“What unites people? Armies? Gold? Flags? Stories. There’s nothing more powerful in the world than a good story.”

— Tyrion Lannister

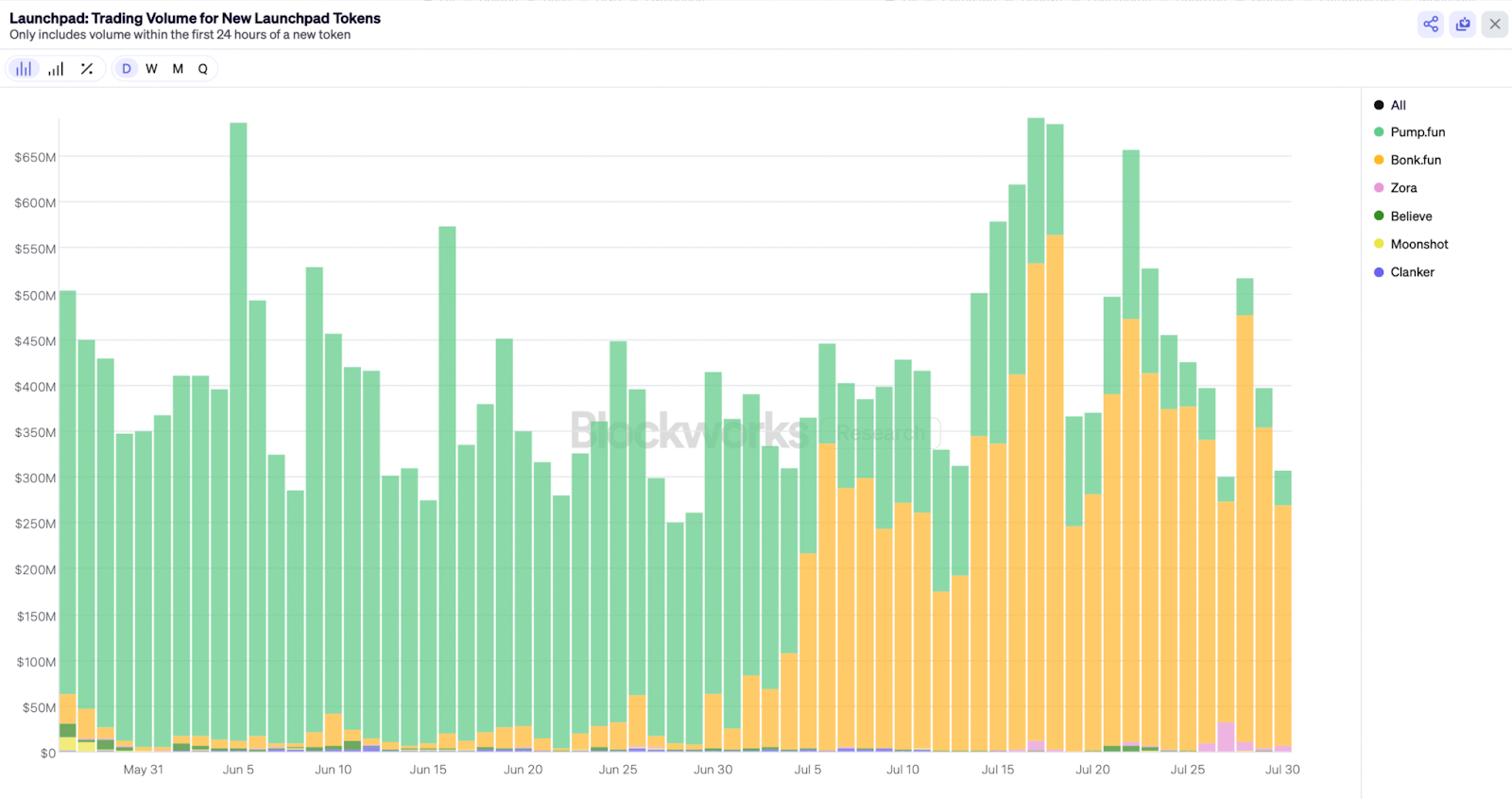

Blockworks Research launchpad dashboard

Here’s an incredible chart from Blockworks Research:

Incredible because it illustrates just how fast fortunes can change in the low-moat business of crypto.

