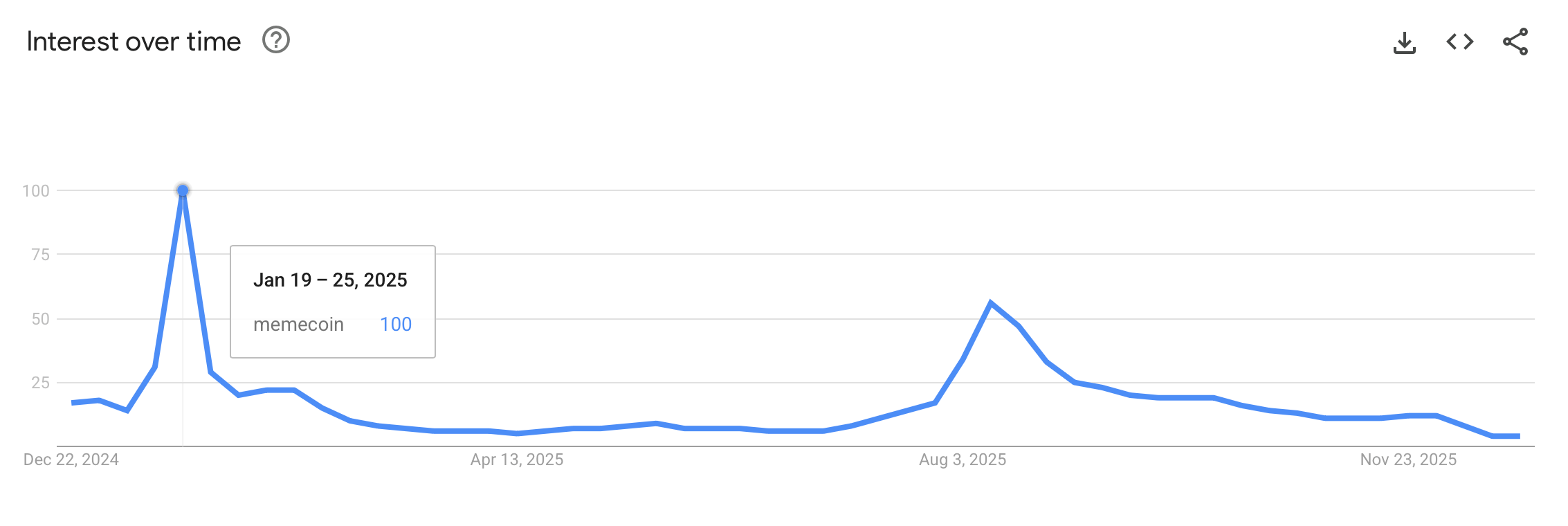

Meme coins entered 2025 riding political buzz and platform-fueled enthusiasm, but they are closing the year sharply smaller, bruised by oversupply, fading attention, and relentless volatility.

