Dogecoin faces resistance below key Fibonacci levels as it approaches crucial support. Will DOGE find support?

Dogecoin (DOGE) has experienced a modest 1.8% gain in the last 24 hours, currently trading for $0.1406. The price has fluctuated between $0.1366 and $0.1423 during this period, reflecting some level of volatility.

Over the past week, Dogecoin has seen a 3.9% decline, while the 14-day performance shows a larger drop of 6.8%. The 30-day and one-year performances show more significant losses, with declines of 18.1% and 66.4%, respectively, highlighting long-term ongoing struggles.

Despite recent short-term gains, Dogecoin faces challenges in sustaining momentum, especially given the broader downtrend over the past month and year. The current price range, along with the mixed performance, suggests that Dogecoin is caught in a larger bearish trend. Can bulls find support and defy the bears?

Dogecoin Price Analysis

Looking at the technical charts, DOGE has faced stiff resistance below the 0.236 Fibonacci level at $0.15030. The price is currently hovering just above the 0 level, with the next potential support around $0.13000. Dogecoin has previously seen a bounce after touching this support, for instance the latest pump to $0.154 on December 3.

If Dogecoin fails to hold above this support, it could face further declines, with the 0.382 Fibonacci level at $0.16162 acting as the next resistance point for any potential bounce.

Meanwhile, the Chande Momentum Oscillator (ChandeMO) reading of -36.21 suggests that Dogecoin is seeing a decline in momentum, signaling a potential for short-term reversal or consolidation. This negative momentum could continue if the price fails to break above the 0.236 level and regain momentum.

However, if Dogecoin manages to stay above the $0.13200 support level and recapture the 0.236 level, it may attempt to retest higher Fibonacci levels, with the 0.618 level at $0.17992 being a crucial resistance to watch for any upward move.

Dogecoin Liquidation Data

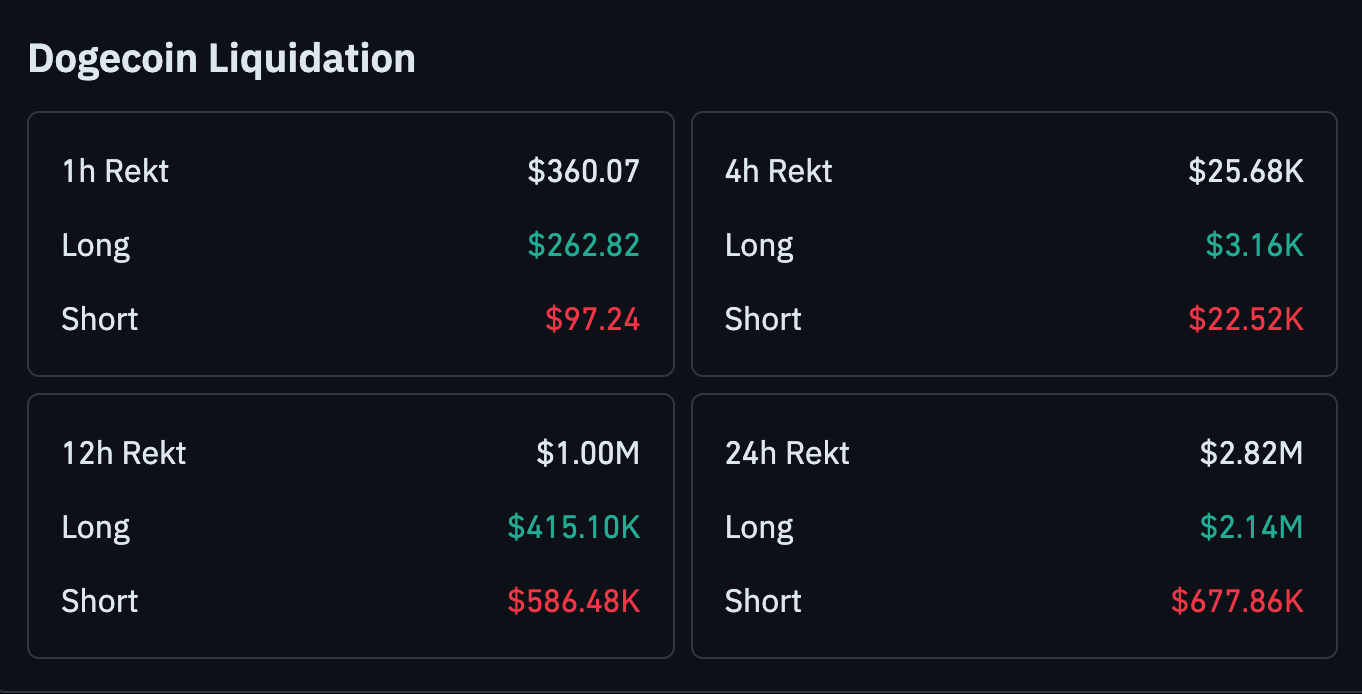

Dogecoin’s liquidation data highlights growing volatility, with long positions dominating recent liquidations. Over the last 12 hours, Dogecoin experienced significant liquidation activity, with a total of $1.00 million in liquidations. Long positions accounted for $415.10K, while short positions saw a higher liquidation of $586.48K, indicating stronger pressure on short positions during this period.

In the last 24 hours, the liquidation volume increased to $2.82 million, with long positions totaling $2.14 million and short positions at $677.86K. This shows that long positions have been hit harder. The dominance of long liquidations suggests that Dogecoin may face further downside if the trend continues.

cointelegraph.com

cointelegraph.com

u.today

u.today