Terra Classic (LUNC) trades near the lower band of its recent recovery structure as traders assess the impact of fresh volatility and shifting sentiment. The token climbed sharply earlier this month before a fast retracement pulled price toward the $0.000053–$0.000054 region.

This zone now acts as the center of an ongoing battle between dip buyers and cautious sellers. Moreover, broader market conditions weakened during the same period, adding pressure.

Technical Picture Shows Tightening Conditions

LUNC surged toward $0.00008157 before momentum cooled and a corrective wave formed. Price then moved toward the Fibonacci support zones, where $0.00005993 and $0.00004655 remain crucial for short-term direction. Buyers continue to defend the 20 and 50 EMAs, which cluster near the mid-range.

Consequently, the trend maintains a higher-low structure that signals steady demand on dips. However, losing $0.00004655 could expose $0.00003828 and challenge the broader rally. Upside attempts still face resistance at $0.00005993 and $0.00006945, with a break above the swing high at $0.00008157 needed for a renewed advance.

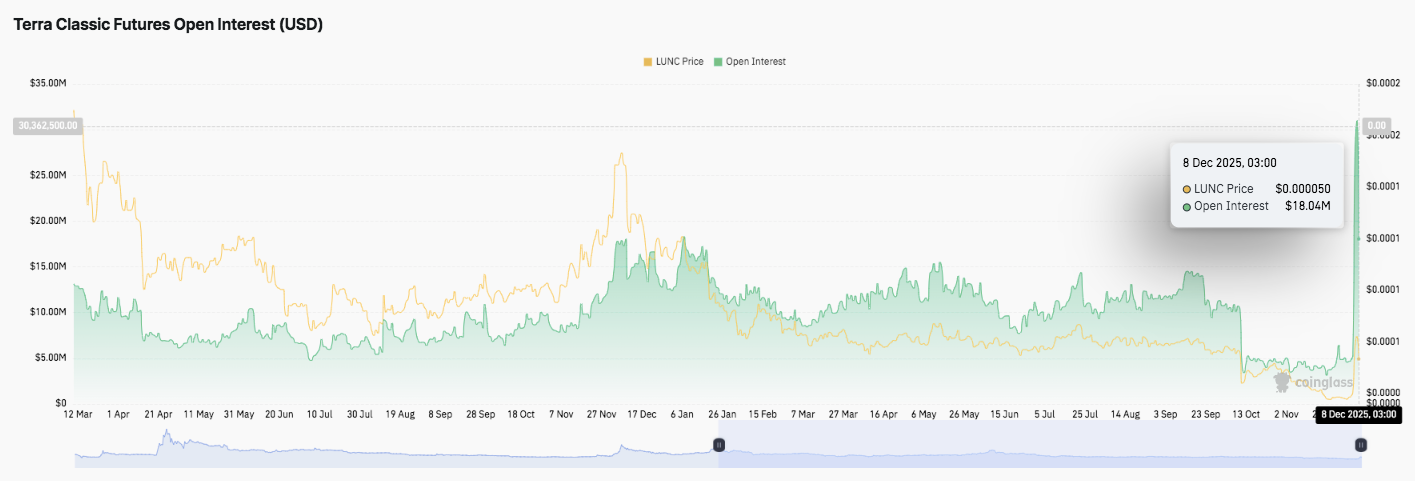

Open interest saw a long decline from peaks near $30 million earlier this year. Activity compressed between $8 million and $15 million during months of reduced volatility. Mid-year spikes lacked follow-through, and conviction weakened.

Related: Cardano Price Prediction: Channel Ceiling Rejects Bulls Again…

However, a sharp rise toward $18 million on December 8 signaled new positioning as traders returned to the market. Additionally, this shift aligns with LUNC’s attempt to form a near-term price floor.

Spot Market Still Shows Heavy Outflows

LUNC’s spot flows recorded persistent outflows across October and November. Sellers dominated most sessions, and inflows stayed limited.

Net outflow of about $718K on December 9 matched the price slide toward $0.000054. Hence, sentiment remains fragile. Traders continue to off-load positions, and sustained recovery needs a clear reversal in liquidity trends.

Ecosystem Catalysts Add New Momentum

The Terra Chain v2.18 upgrade on December 8 boosted network activity and reduced technical issues. Trading volume climbed above $200 million as users reacted to the smoother environment. Binance temporarily paused deposits and withdrawals to support the upgrade and maintain stability.

Attention also increased ahead of Do Kwon’s December 11 sentencing. His plea created fresh uncertainty, yet interest in Terra-linked assets rose as traders positioned for potential volatility. Moreover, this event added another narrative driver to a chart driven by shifting technical signals.

Technical Outlook for Terra Classic (LUNC) Price

Key levels remain clearly defined as LUNC attempts to stabilize after a sharp retracement.

Upside levels sit at $0.00005993, $0.00006945, and $0.00008157, which remain the immediate hurdles. A breakout above these zones may extend toward $0.00009000 and $0.00010200 if momentum strengthens.

Downside levels include $0.00004655, which acts as trendline support, followed by $0.00003828 and $0.00003700 near the EMA200 band. The 0.618 Fib level at $0.00005993 forms the resistance ceiling and is the most important zone for medium-term bullish confirmation.

The technical picture shows LUNC compressing within a broad retracement channel after its parabolic move. Price continues to form higher lows above the 20 and 50 EMAs, suggesting buyers remain active during deep dips. A decisive close above the mid-range resistance cluster may trigger volatility expansion and rebuild market confidence.

Will Terra Classic Recover?

LUNC’s next direction depends on whether buyers defend $0.00004655 long enough to challenge the $0.00005993–$0.00006945 region. Both technical compression and recent rise in open interest point toward a possible volatility spike ahead.

If bullish momentum develops with stronger inflows, LUNC could retest $0.00008157 and potentially extend toward $0.00009000. However, failure to hold $0.00004655 risks breaking the current accumulation base and exposing deeper support near $0.00003828.

Related: Shiba Inu Price Prediction: Sellers Defend Trendline As Whale Activity Signals…

For now, LUNC sits in a pivotal zone. Sentiment improves with the Terra Chain v2.18 upgrade and renewed attention on Terra-related developments, but technical confirmation will determine the strength of any sustained recovery.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

cointelegraph.com

cointelegraph.com

u.today

u.today