Markets were already on edge when Donald Trump reignited the US-China trade war with threats of 100% tariffs and fresh export controls. The result was immediate: global equities tumbled, with the S&P 500 logging its sharpest fall in months. For cryptocurrencies like Shiba Inu ($SHIB), this isn’t just background noise. Meme coins live and die on risk appetite, and when capital flees to safety, $SHIB becomes one of the first assets to feel the shock. The question now gripping traders is simple: could this geopolitical clash trigger a crash that drags $SHIB closer to zero?

Shiba Inu Price Prediction: Why This News Matters for $SHIB Price?

When Donald Trump announced a fresh 100% tariff on Chinese imports along with export restrictions on critical software, global markets immediately shuddered. The S&P 500 logged its sharpest drop since April. For crypto, this matters because risk assets like $SHIB thrive on liquidity, retail speculation, and a “risk-on” environment. If global trade tensions escalate, capital flees to safe havens like gold or the dollar, not meme coins.

For $SHIB, the panic around trade wars hits doubly hard. First, China remains a big player in crypto mining and liquidity provision. Second, macro uncertainty makes meme coins easy targets for liquidation, as traders dump high-beta assets before touching their Bitcoin or Ethereum holdings.

What the $SHIB Price Chart is Telling Us Right Now?

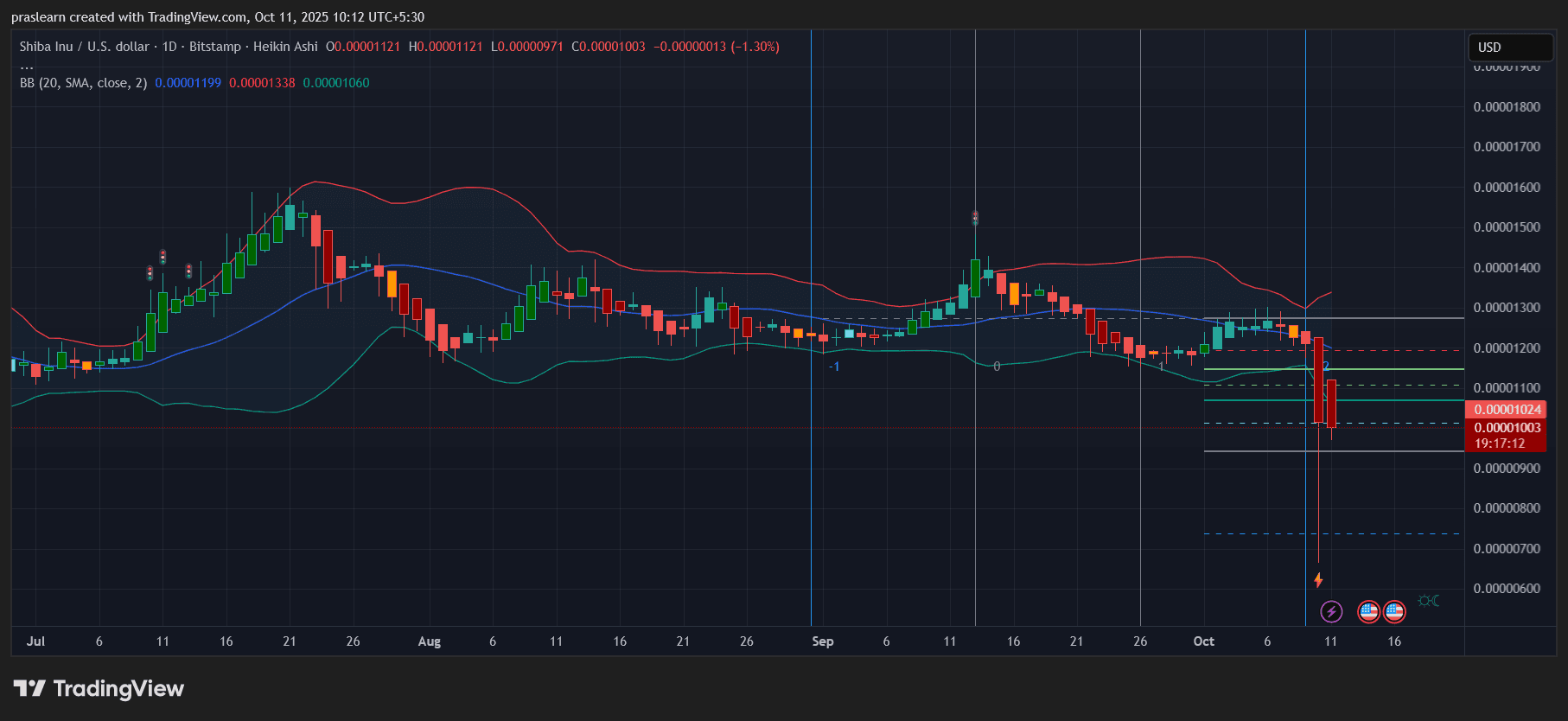

Looking at $SHIB’s daily chart, the situation is tense:

- Shiba Inu Price collapsed below the mid-Bollinger band and is now hugging the lower band around 0.0000100.

- A flash wick dragged $SHIB down toward the 0.0000070 zone, showing how thin liquidity is during panic.

- Resistance has shifted lower to 0.0000119 and 0.0000133. These levels must be reclaimed for recovery to begin.

- Support sits precariously at 0.0000095, and a failure here risks a slide toward the 0.0000070 flash-crash zone.

This is the type of setup where meme coins either dead-cat bounce or unravel.

Short-Term Outlook: Is a Relief Rally Possible?

In the next 7 to 14 days, $SHIB price could see a reflex bounce if markets stabilize. Bollinger bands are widening, suggesting volatility is only just beginning. If $SHIB can close back above 0.0000110, traders may front-run a rally back to 0.0000120–0.0000130. But the probability of this depends on whether broader equities calm down. If Trump escalates further or China retaliates harder, every bounce may get sold.

Medium-Term Shiba Inu Price Prediction: Where Can $SHIB Go in the Next 30–60 Days?

Macro headwinds make this dangerous. A trade war can depress liquidity for months, and $SHIB price doesn’t have a strong fundamental driver right now beyond community hype. The base case is consolidation between 0.0000090 and 0.0000120. The bearish case is more painful: losing 0.0000090 could expose $SHIB to 0.0000070, and eventually, the psychological 0.0000050 zone.

Unless whales or developers trigger some new catalyst, $SHIB is unlikely to revisit September highs anytime soon.

Shiba Inu Price Prediction: Will $SHIB Price Really Crash to 0?

The blunt answer is no. Meme coins rarely go to absolute zero unless abandoned. $SHIB still has a large, active community and ongoing ecosystem projects. However, in a world of tariffs, rare earth fights, and a crumbling S&P, Shiba Inu price could bleed significantly lower before finding new buyers. A move back to 0.0000070 is realistic if markets worsen.

Final Verdict

Donald Trump’s tariff threat has spooked global markets, and $SHIB is caught in the crossfire. The chart is bearish in the short term, with only slim chances of recovery unless risk sentiment improves. While a true crash to 0 is unlikely, $SHIB holders should brace for a grind lower and respect support zones closely. In other words, panic selling might be premature, but blind optimism is just as dangerous.

newsbtc.com

newsbtc.com

ambcrypto.com

ambcrypto.com

u.today

u.today