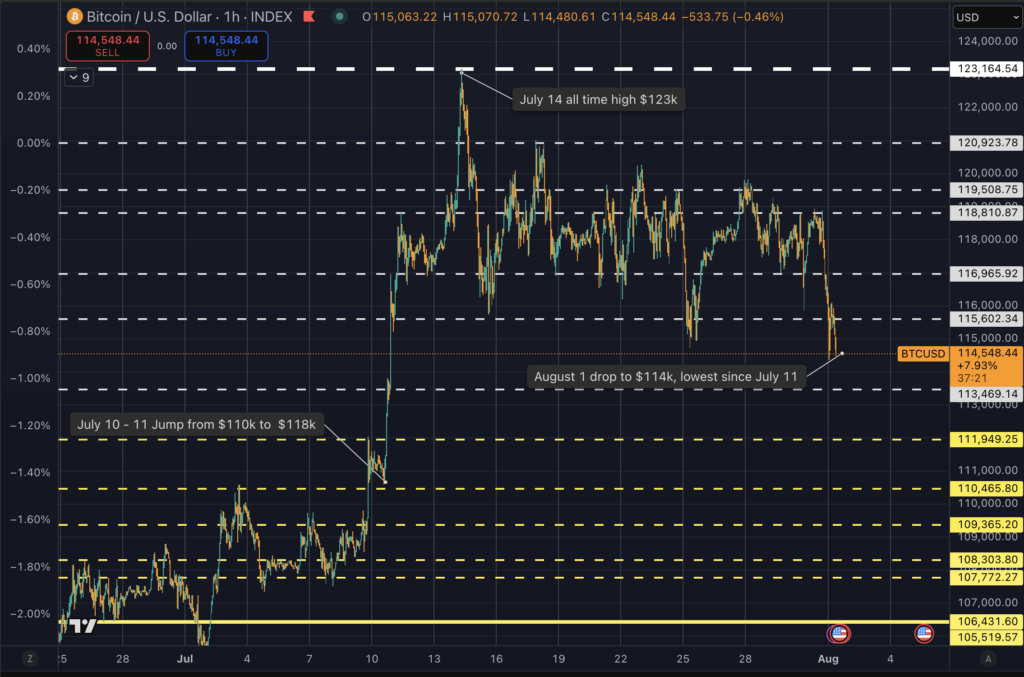

Bitcoin fell below $115,000 on August 1, reaching its lowest level since July 11 after a sustained period of volatility. The drop marked a retracement from the asset’s July 14 peak, when it hit an all-time high of $123,000. The retreat to $114,000 punctuates a 7% pullback from the July high and reflects the broader instability characterizing the crypto market’s late July performance.

The early July period had been marked by aggressive upward momentum. Between July 10 and 11, Bitcoin surged from $110,000 to $118,000 in under 24 hours. That spike represented a 7.2% single-day jump, coinciding with a rush of leveraged short liquidations across derivatives markets and fueling speculation around increased institutional interest.

Following the July 11 surge, BTC rallied further and recorded its all-time high of $123,000 on July 14. However, that level proved to be a temporary ceiling. Despite multiple consolidation attempts above $118,000 throughout the second half of July, Bitcoin repeatedly failed to regain bullish momentum.

This plateau phase saw intraday fluctuations compress into a narrowing range, indicating weakening buying pressure. Per CryptoSlate’s earlier reporting, some traders attributed the stall to profit-taking from early entrants and cautious positioning ahead of the FOMC’s inflation guidance this week, which held rates at 4.4%.

