As precious metals surge to historic highs while digital assets lag behind, Coach JV, a widely followed XRP commentator, suggests the divergence may not last.

Key Points

- Coach JV says silver’s breakout could foreshadow sharp, sudden moves for Bitcoin and XRP

- Gold tops $5,100 and silver $110 as metals surge while crypto remains in consolidation

- Bitcoin trades near $88K and XRP at $1.89, lagging far behind metals’ explosive gains

- Analysts say a silver-like rally could push XRP near $2.90 and Bitcoin to new highs

“Paper Markets Suppress Price… Until They Don’t”

In a recent post, Coach JV argued that Bitcoin and XRP are experiencing the same forces long seen in precious metals markets. He said that “what’s happening in silver will happen to Bitcoin and XRP,” referring to the historic price surge in metals.

“Paper markets suppress price… until reality breaks them,” he wrote.

He offered no timelines or hype, only a warning: when suppression breaks, prices won’t rise slowly; they’ll reprice sharply and suddenly.

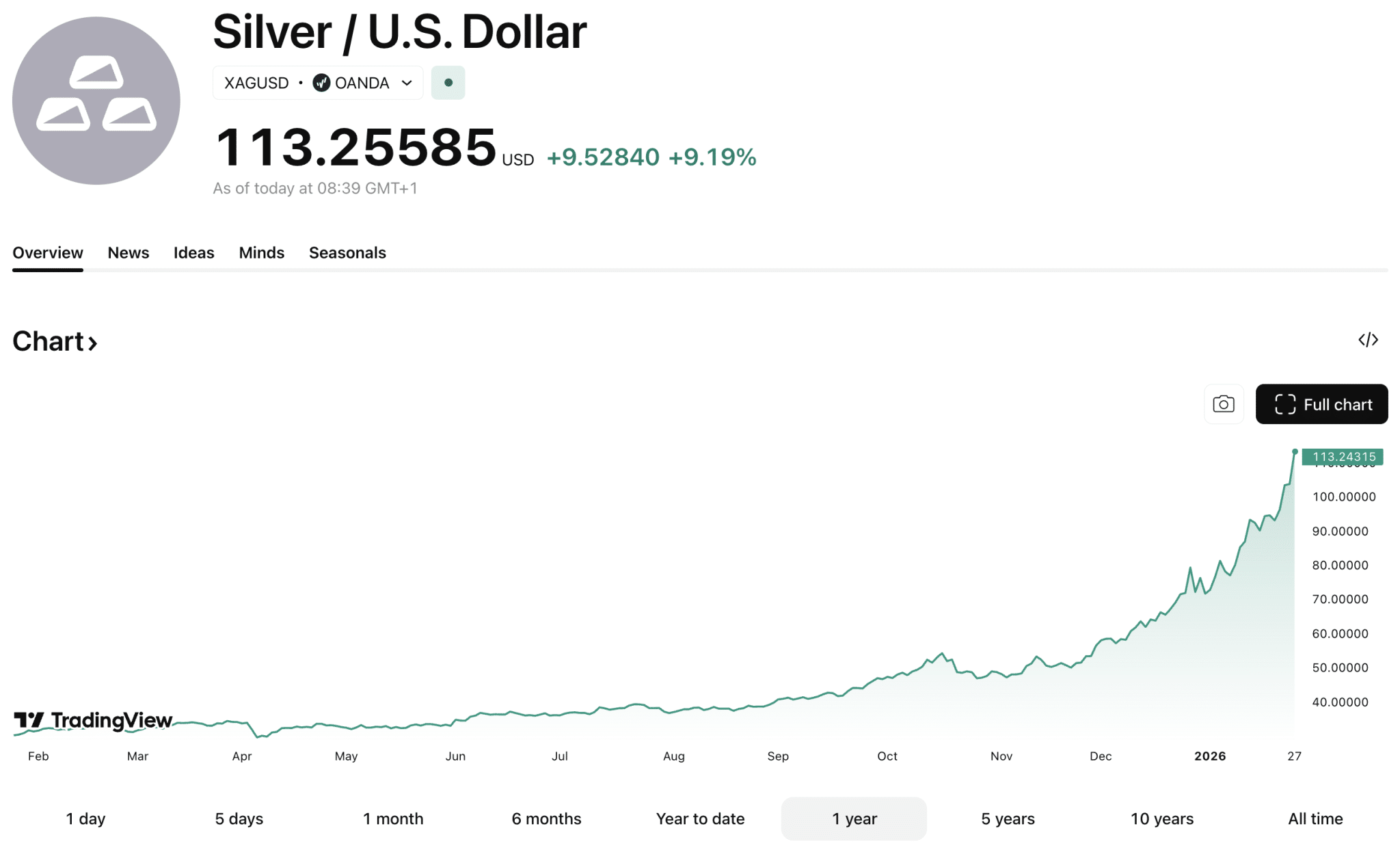

Gold and Silver’s Historic Price Action

The message comes at a time when crypto is consolidating, while gold and silver are doing the opposite. Gold surged above $5,100 per ounce this week, extending a rally that began last year and accelerated into early 2026.

The metal is already up more than 17.63% year to date, with an approximately 84% gain since 2025. Analysts attribute the move to rising geopolitical risks and strong demand from central banks.

Silver has been even more aggressive. Prices smashed through $110 per ounce, marking a historic breakout into triple digits. The metal is up more than 262% since last year, driven by safe-haven demand and strong industrial usage across solar and data center infrastructure.

