Silver prices have been on a tear this year, with prices more than doubling and marking nominal all-time highs several times. Even at current price levels, analysts expect more upside as state-of-the-art battery and data center tech continue to provide strong demand.

Silver Will Continue To Soar High: Battery Tech and Data Center Demand To Rise

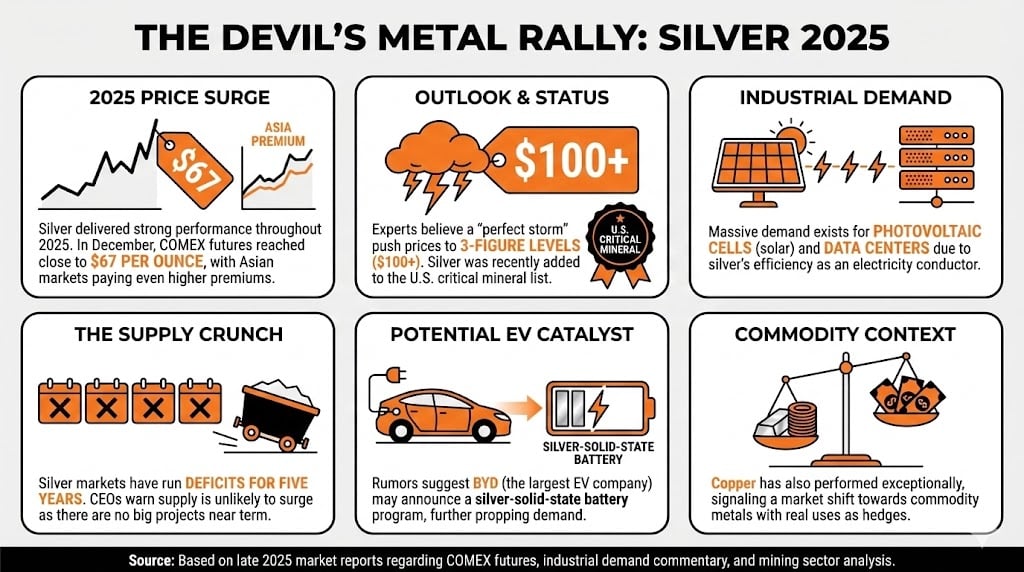

Silver, the so-called devil’s metal, has continued delivering strong performance in December, continuing a rally that has been slowly progressing throughout 2025.

The price of silver futures reached over $67 per ounce on COMEX markets last Wednesday, while prices in Asia have even surpassed these levels, a sign of strong localized demand as Eastern markets aim to become price setters with such a premium.

Even so, with prices rising to record levels, experts believe that silver might still soar, as a perfect storm of elements still supports a path to 3-figure prices. Leaving behind investment-based demand, which is currently booming, silver has been recently added to the critical mineral list in the U.S. because of its myriad uses.

Silver is used in the production of photovoltaic cells and in data centers due to its properties as an efficient electricity conductor. Michael Steinmann, CEO of Pan American Silver, told CNBC that a lot of silver was needed for these applications, and that supply was unlikely to surge as there were not large silver projects coming to fruition in the near term.

Read more: Silver Breaks Into Record Territory—Schiff Says ‘The Silver Train Can’t Be Stopped’

In addition, rumors about the upcoming announcement of a silver-solid-state battery program from BYD, the largest EV company in the world, might also prop up demand. Silver markets have been running deficits for five years, contributing to the ongoing supply crunch.

Silver has not surged on its own, though. Copper, another metal with almost infinite industrial uses, has also performed exceptionally in 2025, signaling a shift for commodity metals with real uses as hedges.

FAQ

-

What recent milestone has silver achieved in December 2025?

Silver futures prices surpassed $67 per ounce on COMEX, indicating a strong ongoing rally fueled by increased demand. -

Why are prices higher in Asian markets?

Prices in Asia have exceeded COMEX levels due to robust localized demand, positioning these markets as potential price setters. -

What contributes to the optimistic outlook for silver prices?

Experts suggest the potential for silver prices to reach three figures is supported by a mix of industrial demand and limited future supply. -

How is silver being integrated into emerging technologies?

Silver’s critical role in producing photovoltaic cells and its rumored application in new solid-state batteries highlight its growing industrial significance.

news.bitcoin.com

news.bitcoin.com

u.today

u.today

coindesk.com

coindesk.com