As measured by trading volumes, Pump.fun (in green) went from a nearly 100% share of the market for launchpad tokens on June 9 to under 10% now.

But the even more incredible part might be what happened in between: the Pump.fun ICO.

Has there ever been a similar case where the underlying business of a company was collapsing in the same moment that investors were eagerly sending the company their money?

The closest I can find is when Blue Apron IPO’d in 2017, just a week after Amazon bought Whole Foods.

The prospect of Amazon delivering groceries the way it delivers everything else suddenly made Blue Apron’s business of delivering meal kits seem doomed.

It was — and most investors seemed to know it. The IPO was re-priced sharply lower, the stock immediately fell even further than that and the company was eventually acquired for less than one-tenth its valuation at IPO.

Crypto investors, by contrast, seemed weirdly eager to buy into a similar setup, with Pump.fun in the role of Blue Apron and Bonk.fun in the role of Amazon.

Bookmark the dashboard to see if they can rewrite the ending.

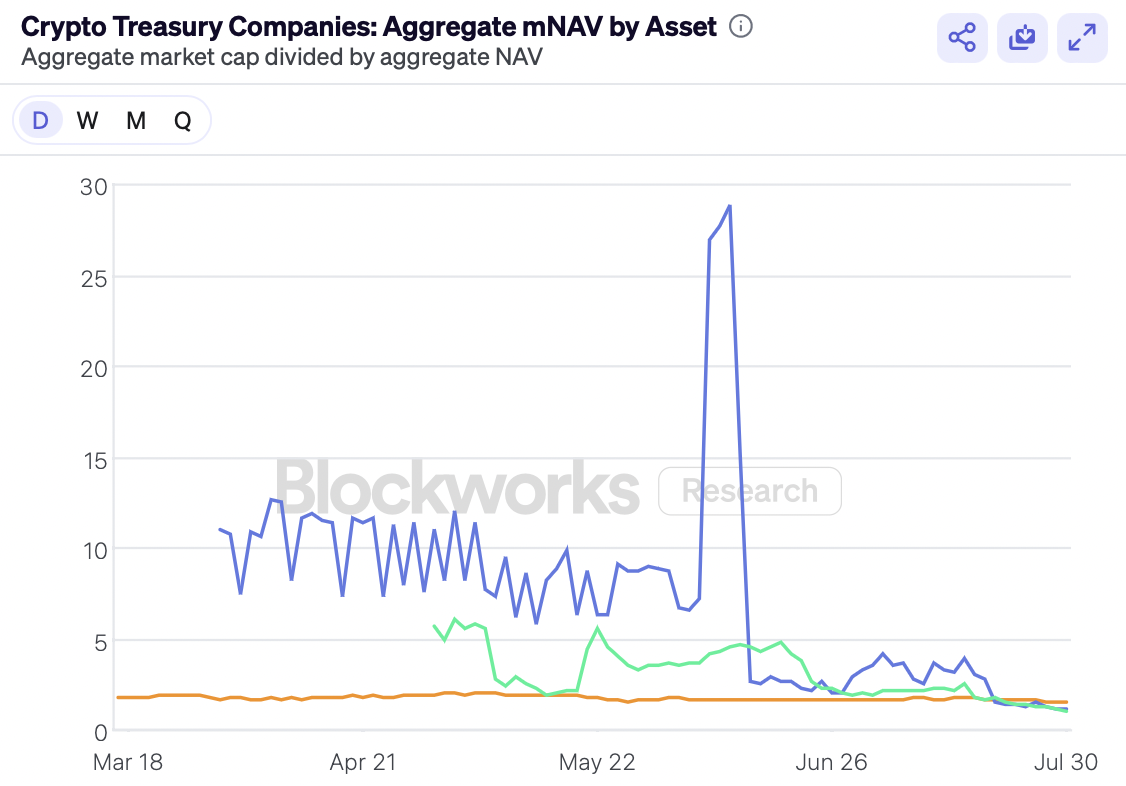

Blockworks Research DAT dashboard

Another new Blockworks Research dashboard is the best way to follow the story of crypto treasury companies without having to pay attention to crypto treasury companies.