Market participants note that silver’s rally has long been associated with tight supply conditions and heavy paper trading. Now, crypto commentators are drawing these parallels with Bitcoin and XRP.

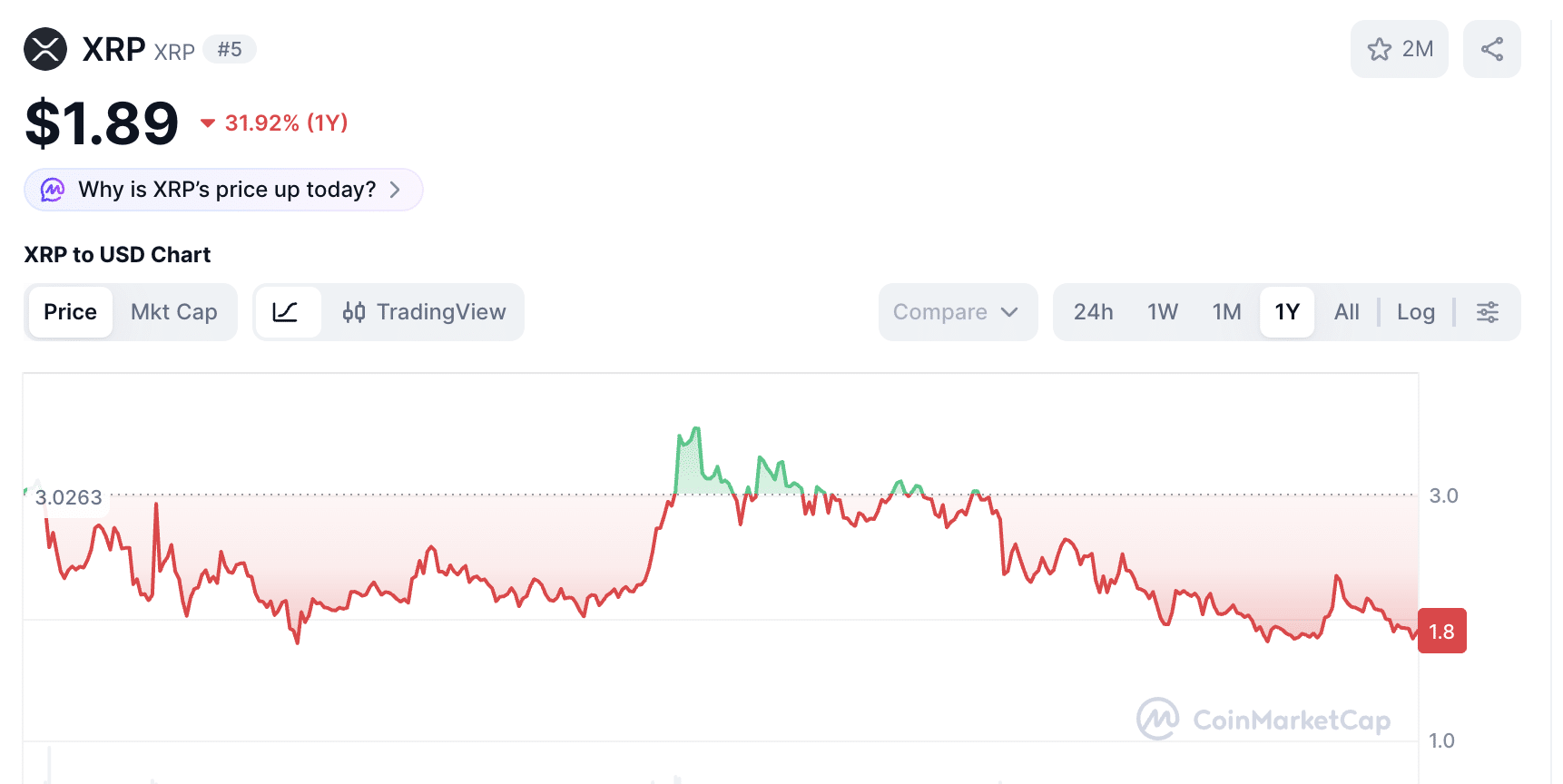

Bitcoin and XRP Lag as Capital Rotates

Indeed, Bitcoin has yet to follow metals higher. The asset currently trades around $88,212, down 30% from its October peak near $126,200. Similarly, XRP is trading at $1.89, down nearly 50% from its 2025 peak of $3.66.

The price performance of Bitcoin and XRP remains far behind the explosive gains seen in gold and silver. In Coach JV’s view, this gap reflects timing rather than weakness.

He suggests silver’s breakout is a signal, not a finale. If long-suppressed markets eventually break free, Bitcoin and XRP could follow with sharp, sudden moves instead of gradual gains.

XRP Price if It Follows Silver’s Path

As the wait for Bitcoin and XRP continues, some analysts are speculating on how their prices could perform relative to previous metals rallies. Considering silver has surged 52% so far this year, a similar move from XRP’s current $1.89 level would lift its price to approximately $2.89.

While still below its 2025 peak, this would represent a remarkable comeback for XRP’s price and could set the stage for a retest of the $3 range.

Meanwhile, applying the same estimate to Bitcoin would raise its price to about $134,750, marking a new all-time high. However, using gold’s year-to-date gain of roughly 17% would place Bitcoin near $103,200, still below its 2025 peak.

coindesk.com

coindesk.com