XRP community figure Chad Steingraber recently suggested that by the end of 2026, all combined XRP ETFs could achieve the largest first-year percentage gain in Wall Street history.

If such a milestone comes to pass, the impact on XRP’s price could be dramatic. This article examines where XRP’s price could realistically land by the end of 2026 under this scenario.

XRP ETFs Are Already Setting Records

XRP ETFs are already posting record-breaking inflows, absorbing XRP supply at an unprecedented rate. For instance, Canary Capital opened on November 14 with a first-day inflow of $243 million.

According to Bloomberg senior analyst Eric Balchunas, this was the largest first-day turnover of the over 900 ETFs that entered the market in 2025.

Meanwhile, the momentum has continued, with consistent daily inflows since that day and no outflows recorded across the 15 days of trading. Other ETFs have joined along the line, including Bitwise, Grayscale, and Franklin Templeton.

Together, these XRP ETFs have pulled in inflows of $897.35 million, accumulating over 430 million XRP. Notably, this also represents another record for the XRP ETF market.

In particular, XRP ETFs have emerged as the second-fastest crypto ETFs to hit the $800 million inflow milestone. Inflows are now approaching the major $1 billion target.

Such inflows reduce liquid circulating XRP, increase competition for spot supply, and accelerate price discovery.

Meanwhile, more XRP ETFs are on the horizon from WisdomTree and 21Shares. Accordingly, Steingraber predicts that, by the end of 2026, the combined XRP ETFs could achieve the highest first-year percentage gains in Wall Street ETF history.

What Could This Mean for XRP’s Price?

Base Case for XRP Price

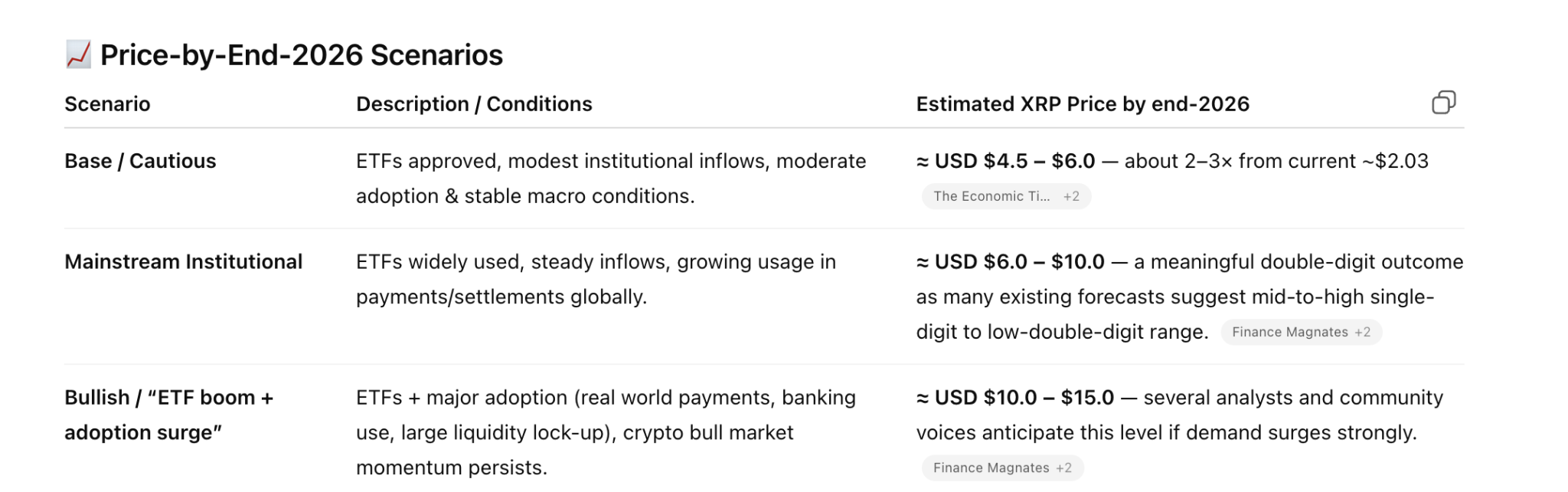

According to an analysis by OpenAI’s model, ChatGPT, if ETF adoption grows steadily but remains within realistic bounds, XRP could end 2026 in the $4.50 to $6 range. This assumes a steady flow of assets under management and a supportive macro environment.

In this scenario, XRP doesn’t need explosive growth to outperform. The asset simply needs its ETFs to maintain strong inflows and track a broader crypto uptrend throughout 2026.

Mid-Range Bullish Scenario

The model also suggests that if XRP ETFs not only perform well but mirror the early surge seen in Bitcoin ETFs, combined with expanding utility in payments and cross-border settlements, prices in the $6 to $10 range are a realistic outlook.

This scenario relies on deeper institutional exposure, reduced exchange liquidity, and XRP’s usefulness in settlement gaining mainstream recognition.

High-End Scenario: Record ETF Year Creates a Perfect Storm

Notably, Chad Steingraber’s prediction implies something far larger than standard success. A record-setting ETF performance would require intense inflows, global demand, and significant supply compression. Steingraber argues that XRP ETFs could absorb half of XRP’s supply in one year.

In that environment, XRP’s price could push into the $10 to $15 range by the end of 2026.

Meanwhile, the model suggests that if global institutions treat XRP as a large-scale liquidity asset, prices could even exceed these upper estimates. However, such outcomes rely heavily on extraordinary adoption.

Opposing Views

Some market participants reacting to Steingraber’s post pointed out that first-year ETF records are not really about percentage gains but about assets under management (AUM).

X user OGA NFT argued that even if XRP ETFs 10x from here, they would still be tiny compared to the records set by gold and Bitcoin. For context, Bitcoin ETFs pulled in over $50 billion in one year.

According to OGA NFT, the real question is whether XRP ETFs can even reach $5 billion AUM to compete with Bitcoin and gold.

First-year ETF records aren't really about percentage gains – they're about assets under management (AUM).

Even if XRP ETFs 10x, they'd still be tiny vs gold/BTC.

The real question: can they crack $5B AUM to compete?

— OGA NFT (@OGA_Studio) November 22, 2025

Notably, while record inflows in Bitcoin ETFs helped its price cross $100K, similar record ETFs in Ethereum have failed to significantly affect the price of ETH. This raises questions about the actual impact of ETFs on XRP’s price.

Moreover, since the ETF accumulation in November, XRP’s price has dipped rather than surged.

ambcrypto.com

ambcrypto.com

thecryptobasic.com

thecryptobasic.com

coinedition.com

coinedition.com