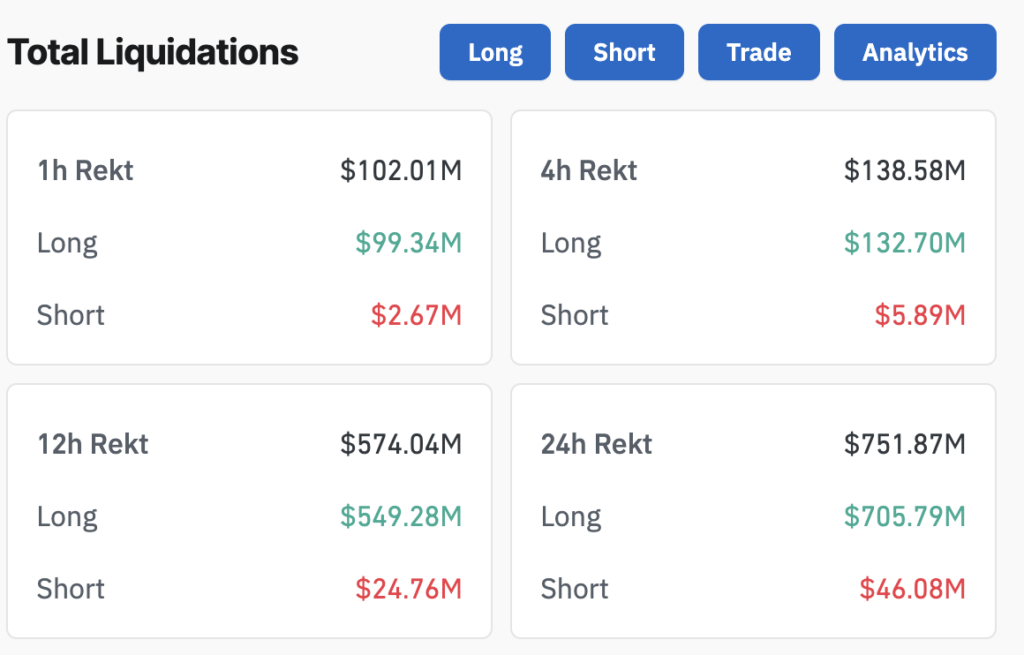

The correction that followed today was exacerbated by over-leveraged positioning in perpetual contracts.

According to liquidation data, more than $705 million in long positions were wiped out across major exchanges in the past 24 hours, with Binance and Bybit accounting for over 67% of the total.

These liquidations coincided with Bitcoin’s slide below $115,000, accelerating downside momentum and pushing the price to levels not seen since the July 10 rally. Market data also shows that more than $12 million in BTC-specific liquidations occurred in the past hour alone, further confirming cascading leverage unwinds.

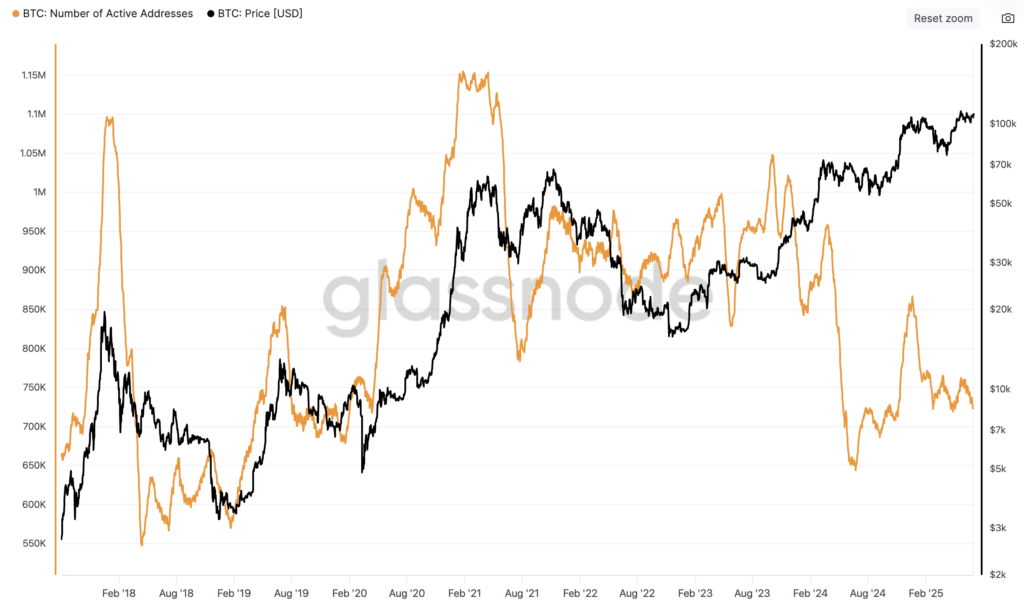

Despite the sell-off, Bitcoin’s price is still up over 8% since the start of July. Should BTC break below the $113,500-$114,000 support region, there’s a risk of a revisit to early July consolidation zones near $110,000. On-chain metrics, including declining active addresses and dropping exchange outflows, have also supported a short-term bearish outlook, according to data from Glassnode.

The broader altcoin market mirrored Bitcoin’s losses. Ethereum dropped 6.4% to $3,611, while Solana and XRP fell over 7% each in the same 24-hour window. Market-wide long liquidations amounted to over $680 million, accounting for more than 93% of total liquidations, illustrating an overwhelmingly long-heavy derivatives landscape prior to the correction. This uneven leverage skew likely contributed to the sharp cascade, as high beta assets amplified losses amid falling BTC prices.

However, it is also possible that Bitcoin followed altcoins for once, with overleveraged alts retracing after July’s ‘alt season’ rally.

Bitcoin’s drop to $114,000 caused a drop in the fear and greed index, with the metric falling to ‘neutral’ after a period of ‘greed’.

Though the recent decline has rattled short-term sentiment, BTC’s price remains well above its June consolidation range near $100,000 and its 4-month low of $74,000, reflecting a longer-term bullish structure despite the current turbulence.

cryptoslate.com

cryptoslate.com