As 2025 draws to a close, XRP price finds itself at a pivotal juncture — trapped between long-term investor fatigue and flashes of renewed optimism tied to global monetary easing. The broader financial landscape is shifting again: central banks are leaning toward policy relaxation, the dollar is softening after a volatile year, and the AI-driven capital cycle is reshaping risk appetite. Against this macro backdrop, XRP’s current price action reflects both exhaustion and potential. The question is whether this consolidation is a base for a 2026 breakout or a precursor to another leg down.

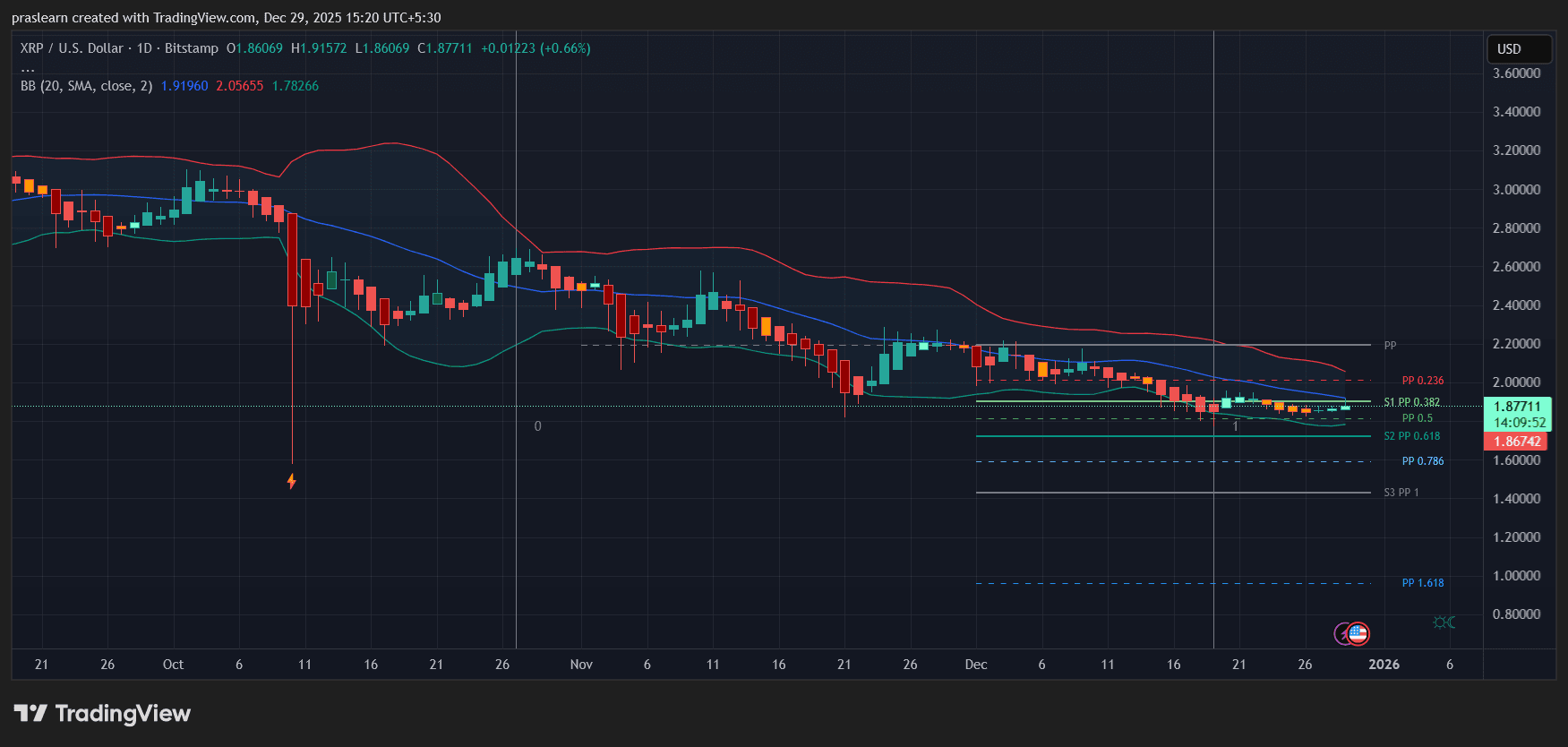

XRP Price Prediction: What Does the Daily Chart Tell Us Right Now?

XRP price daily chart shows a clear pattern of descending resistance stretching from the 2024 highs, with price compressing into a tight range between $0.47 and $0.55. The lower Bollinger Band is flattening, signaling reduced volatility, while RSI hovers near 45, reflecting indecision rather than weakness.

Volume trends suggest waning selling pressure — a subtle bullish divergence compared to earlier capitulation phases. However, XRP has yet to reclaim its 100-day moving average, a key technical trigger that has repeatedly capped rallies since Q3 2025. The $0.56–$0.60 zone remains the decisive breakout region; a daily close above it would open the path toward $0.68–$0.72, where prior liquidity clusters sit.

On the flip side, if XRP fails to hold $0.47, it risks retesting the structural support at $0.43, which coincides with the 2023-2024 accumulation base. A breakdown below that could re-ignite bearish sentiment, especially if Bitcoin dominance surges or liquidity thins in early 2026.

