Dogecoin shows strong recovery momentum as buyers regain control, while futures data suggests growing confidence.

Dogecoin (DOGE) is showing strong short-term momentum, rallying over 10% in the past 24 hours to trade around $0.1326. Price action remains firmly bullish throughout the session, with DOGE bouncing from a 24-hour low near $0.1203 and pushing to an intraday high around $0.1329.

Overall, the structure favors buyers, but DOGE may need to cool off after the rapid advance. Notably, holding above support would keep the bullish bias intact, whereas a failure to do so could shift focus back to range-bound trading. Where’s DOGE headed?

DOGE Price Prediction

Looking at technical charts, Dogecoin is attempting a short-term recovery after a prolonged downtrend. The daily chart shows DOGE pushing back above the middle Bollinger Band (20-day SMA) near $0.127, which is an encouraging sign for bulls.

This level now acts as immediate support, reinforced by the lower Bollinger Band around $0.118, which marks a stronger downside buffer if selling pressure returns. Meanwhile, RSI has climbed toward the neutral zone just above 50, indicating improving momentum but not yet a fully bullish condition.

On the upside, resistance is clearly defined by the upper Bollinger Band near $0.136, which aligns with a prior breakdown zone and could cap further gains in the near term. A sustained move above this area would signal a stronger trend shift and open the door for additional upside.

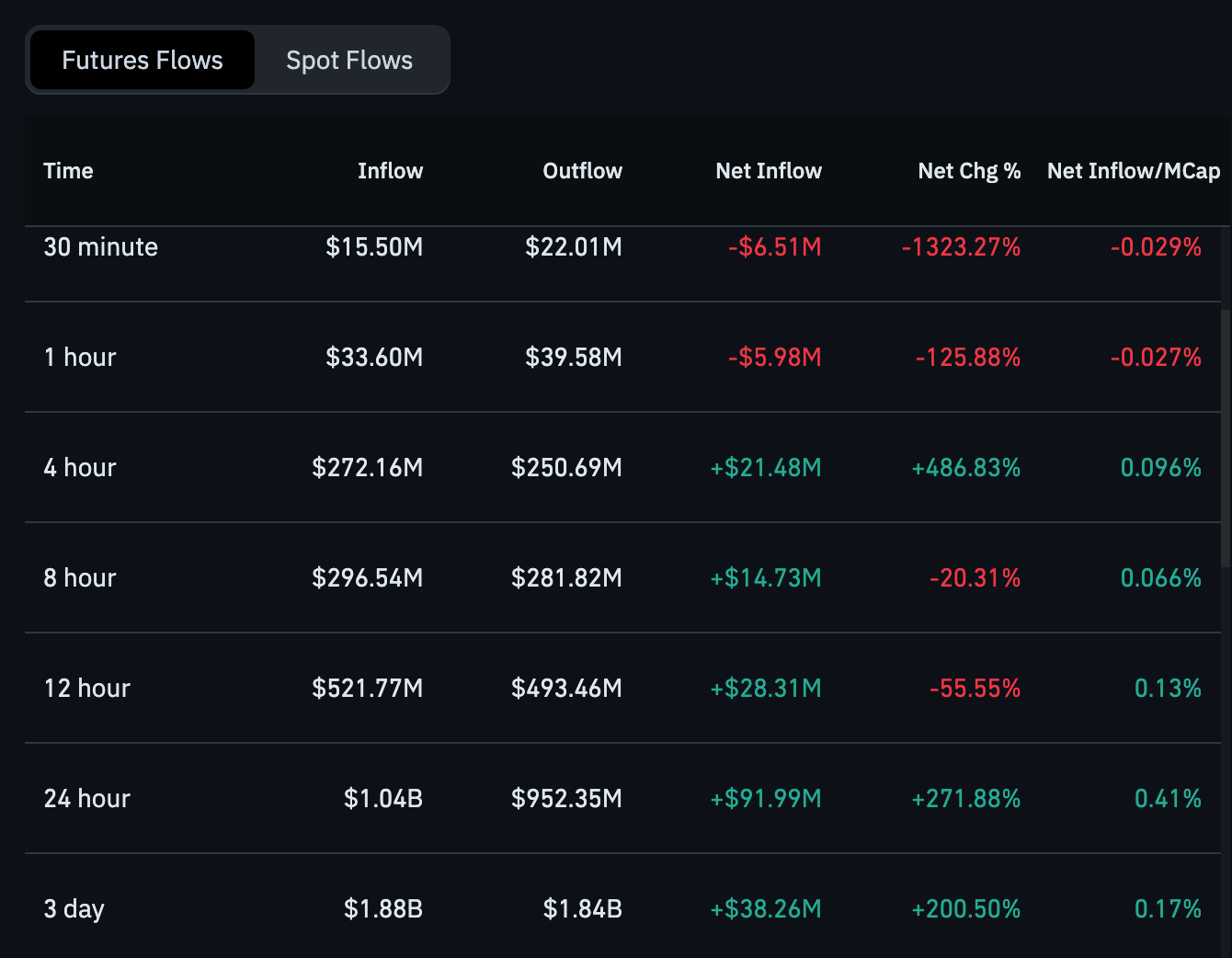

DOGE Futures Flows

Meanwhile, the futures flow data shows short-term pressure but improving sentiment on higher timeframes. In the last 30 minutes and 1 hour, net outflows of $6.51M and $5.98M suggest brief profit-taking or hesitation among traders. This near-term trrend indicates some caution after recent price movement, as short-term participants reduce exposure.

However, sentiment shifts when zooming out. The 4-hour, 8-hour, and 12-hour windows all show net inflows of $21.48M, $14.73M, and $28.31M, signaling that larger players are gradually positioning back into the market.

This trend strengthens further on the 24-hour and 3-day horizons, with net inflows of $91.99M and $38.26M, respectively. Overall, despite short-lived outflows, the broader futures data suggests underlying bullish positioning is rebuilding, supporting the idea of stabilization rather than a sustained downturn.

cryptobriefing.com

cryptobriefing.com

u.today

u.today