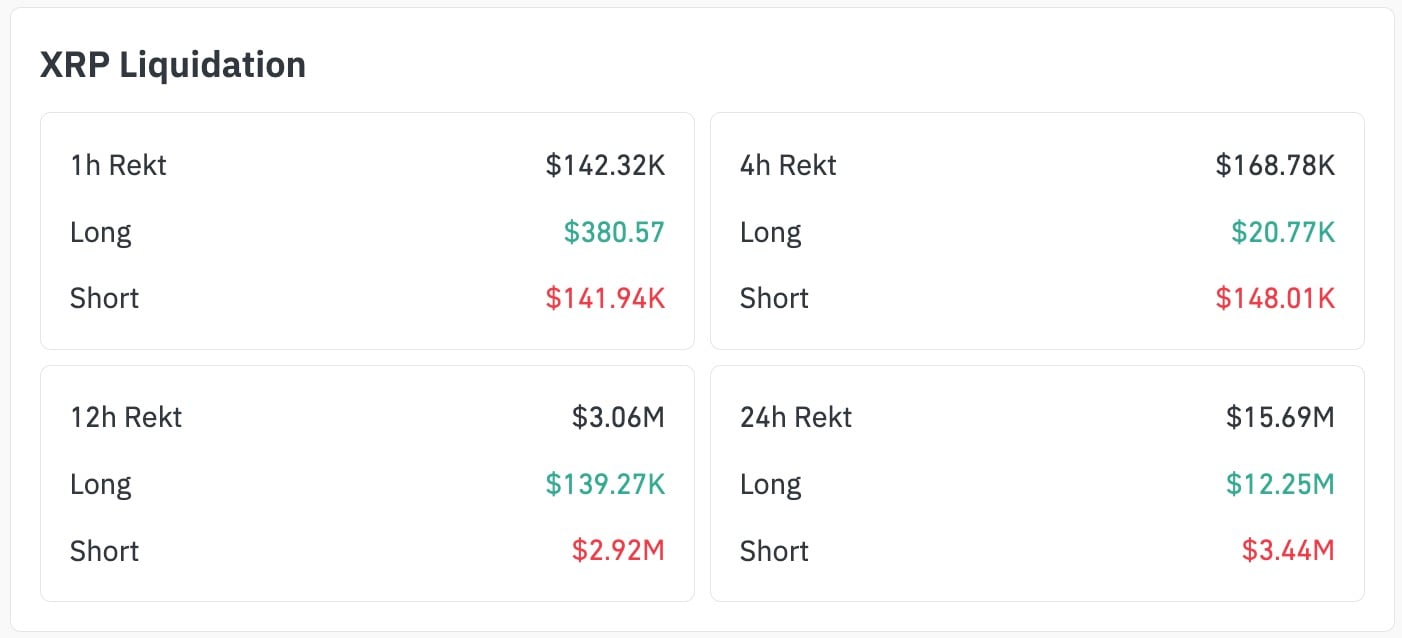

XRP just got hit with one of the worst bear traps of the month. After dipping below $1.83 in the early Asia hours, the coin made a comeback, taking short sellers by surprise with a 37,296% liquidation imbalance — wiping out $2.92 million in shorts in just 12 hours while leaving long positions almost untouched, as per CoinGlass.

At its peak, the XRP price spiked from $1.82 to $1.90 in a fast manner, triggering cascading stop-outs. The hourly liquidation footprint shows that over 99.7% of "rekt" volume came from short positions during the most volatile parts of the move.

Even during that 24-hour period, bears absorbed over $3.44 million in liquidations — more than 10 times the damage inflicted on longs in earlier sessions.

The one-minute candle chart shows a classic liquidation ladder: a clean five-wave pump, a brief consolidation, then a secondary spike above $1.8970 that forced late shorts to exit at a loss.

What actually happened?

Despite closing at around $1.896, the fact that the liquidation flow was so uneven suggests that there is a lot of mispositioning in the perpetual markets. This is probably due to a false sense of confidence in a short-term retracing after last week's +14% breakout.

This kind of imbalance usually does not go away on its own. If the structure holds, XRP's next leg could challenge the psychological $2 zone. That level has not been sustained for more than 72 hours since December 2025.

The bulls should keep an eye on funding rates and open interest to spot any early signs of overheating, but derivatives positioning remains moderate, with leverage still below levels that usually come before things get overbought.

Shorts just got torched, and if things get more volatile in the middle of the week, the next squeeze might be coming for XRP.

beincrypto.com

beincrypto.com

coinspeaker.com

coinspeaker.com