A crypto commentator has pointed to a sharp decline in XRP holders’ profitability, arguing that the downturn could set the stage for a major price reversal.

Amid the market-wide sell-off, analyst Steph Is Crypto noted that 48% of XRP’s 60.57 billion circulating supply is now underwater, meaning those tokens were purchased at prices above XRP’s current market value.

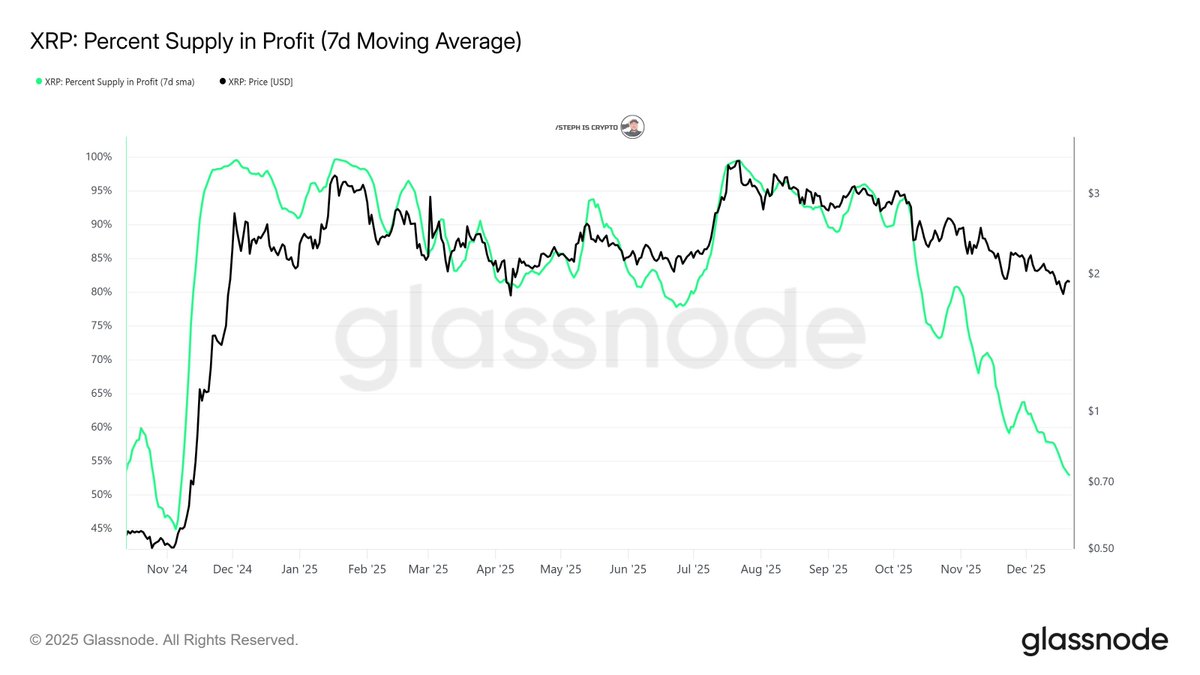

Citing on-chain data from Glassnode, Steph stated that only about 52% of the circulating supply remains in profit. He emphasized that this share has steadily declined in recent weeks as XRP’s price action weakened.

Significance of Decline in Profitability

Notably, this decline in profitability matters because it directly affects investor psychology. As more holders slip into losses, market participants typically become increasingly sensitive to further downside movements.

Historically, such conditions tend to heighten the risk of panic-driven selling, particularly if prices continue to drift lower. Consequently, Steph suggested that already-underwater holders may feel compelled to exit their positions during prolonged weakness, thereby adding to short-term selling pressure.

Historical Performance Hints at Potential Rebound

Meanwhile, the market watcher drew on a historical parallel that adds nuance to the current outlook. According to him, the last time XRP’s profitability metrics fell to similar levels was in November 2024.

At that time, on-chain charts showed XRP profitability sliding to around 45% while the price hovered near $0.50. Shortly afterward, the post-election rally reversed the trend. Profitability surged to nearly 100% as XRP’s price climbed to almost $3 in early December 2024.

This sequence suggests that the sharp drop in profitability did not trigger a prolonged downturn. Instead, it paved the way for a substantial upside.

Can XRP Replicate Its November 2024 Performance?

With XRP profitability now slipping back to levels last seen in November 2024, Steph’s commentary suggests another major uptrend may be on the horizon.

His assessment comes amid the broader crypto market downturn that has weighed heavily on XRP. The token has traded below the $2 mark since December 16 and is currently hovering around $1.85.

While Steph hints that declining profitability could precede a rebound similar to late 2024, the broader context has changed. The key catalyst behind XRP’s previous rally was the re-election of Donald Trump, widely dubbed a “Crypto President.”

The momentum enabled XRP to record the largest gains as investors bet that Trump’s administration would resolve the Ripple lawsuit, which had weighed on the token. This outlook later materialized, driving XRP to a peak of $3.65 in July 2025.

For now, market expectations are driven by different factors. Investors are increasingly focused on the passage of the CLARITY Act and rising demand for XRP ETFs, which many believe could propel the token to new highs. It remains unclear whether these factors can spark a major rally comparable to the surge that followed Trump’s victory.

coinedition.com

coinedition.com

cryptopolitan.com

cryptopolitan.com

beincrypto.com

beincrypto.com