Most XRP investors have a long-term goal of retiring with their stack, but could entering the XRP rich list help with this goal in the next 10 years?

XRP has maintained a spot among the largest and most liquid crypto assets since its debut over a decade ago. With CoinMarketCap suggesting a 32,655% increase since launch, multiple investors may have already retired from XRP. For perspective, a 32,655% ROI would yield $3.27 million from a $10,000 investment.

While some believe XRP may have already run its course and it might be too late to see such substantial gains again, others remain confident that XRP still has a long way to go. Most of the analysts who hold this belief insist that the market is still early despite XRP being over 12 years old, projecting much higher targets from here.

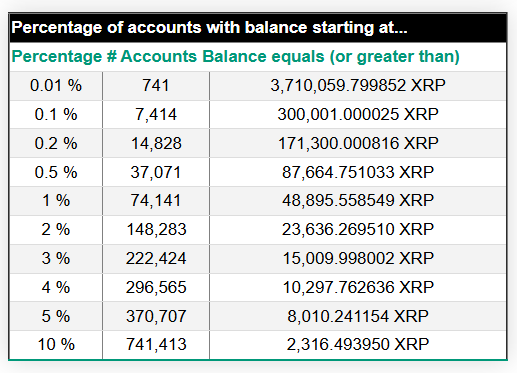

However, should some of these targets play out as expected, how much would investors need to hold to attain their retirement goals? In this context, the XRP Rich List provides important information on how much XRP most investors hold.

Requirement to Enter XRP Rich List

Notably, on-chain data confirms that there are about 7.41 million XRP wallets at press time. For context, these wallets numbered 5.82 million at the start of this year. This indicates that the XRP ecosystem has added up to 1.59 million addresses this year, representing one of its best years in a long time.

Of the 7.41 million existing wallets, 741,413 accounts are among the top 10% on the XRP Rich List. These accounts each hold a balance of 2,316 XRP or more. Meanwhile, for the top 5%, this tier hosts 370,707 wallets holding at least 8,010 XRP. Moreover, the 74,141 wallets in the top 1% hold 48,895 XRP or more.

Naturally, investors within higher tiers on the XRP Rich List are more likely to profit from a future XRP price surge. In addition, the nationality of the investor would also play an important role. For instance, while most workers in the U.S. say they need $1 million to retire, estimates suggest investors could retire with $400,000 in Ghana.

Notably, for countries like the U.S. that demand at least $1 million for retirement, investors in the top 1% of the XRP Rich List, holding at least 2,316 tokens, would only reach their retirement goal if XRP claimed $431 or less per token.

Meanwhile, those in the top 5%, holding 8,010 XRP or more, would retire with an XRP price of $124.8 per token.

For the investors within the top 1%, XRP would have to rise to just $20 per token for their 48,895 XRP tokens to reach a value of $1 million.

Could Investors on the XRP Rich List Retire in 10 Years?

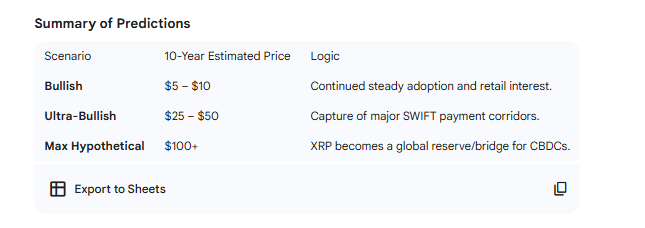

Now, the more important question remains: could XRP hit these price targets in the next 10 years? According to AI chatbot Google Gemini, XRP may reach a “max hypothetical” price of $100 over the next 10 years. At this price, investors in the top 1% would hold over $4.8 million, enough to retire comfortably.

However, those in the top 10% would only see their holdings rise to $231,600, which is insufficient even for retirement in some low-cost countries, much less the U.S. For the top 5%, their investments could rise to $800,000, enough to retire in some U.S. states and nearly every low-cost country. Nonetheless, an XRP run to $100 by 2035 remains unguaranteed.

thecryptobasic.com

thecryptobasic.com