The Meme Coin Reckoning: How 2025 Turned Speculation Into Capitulation

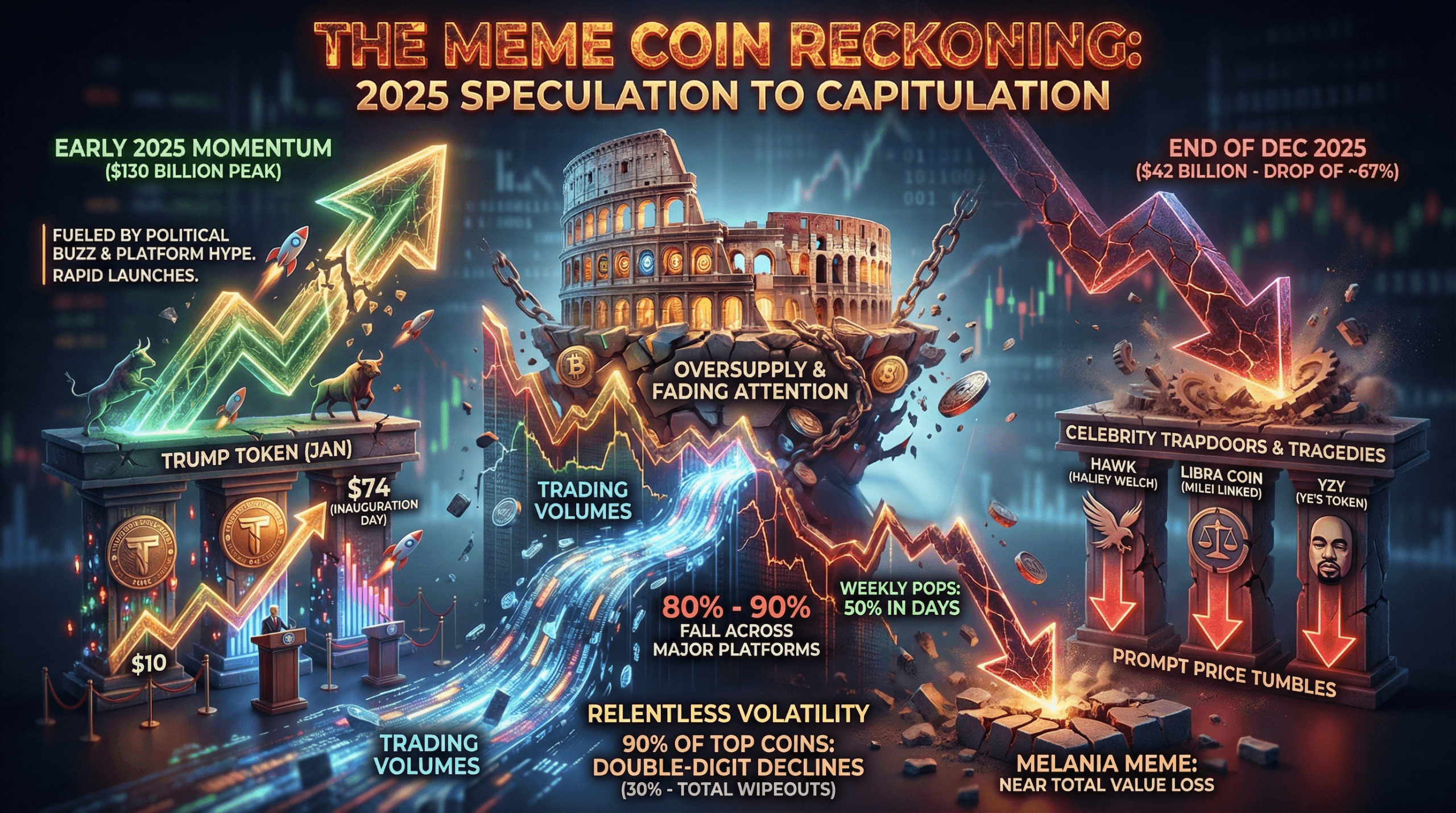

The meme coin sector began the year with a market capitalization near $130 billion, carrying momentum from late 2024 and a steady stream of new launches. Early optimism pushed the category briefly higher, but by the end of December, the sector had contracted to roughly $42 billion, a drop of about 67% from its peak.

That reversal defined 2025. Meme coins were and still are everywhere, created faster than traders could track them, traded aggressively during hype windows, and discarded just as quickly when attention moved on. Trading volumes followed the same path, falling 80% to 90% across major platforms as the year progressed.

Politics played an outsized role early on. The launch of official trump (TRUMP) in January turned a meme into a headline event, with the token climbing from under $10 to more than $74 on inauguration day. Investor dinners and POTUS-linked moments repeatedly injected short-term excitement, reinforcing how dependent the sector had become on external narratives rather than onchain utility.

