The XRP open interest (OI) has now collapsed to a 14-month low, hitting levels XRP last witnessed when it traded below $1.

This comes as the XRP price continues to slide to new lows, having recently collapsed to a new yearly floor of $1.8 amid a broader market collapse that has seen Bitcoin (BTC) drop to $86,000. XRP’s current price of around $1.8 represents a 25% decline from the yearly peak of $2.41 and coincides with a drastic crash in open interest.

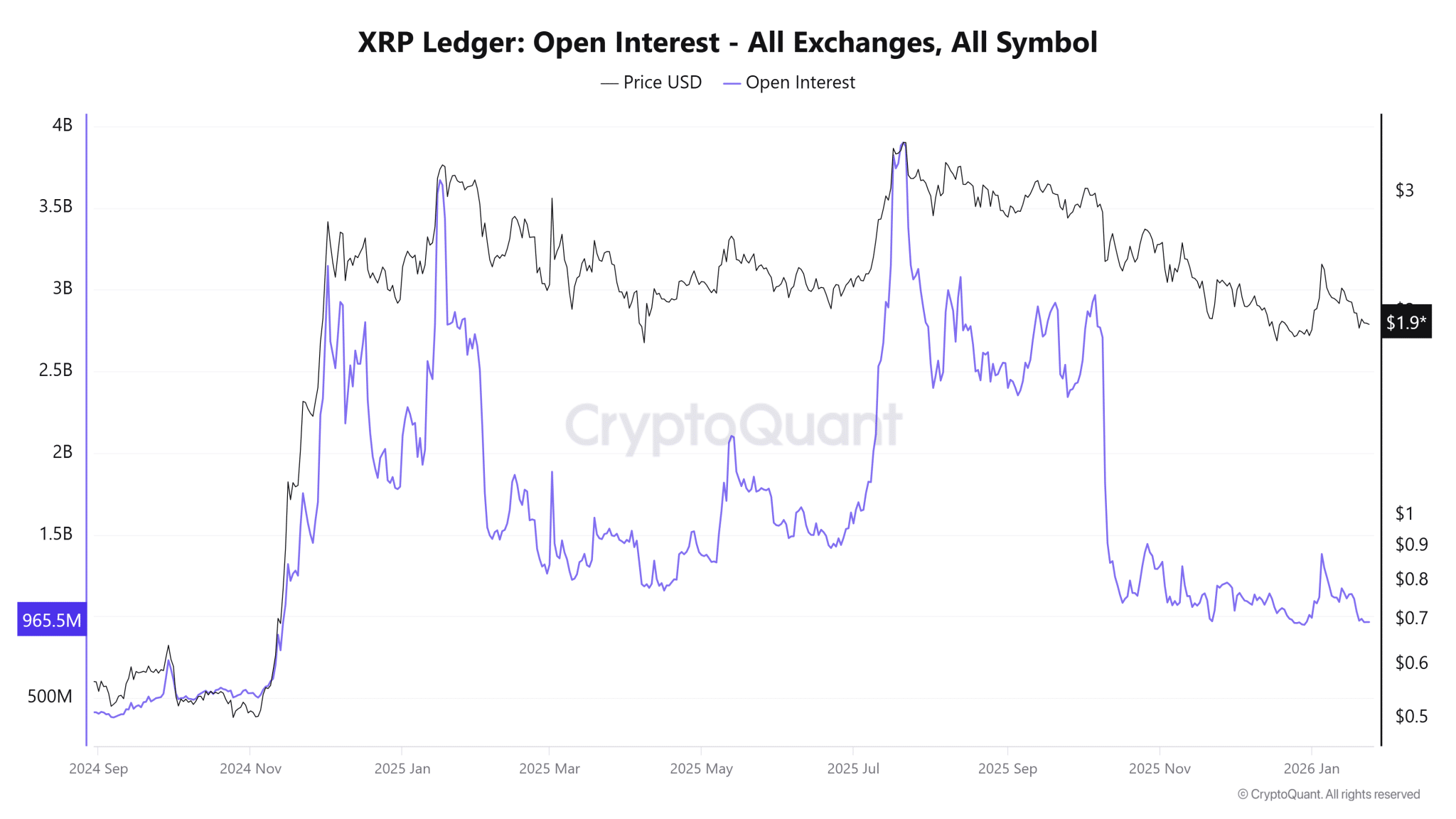

Specifically, futures market data indicates that the XRP open interest recently dropped to $965 million, the lowest figure recorded since November 2024, when prices still traded below the $1 mark. Further data shows that sharp declines in XRP open interest have often accompanied price drops.

Key Points

- The XRP open interest has dropped significantly, reaching a new yearly low of $965.5 million.

- Market data confirms that the last time XRP saw such a low open interest was in November 2024, when it still traded below $1.

- This recent drop in XRP open interest comes as XRP’s price crashes to new yearly lows around $1.8.

- Further futures market data indicates that gradual declines in XRP open interest have often accompanied drops in prices.

- This shows fading confidence and lower activity, which can weaken short-term momentum but reduce selling pressure.

XRP Open Interest Drops to 14-Month Low

Market analytical resource CryptoQuant confirmed this gradual decline in XRP open interest over the past 21 days. Notably, open interest had risen to $1.382 billion on Jan. 5, coinciding with XRP’s price recovery from a low of $1.84 at the end of 2025 to above $2.3 in early January.

However, as the price faced resistance at its new yearly high, the pullback also translated to a drop in open interest, a trend that has always played out in the market. XRP’s OI dropped from the $1.382 billion peak to $1.088 billion by Jan. 12, as prices collapsed to $2.053.

When XRP staged a rebound attempt from here, open interest also recovered, reaching $1.172 billion by Jan. 13. Interestingly, as prices began sliding again, the XRP open interest saw another drop to the current low of $965 million. For context, the last time XRP saw this figure was in November 2024, when it changed hands at around $0.77.

What Could This Mean for Price Action?

When price drops at the same time open interest falls to new lows, it shows that most traders are closing their positions and pulling money out of the market instead of opening new trades. This happens when uncertainty grows or when people expect further downside, leading to lower trading activity and weaker short-term momentum.

Going forward, this can have two effects. In the near term, it may keep XRP under pressure because there is less demand pushing prices up. However, since many leveraged positions have already closed, it can also reduce sharp sell-offs and create a more stable base. If fresh buyers step in, this quieter period can sometimes lead to a gradual recovery.

Historical Data Around XRP Open Interest and Price

Notably, historical data also confirms the close-knit relationship between the XRP open interest and price action. When XRP’s price rose from $0.5 on Nov. 5, 2024, to the peak of $3.4 by January 2025, open interest also increased from $570 million to $3.67 billion within the same period.

As the XRP price corrected from the $3.4 high, OI also saw gradual declines, hitting a low of $1.158 billion in mid-April 2025. However, with prices recovering to $3.6 by July 2025, the XRP open interest rebounded to a new multi-year high of $3.87 billion.

beincrypto.com

beincrypto.com