Pepe

The wider memecoin market, based on the CoinDesk Memecoin Index (CDMEME) saw a 3% decline in the last 24-hour period, significantly underperforming the wider market. Measured through the CoinDesk 20 (CD20) index, the wider market lost just 0.1% of its value over the period.

Whale accumulation has nevertheless been ongoing, with the top 100 PEPE addresses on the Ethereum network seeing their holdings rise 1.5% in the last 30 days, while PEPE on exchanges dropped by 0.5% over the same period according to Nansen data.

Technical Analysis Overview

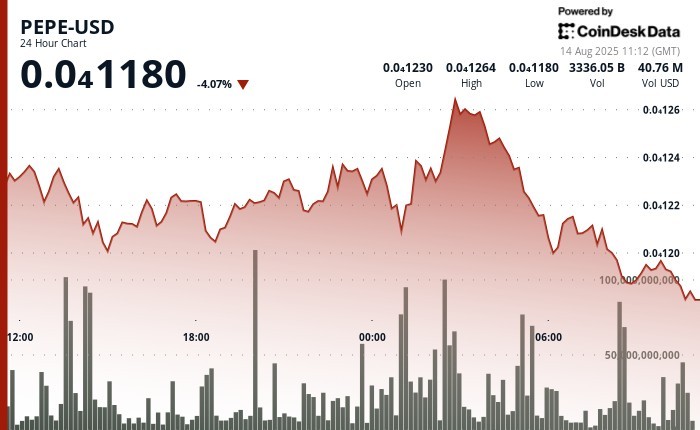

PEPE traded in a $0.0000081 range over the past 24 hours, marking a 7% spread between the high and low, according to CoinDesk Research's technical analysis data model.

The peak came at $0.0000126621, but repeated breakout attempts above $0.000012 met selling pressure. Critical intraday support was tested around $0.0000118094. The token then moved into a tight consolidation channel between $0.00001181 and $0.00001198, signaling indecision among traders.

The day ended with PEPE settling at $0.0000118, slightly above support but under clear distribution pressure from sellers. Unless its price can reclaim and hold above the $0.000012 resistance zone, momentum may favor a retest of lower support levels.

Volume patterns during the session suggest waning buyer strength compared to earlier in the week, which could limit the chances of a sustained upside breakout without renewed market catalysts.

cryptopotato.com

cryptopotato.com

cointelegraph.com

cointelegraph.com