What could be the impact on XRP price if SWIFT corridors migrated to RippleNet, Ripple’s XRPL-based payment network?

Over the past few years, XRP proponents and industry leaders have discussed whether XRP might eventually work with SWIFT or even replace the network.

Could XRP Work with SWIFT?

For instance, in 2015, Ripple Chairman Chris Larsen told Global Finance Magazine that Ripple connects payment networks for real-time settlement in any currency and can work alongside existing systems like SWIFT or ACH.

Moreover, earlier this year, Ripple CEO Brad Garlinghouse said XRP could capture 14% of SWIFT’s volume within 5 years.

Notably, these comments have led to an assessment of how XRP price could react if SWIFT corridors, which facilitate the network’s payments, moved to RippleNet.

SWIFT Corridors

For context, SWIFT corridors represent direct payment routes between financial institutions in different countries and currencies across the SWIFT network. SWIFT currently runs about 40,000 of these routes, covering more than 150 currencies and more than 200 countries and territories.

Recent data shows the existence of about 40,000 total corridors in 2024. These corridors handle about $150 trillion in cross-border value each year, equal to about 1.5x global GDP. In addition, the network processes more than 47 million daily messages as of mid-2025.

Notably, about 60% of wholesale payments arrive in destination accounts within 1 hour after a SWIFT message goes out. The most used currencies include USD at 50% of total value, EUR at 23%, and CNY at less than 4% as of early 2025.

Meanwhile, SWIFT has also continued to expand of late. Daily messages rose from about 32 million in 2015 to more than 47 million in mid-2025. In addition, annual value is projected to reach $125 trillion in 2025, which marks 4% annual growth. The network now moves an amount equal to global GDP roughly every 3 days. SWIFT also announced ISO 20022 migration in November 2025.

XRP Price if SWIFT Corridors Migrated to RippleNet

Considering this scale, we recently assessed how the crypto asset might react if SWIFT corridors eventually migrate to RippleNet, with XRP trading at $2.04 at the time of analysis. To get an overview, we turned to Google Gemini.

Gemini modeled what would happen if RippleNet handled the entire $150 trillion in annual flows. It explained that such a model must consider both transaction utility and the liquidity depth institutions require to avoid heavy price swings. In other words, the asset must hold enough market value to settle global payments without severe volatility.

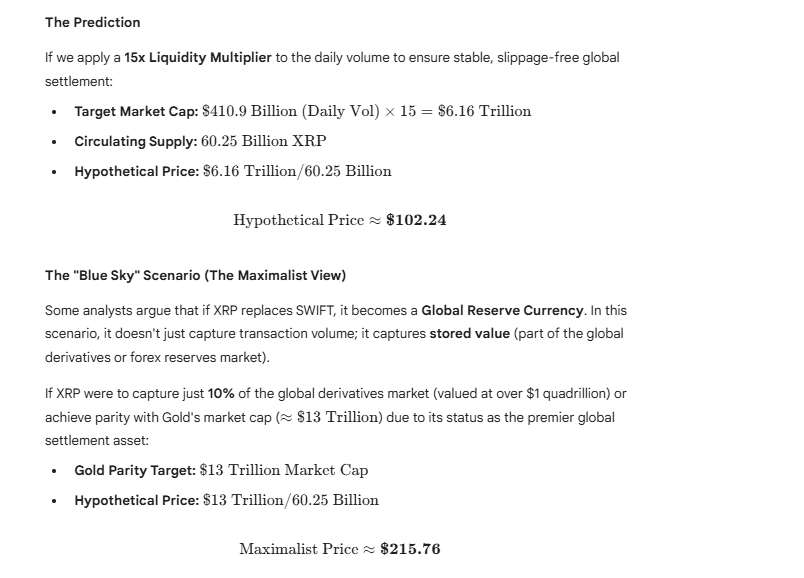

According to Gemini, $1150 trillion in volume per year equals about $410.9 billion per day. Meanwhile, analysts often apply a “liquidity multiplier” in these calculations.

In ordinary utility systems, fast settlement allows lower prices because the asset moves many times per day. However, in institutional systems, deep liquidity matters. Traditional FX markets often hold market values 10x–20x daily volume. As a result, Gemini used a 15x multiplier.

A $410.9 billion daily requirement multiplied by 15 produces a hypothetical market cap of $6.16 trillion. With a circulating supply of 60.25 billion XRP, this model places the token at around $102.24.

Meanwhile, a more bullish outlook considers global reserves and derivatives. If XRP captured 10% of the global derivatives market, which exceeds $1 quadrillion, or matched gold’s $13 trillion market cap, the model places XRP at about $215.76.

Here’s What 3,000 and 7,000 XRP Could be Worth

This shows how much retail holders could gain if this extreme scenario plays out, especially for those holding 3,000 to 7,000 XRP. At current prices, 3,000 XRP worth $6,120 could jump to $300,000 to $645,000. This increase would give the holder profits of $293,880–$638,880.

Meanwhile, investors with 7,000 XRP, currently valued at $14,280, could see their holdings climb to $700,000 to $1.505 million, creating profits of $685,720 to $1.49 million.

However, these projections rely on XRP capturing 100% of SWIFT’s volume and assume institutions would hold XRP instead of buying and using it within seconds.

This scenario remains unlikely, especially since SWIFT continues to explore blockchain options such as a SWIFT-issued blockchain while ignoring the XRPL. These projections also do not factor in competition from CBDCs and private stablecoins, which now pursue similar settlement goals.

thecryptobasic.com

thecryptobasic.com