How Global Policy Shifts Could Influence XRP’s Next Move

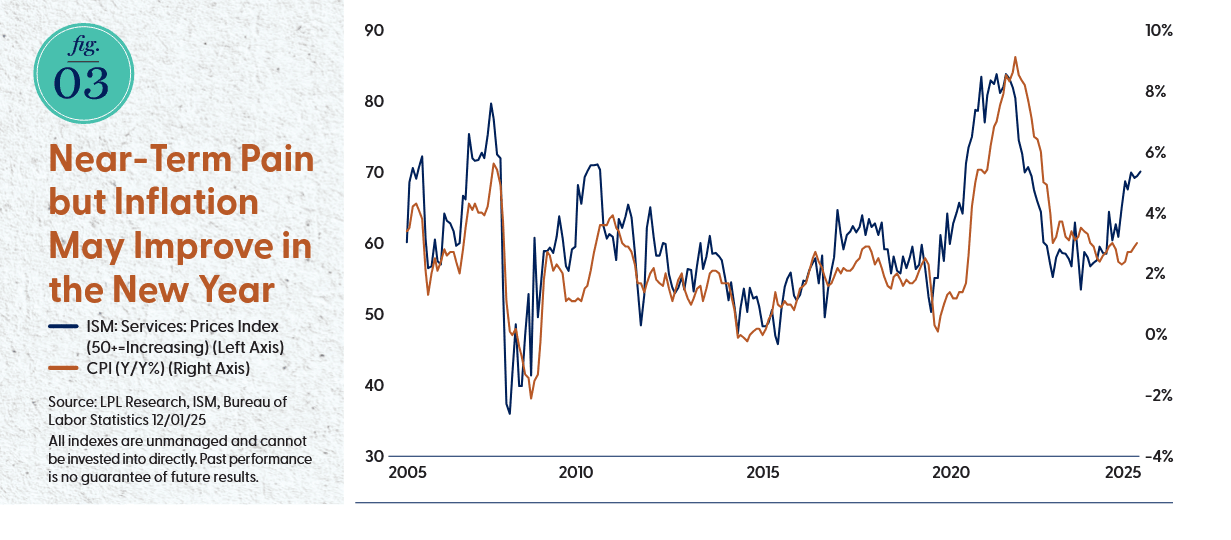

According to the LPL Research Outlook 2026, the upcoming year will be dominated by monetary easing, AI-driven investment, and a soft-landing economy. The Fed is expected to cut rates gradually through 2026, bringing the 10-year Treasury yield into the 3.75–4.25% range. This shift toward cheaper capital often re-energizes risk assets — from equities to crypto — as liquidity returns to markets.

For XRP price, which historically correlates with broader risk sentiment rather than direct macro fundamentals, this could mark a subtle turning point. A softer dollar, easing inflation, and rebounding investor confidence in fintech assets could push speculative capital back into altcoins, especially those tied to cross-border payments and tokenized finance.

Yet, the same report also warns that volatility will remain elevated in a policy-driven market. That means sharp rallies could easily reverse on headlines or regulatory setbacks — a pattern XRP holders know too well.

Is the Fundamentals Story Strong Enough?

The long-term case for XRP price still rests on Ripple’s institutional utility and ongoing integration into payment networks. The company’s push for on-demand liquidity solutions continues, and despite prolonged regulatory uncertainty, its infrastructure is quietly expanding in Asia and the Middle East.

However, XRP’s Achilles’ heel remains adoption velocity. Unlike Ethereum or Solana, its ecosystem lacks consistent developer momentum and DeFi traction. Unless Ripple manages to broaden XRP’s use case beyond institutional corridors, the token may continue to lag in speculative cycles dominated by newer narratives like AI-linked blockchains or tokenized assets.

Could XRP Rebound in 2026?

Technically, yes — if certain catalysts align. A confirmed breakout above $0.60 would complete a mid-term trend reversal pattern, targeting $0.80–$0.85 in Q2 2026. That move would mirror the broader AI-driven equity momentum highlighted in the LPL outlook, where capital rotates into riskier growth assets during easing cycles.

For that scenario to hold, Bitcoin must maintain stability above $90,000–$95,000, and market liquidity needs to expand post-rate cuts. If those tailwinds materialize, XRP could revisit the psychological $1.00 mark by late 2026 — its first serious attempt since the 2021 bull run.

On the other hand, a failure to hold $0.47 amid renewed dollar strength or weak crypto inflows could drag XRP back toward $0.40, delaying any meaningful recovery until mid-2027.

What Traders Should Watch Next

From a trader’s perspective, the next two months are about patience and confirmation. XRP price volatility compression is a classic prelude to expansion — but direction depends on macro tone. Watch for:

- A confirmed daily close above $0.60 with volume expansion.

- RSI crossing above 55 on the daily timeframe.

- Broader crypto risk-on signals — Bitcoin dominance flattening and total market cap reclaiming the 2025 midline.

If these align with the Fed’s expected dovish stance in Q1–Q2 2026, XRP could finally step out of its long consolidation. Until then, traders may prefer to accumulate near support and avoid chasing minor breakouts.

XRP Price Prediction: XRP’s 2026 Could Be Defined by Liquidity, Not Hype

The outlook for XRP price in 2026 depends less on hype cycles and more on global liquidity restoration. The combination of Fed easing, AI-driven fiscal expansion, and a weaker dollar provides a setup for recovery — but only if Ripple converts institutional partnerships into consistent transactional volume.

For now, $XRP remains in accumulation territory, oscillating between caution and hope. The chart shows consolidation, not capitulation — a sign that the worst may be behind, yet conviction hasn’t fully returned. If macro trends play out as forecasted, 2026 might be the year XRP finally starts building a sustainable uptrend instead of chasing fleeting rallies.

invezz.com

invezz.com

coinedition.com

coinedition.com

coingape.com

coingape.com