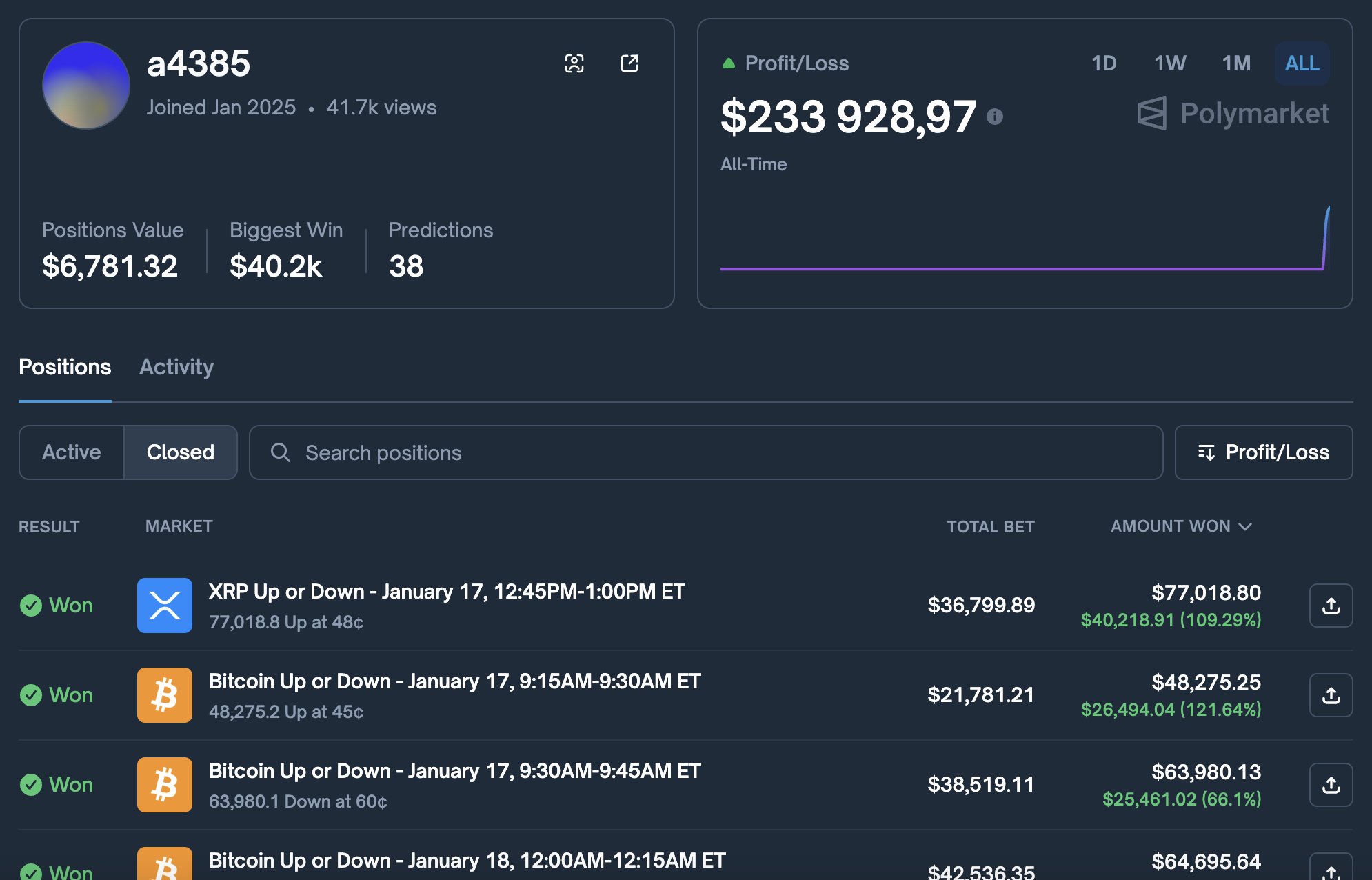

A Polymarket trader made $233,000 in a day after he spotted a gap in weekend liquidity and turned it into a large advantage in the XRP and BTC markets.

Market data indicates that the individual took advantage of thin trading activity across both Polymarket and Binance. Specifically, he focused on a 15-minute window involving XRP’s direction on Jan. 17, buying every available “up” contract while the market stayed quiet and liquidity remained low.

The trader backed his bet by triggering roughly $1 million in spot buying on Binance minutes before settlement, pushing XRP about 0.5% higher. His total execution costs sat near $6,200, allowing him to repeat the same method several times during the night.

Key Points

- A trader earned roughly $233,000 overnight by targeting thin liquidity on Polymarket prediction markets and Binance.

- He focused on the January 17 XRP “up” versus “down” market running from 12:45 PM to 1:00 PM Eastern Time.

- The individual bought around 77,000 “up” contracts at an average price near $0.48.

- Minutes before settlement, a $1 million Binance spot buy pushed XRP roughly 0.5% higher, giving him the win.

- Estimated trading costs totaled about $6,200, including fees and slippage.

Trader Identifies Thin Liquidity on the XRP 15m Market

Predict Trader, a well-known presence on Polymarket, shared the story in a recent X commentary. The trader at the center of everything goes by “a4385” on Polymarket. Notably, he discovered that short, 15-minute prediction markets gave him room to push prices if he acted at the right moment.

With this, the individual focused on a single question tied to XRP’s direction on Jan. 17 between 12:45 PM and 1:00 PM Eastern Time. He started buying contracts that paid out if XRP rose, and he kept buying them at every level that other traders offered.

For context, Saturday nights normally bring quiet trading, with Polymarket making it easy for small developers to deploy bots. As a result, many counterparties turned out to be automated.

Price Spike Lures Bots in

By the tenth minute of the window, XRP slipped by roughly 0.3% from its open. Despite this, his buying spree pushed the payout price for the “up” option to about $0.7, above a fair midpoint. The bots read this spike the wrong way and saw free money, so they sold more contracts to him instead of stepping back from the market.

This activity left him holding around 77,000 “up” shares at an average cost of about $0.48. He then waited for the final moments and made his second move.

Notably, 2 minutes before the market closed, a separate wallet on Binance executed a spot buy worth roughly $1 million in USDT. This order pushed XRP higher by about 0.5% and locked in the outcome he needed. Seconds after the prediction market settled, the same wallet unloaded the XRP and reversed the earlier buy.

The trade cost far less than the profit it delivered. Specifically, Predict Trader estimated that fees and price slippage on both sides amounted to roughly 0.25% in each direction. With a Binance VIP 4 fee level near 0.06%, the full cost came to roughly $6,200, and the real total may actually be slightly below this estimate.

Losses on the Opposite End

Predict Trader noted that once he proved the strategy worked, the trader repeated it across multiple 15-minute markets through the night. Data shows he made similar trades on the Bitcoin (BTC) market. Weekend volume never recovered, which meant trading bots kept showing up on the other side of his orders.

Notably, some automated accounts recognized the threat and shut down fast enough to avoid more damage. However, others reacted too slowly and drained their balances. One of the hardest was the trader “Aleksandmoney,” who lost about $34,000, representing his total gains for the year.

news.bitcoin.com

news.bitcoin.com

coindesk.com

coindesk.com

cryptopotato.com

cryptopotato.com