Other breakout acts stuck to a script everyone knows by heart. Tokens such as FARTCOIN and SPX flashed headline-grabbing weekly pops during moments of peak hype, at times clearing 50% in just a few days. Elsewhere, the trapdoor opened: Haliey Welch’s HAWK, the LIBRA coin tied to Argentina’s President Javier Milei, and Ye’s meme token YZY all invited controversy—then promptly took major price tumbles.

HAWK reached $0.01737 per unit and now stands at $0.00008276 after suffering a 99% loss. LIBRA too is down 99% from its peak, and Ye’s yeezy coin (YZY) has suffered a 87.6% decline as well.

The downside was far more crowded. Data shows roughly 90% of top meme coins suffered double-digit declines over a nine-month stretch, with losses ranging from 30% to nearly total wipeouts. MELANIA Meme stood out for all the wrong reasons, shedding almost its entire value over the year. On Jan. 20, 2025, MELANIA tapped an all-time high of $13.05 per coin, and now it’s down 99% at $0.112 per unit.

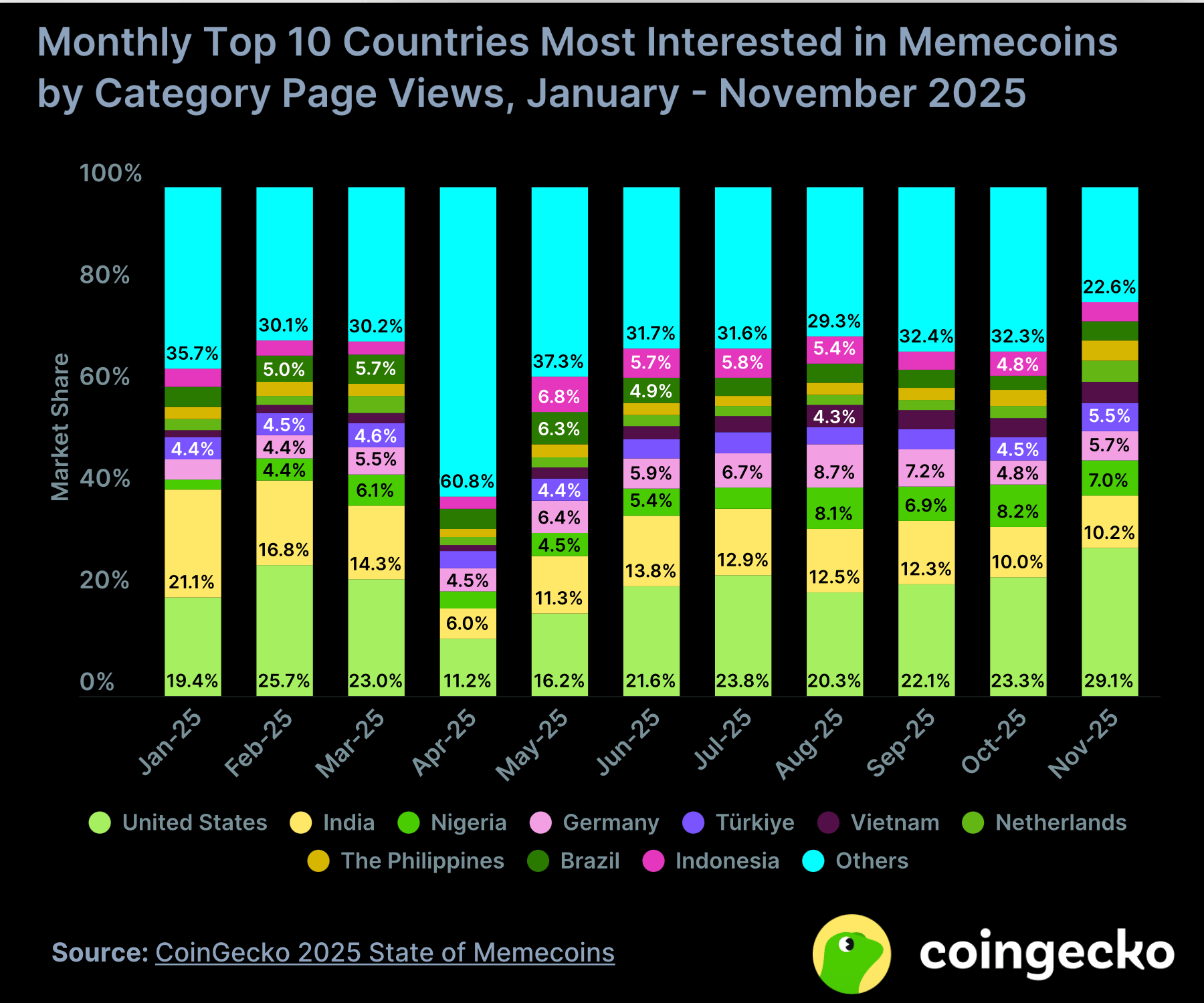

Even established names were not immune. Coins such as PEPE, SHIB, and DOGE experienced repeated pullbacks during periods of broader market stress, reminding traders that brand recognition does not equal insulation. Survival, not dominance, became the real metric by year’s end. Coingecko’s State of Memecoins Report 2025 explains that while a great deal of meme coins stemmed from meme token launchpads, independent versions still dominated by 86.2%.

Oversupply magnified the damage. More than 13 million new meme coins were created in 2025, overwhelming discovery mechanisms and fragmenting liquidity across countless micro-markets. Launchpads lowered barriers to entry, but they also accelerated burnout among retail participants.

Regulatory signals briefly steadied sentiment. A February statement from the Securities and Exchange Commission (SEC) indicating most meme coins were not securities removed a layer of legal anxiety, but it did little to change long-term behavior. Speculation continued to dominate, just with fewer participants willing to stay through downturns.

