The US crypto ETF (exchange-traded fund) market is approaching a tipping point. Bitwise Asset Management’s 2026 forecast anticipates the launch of more than 100 new crypto-linked ETFs, driven by the SEC’s streamlined listing standards effective from October 2025.

While the outlook projects new all-time highs for Bitcoin, Ethereum, and Solana, Bloomberg ETF analyst James Seyffart warns that a significant shakeout may be inevitable as the sector becomes overcrowded.

Bitwise Shares 11 Crypto Predictions for 2026

Bitwise has made 10 projects for 2026, spanning crypto and ETF markets that investors will track closely. According to the crypto index fund manager:

- Bitcoin, Ethereum, and Solana will set new all-time highs

- Bitcoin will break the four-year cycle and set new all-time highs

- Bitcoin will be less volatile than Nvidia.

- ETFs will purchase more than 100% of the new supply of Bitcoin, Ethereum, and Solana as institutional demand accelerates.

- Crypto equities will outperform tech equities.

- Polymarket open interest will set a new all-time high, surpassing 2024 election levels.

- Stablecoins will be blamed for destabilizing an emerging market currency.

- Onchain vaults will double in AUM.

- Ethereum and Solana will set new all-time highs (if the CLARITY Act passes).

- Half of Ivy League endowments will invest in crypto.

- More than 100 crypto-linked ETFs will launch in the US.

- Bitcoin’s correlation to stocks will fall.

A Wave of ETF Liquidations Could Occur in 2026, James Seyffart

The eleventh prediction turned heads, becoming of particular concern for analysts. The surge of anticipated crypto-linked ETF launches follows a major regulatory shift.

In September 2025, the SEC introduced generic listing standards for commodity-based trust shares, including crypto assets.

“[Several leading exchanges] filed with the SEC proposed rule changes to adopt generic listing standards for Commodity-Based Trust Shares. Each of the foregoing proposed rule changes… was subject to notice and comment. This order approves the Proposals on an accelerated basis,” the SEC’s filing claimed.

This change allows ETFs to list without individualized review, reducing delays and uncertainty.

Bitwise expects this regulatory clarity to drive institutional adoption and fresh inflows into crypto ETFs in 2026.

2026 PREDICTION: More than 100 crypto-linked ETFs will launch in the U.S.⁰⁰In October 2025, the SEC published generic listing standards, allowing ETF issuers to launch crypto ETFs under a general set of rules. A clearer regulatory roadmap in 2026 is why we see the stage being… pic.twitter.com/rQbcWe6JE4

— Bitwise (@BitwiseInvest) December 17, 2025

“I’m in 100% agreement with Bitwise here,” Seyffart indicated. “I also think we’re going to see a lot of liquidations in crypto ETP products. Might happen at the tail end of 2026, but likely by the end of 2027. Issuers are throwing A LOT of products at the wall.”

Bitcoin ETF Dominance and Altcoin Saturation

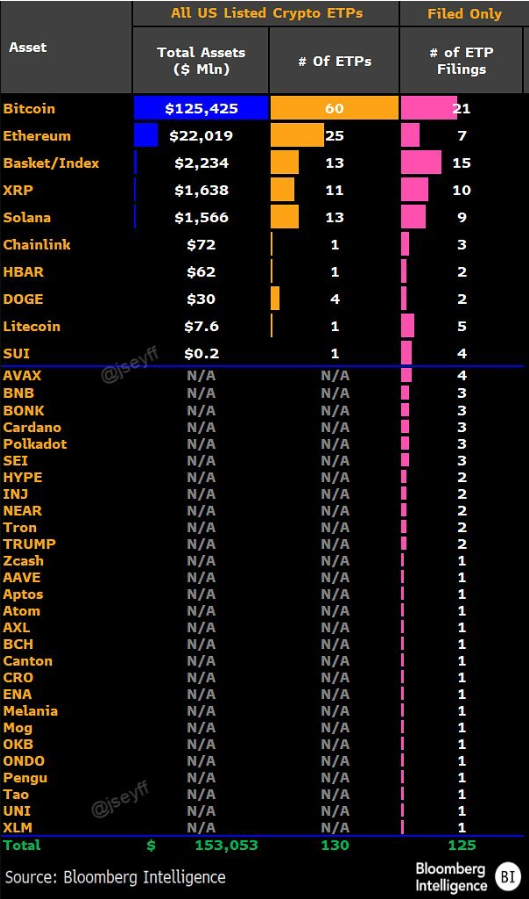

Bloomberg data shows 90 existing crypto ETPs managing $153 billion, with 125 filings pending. Bitcoin leads with $125 billion across 60 products, while Ethereum follows at $22 billion in 25 ETFs.

Altcoins like XRP and Solana remain niche, with 11–13 products each and $1.5–$1.6 billion in assets, signaling rising saturation risks.

With the market poised to be flooded, analysts anticipate direct competition for investor capital. However, historical trends suggest caution, with roughly 40% of ETFs launched since 2010 eventually closing, often due to insufficient assets or trading volume.

The Coming Crypto ETF Shakeout: Winners, Losers, and the Rise of ‘Zombie’ Assets

Seyffart’s warning reflects a broader concern that fast expansion often precedes consolidation. Crypto ETFs that fail to attract sufficient AUM, differentiate their strategies, or establish strong distribution networks may face early closure.

Products offering specialized exposure strategies, income features, or tailored risk profiles could establish lasting positions.

Chris Matta, CEO of Liquid Collective, echoes this concern in the context of “zombie” projects, describing crypto assets with market caps of $1 billion or more but minimal development.

“Maybe the failure to sustain an ETF in trad markets will be a stronger signal and will result in larger performance dispersion between active and dead crypto assets,” Matta said.

Therefore, investors entering the ETF space will need to be highly selective. Trading liquidity, tracking accuracy, fee structures, and issuer credibility will be crucial in distinguishing sustainable products from those that are likely to fail.

Meanwhile, Bitwise’s bullish predictions suggest that leading ETFs tied to major assets may continue to benefit from sustained institutional inflows.

The expected wave of liquidations by late 2027 will likely reshape the sector, consolidating capital among the strongest products.

While disruptive, the process may ultimately strengthen the US crypto ETF market by:

- Removing weak offerings,

- Clarifying choices for investors, and

- Highlighting differentiated strategies.

The question remains: in a crowded ETF sector, which products will survive and which will join the growing ranks of crypto’s forgotten “zombie” assets?

The post The 11th Crypto Prediction from Bitwise May Not Survive—James Seyffart Warns appeared first on BeInCrypto.

beincrypto.com

beincrypto.com