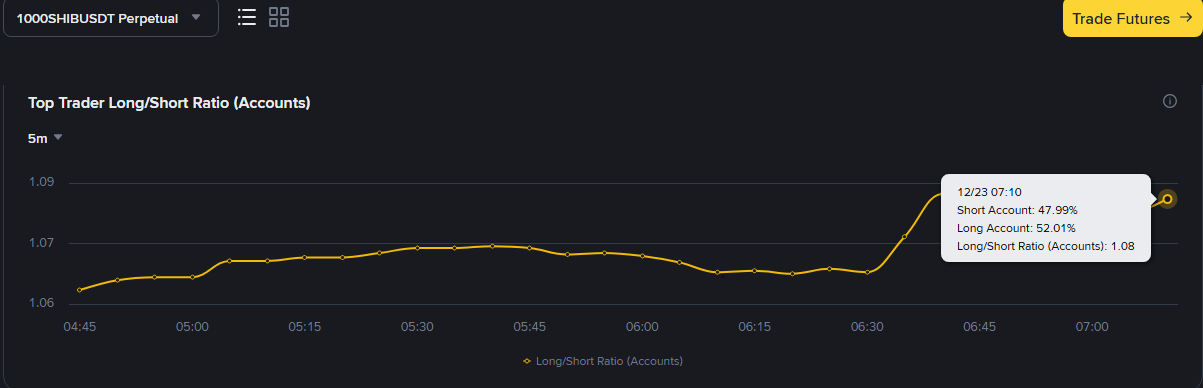

Fresh data from Binance’s top-trader accounts signal a cautiously bullish bias toward Shiba Inu (SHIB), as a slightly higher share of professional traders are anticipating an upside.

According to the latest figures, Shiba Inu top-trader accounts on Binance hold 52.01% net long versus 47.99% net short. This estimate pushed the long-to-short ratio to 1.08.

While the gap is narrow, it still indicates a mild preference for the SHIB token among experienced traders. Moreover, the split suggests that the group of traders is anticipating a potential rebound rather than placing strong bets against SHIB.

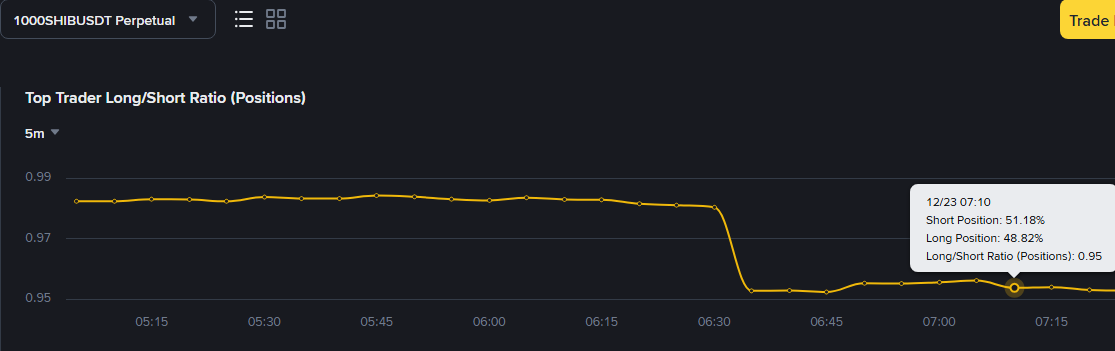

Open Positions Paint a Different Picture

However, a closer look at open positions reveals a more cautious stance. By position size, top traders allocate 48.82% of their Shiba Inu exposure to long positions and 51.18% to shorts, resulting in a ratio of 0.95. This imbalance shows that despite the bullish tilt in sentiment, traders are limiting capital deployment on the long side.

This cautious positioning aligns with Shiba Inu’s recent price performance. Like much of the broader crypto market, SHIB has endured steep declines in recent months. On October 10, the token plunged from around $0.000012 to a low of $0.000007448, marking one of its sharpest drops during the period.

Since then, the downtrend has continued. SHIB has slipped below its October 10 low, reaching $0.000007011 on December 19, before staging a modest rebound to about $0.000007152.

Nonetheless, many traders remain wary that further downside is possible. As a result, Binance’s top traders currently allocate slightly more capital to short positions than to longs, even though roughly 52% of their accounts remain positioned long.

Top-Trader Accounts Remain Bullish Despite Latest Dip

It is worth noting that before yesterday’s correction, Binance’s top-trader accounts were strongly bullish, with 62.3% positioned long and just 37.7% allocated to shorts. Also, open positions among these traders leaned decisively long, accounting for 67.9% of exposure, compared with only 32.1% on the short side.

However, the latest dip across the broader market, which pushed SHIB down by 2.1% over the past 24 hours, triggered a swift shift in positioning. In response, short positions briefly overtook longs, driving the long-to-short ratio down to 0.95.

Despite this, sentiment among Binance’s top traders remains cautiously bullish. Long accounts still make up 52.01% of the group, while shorts account for approximately 47.99%, suggesting confidence has softened but not fully reversed.

Essentially, with Shiba Inu trading 90% below its all-time high, some see a buying opportunity in the meme coin.

u.today

u.today

cointelegraph.com

cointelegraph.com

en.cryptonomist.ch

en.cryptonomist.ch

coindesk.com

coindesk.com