Midyear brought isolated rebounds tied to sector rotations and broader crypto optimism, including a summer rally led by several top names. These moves provided temporary relief but failed to reset the overall trajectory, as capital quickly rotated away once momentum stalled.

Also read: 2025 EOY Report: VC of the Year

By autumn, the tone had shifted decisively. Creation numbers remained high, but engagement thinned, and capital concentrated in a shrinking group of survivors. November marked the clearest capitulation phase, with the market settling near $47 billion despite brief spikes in launchpad activity.

December closed with familiar patterns after shedding another $5 billion: sudden jumps in niche tokens, short-lived optimism, and an audience that had learned—sometimes painfully—how quickly meme coin narratives expire. The sector did notch a modest month-end lift, but it was incremental rather than transformative.

Even with plenty of coins in the red, one meme coin managed to keep its footing in 2025. Toshi (TOSHI), for example, is up 130% since the start of the year. At year’s end, meme coins remain what they have always been: community-driven experiments in attention economics. They can still move quickly, still generate eye-catching returns, and still erase them just as fast.

What changed in 2025 was scale—the booms were bigger, and the exits came faster. For traders and observers alike, the lesson was blunt. Meme coins thrive on timing, which spurred snipers, culture, and spectacle, not patience. As 2026 approaches, the category looks leaner, louder, and far more selective about where attention—and money—flows next.

FAQ ❓

- What happened to meme coins in 2025?The sector shrank sharply after early-year hype gave way to oversupply and declining trading activity.

- Which meme coins performed best in 2025?Event-driven tokens like TRUMP and short-term standouts such as FARTCOIN and SPX6900 posted the biggest gains during peak moments.

- Why did so many meme coins fail this year?More than 13 million new launches diluted liquidity and attention, leaving most tokens vulnerable to rapid sell-offs.

- Are meme coins finished going into 2026?No, but they remain highly speculative, with success tied to timing, community momentum, and fleeting narratives.

tokenist.com

tokenist.com

thecryptobasic.com

thecryptobasic.com