligence platform Nansen.

“Another key factor is the repricing of Fed rate cuts, with markets now pricing an elevated terminal rate of around 3.8% over the next five years, which tightens liquidity conditions for risk assets,” Barthere told Cointelegraph.

“At the same time, political gridlock around the CLARITY bill has weighed on sentiment, adding an additional crypto-specific headwind alongside broader macro pressures,” Barthere added.

The crypto market structure bill suffered another delay this week after the US Senate Agriculture Committee delayed a scheduled markup for its version of the bill to Thursday from Tuesday after the US was hit by a severe winter storm, Cointelegraph reported on Monday.

Related: Wallet linked to alleged US seizure theft launches memecoin, crashes 97%

Robotics investments rise as VC crypto interest sinks at the end of 2025

Investment is accelerating into robotics startups, which raised a cumulative $13.8 billion during 2025, up from $7.8 billion in 2024 and increasing their previous record year of $13.1 billion raised in 2021, according to CrunchBase data.

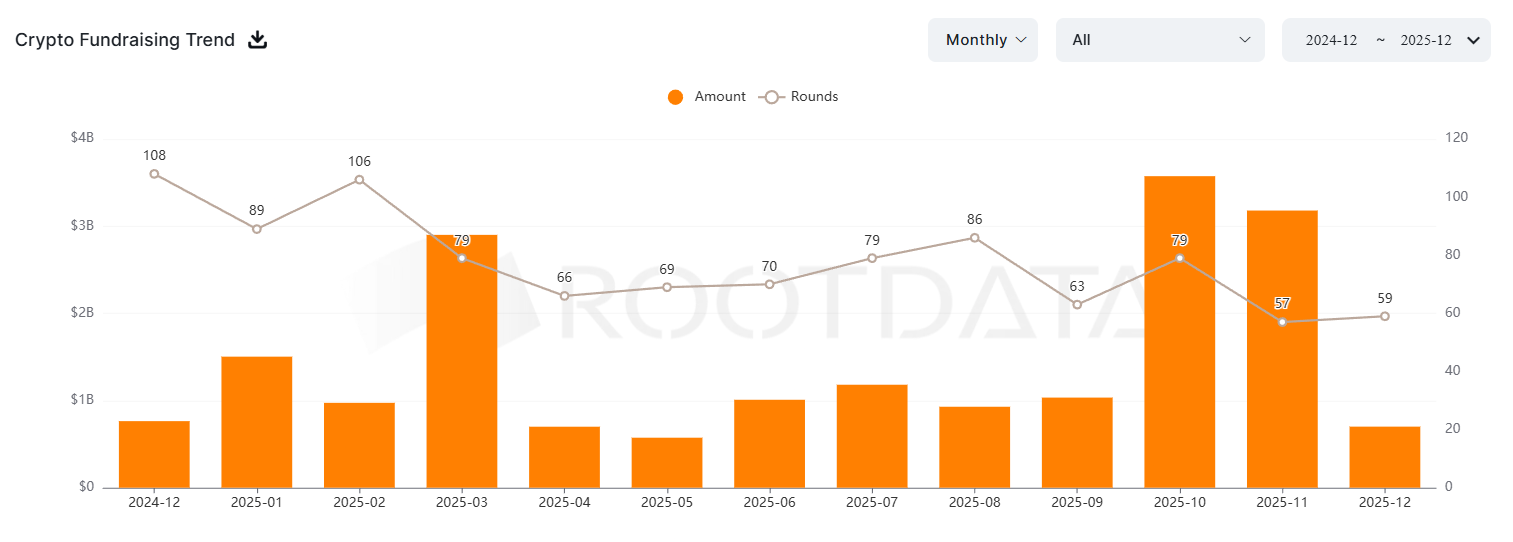

Venture capitalists also remain active in crypto, as VC funding rose to $18.2 billion across 902 deals in 2025, up about 80% from $10.1 billion raised across 1,548 deals in 2024, according to data aggregator Rootdata.

However, investments significantly slowed at the end of the year, from $3.1 billion across 67 deals in November to $700 million across 59 deals in December, a 77% monthly decline.

The slowdown came after the record $19 billion crypto market crash at the beginning of October, following US President Donald Trump’s threat to escalate tariffs on Chinese goods.

It marked the largest liquidation event on record, after the $9.9 billion liquidation in April 2021, which was contributed to by the initial rumours of a broad Anti Money Laundering crackdown, according to Coinglass data.

Magazine: Did a time-traveling AI invent Bitcoin?

coingape.com

coingape.com

thecryptobasic.com

thecryptobasic.com