On multiple metrics, the story seems to be losing steam.

The collective mNAV (multiple of net asset value) for treasury companies investing in ETH and SOL, for example, has fallen below the mNAV for bitcoin treasury companies — which might be a sign that the MicroStrategy phenomenon is not as easy to replicate as its emulators seem to think.

Personally, I blame this week’s announcement of a SUI treasury company, which has surely taken things too far.

What would Michael Saylor say???

Someone laundered the money

Tornado Cash has long been a cause célèbre in crypto circles, mostly on the basis that code is speech.

The case that the prosecution just finished making against co-founder Roman Storm, however, is not that he wrote the code, but that he owned and controlled Tornado Cash.

Whatever the merits of that argument, it’s interesting to think through the implications should the jury return a non-guilty verdict for Storm — because someone laundered the money.

“Somewhere in the Tornado Cash stack,” JP Konig wrote when Storm was indicted, “someone is committing the crime of money laundering.”

The US government says that someone was Storm and his co-founder, Roman Semenov.

If a jury disagrees, it presumably means someone else was responsible, because no one disputes that money was indeed laundered.

“Crooks depositing dirty ether are still ending up with laundered ether, so there is by definition a ‘someone’ in the stack who is providing laundering services to them,” Konig wrote.

Could that someone be the users of Tornado Cash?

“A person who is aware that criminals are depositing dirty money into Tornado Cash smart contracts, yet decides to deposit their own funds into those same smart contracts…ticks all the boxes for a money laundering charge.”

No user of Tornado Cash could plausibly claim ignorance of its use for money laundering. So, if the co-founders don’t take the rap, users might have some explaining to do.

“Counterintuitively, the indictment [of Roman Storm] seems like a win…for fans of decentralized finance, or DeFi,” JP Konig concluded.

If so, a win for Roman Storm could, counterintuitively, turn into a loss for DeFi.

Ethereum closing bell

The 10th anniversary of Ethereum’s founding was celebrated yesterday with a ceremonial ringing of the closing bell for Nasdaq.

It’s surprising just how unsurprising that seems.

Crypto, conceived as an alternative financial system, is suddenly most celebrated by the traditional system it was meant to replace.

Crypto is worth more on the stock market than it is in crypto markets; stock market investors value Circle at 10x what crypto investors probably would have; crypto IPOs are hotter than crypto ICOs.

And no one seems particularly surprised about it.

TradFi is having a crypto moment. I get it.

But what’s unclear to me is whether crypto is changing finance or finance is changing crypto.

In the case of Ethereum, the community has been executing on its technical roadmap, but the token was languishing, which made people question the roadmap.

Now, the token is hot again, but only because the stock market has somewhat arbitrarily decided to like it for reasons unrelated to its technical development.

Is that good?

In investing, everything is a story and the stories determine what kind of businesses get built.

Now, Wall Street seems to be writing a new story for ETH and that might affect what kind of Ethereum gets built.

Jim Cramer, for example, says he’s buying ETH as a hedge against inflation and if that’s a story that catches on, it might just become that.

Ethereum isn’t a company, of course, so maybe it’s exempt from the perception-is-reality dynamics of TradFi.

Still, my guess is that celebrating Ethereum’s 10th birthday on a stock exchange will have an effect on what it becomes by its 15th or 20th.

A golden age of digital assets is coming

In a statement this week, the White House declared its ambition to usher in “a golden age of crypto,” along with a report on the regulatory and legal changes that will make this possible.

The 160-page document makes clear just how committed the administration is to digital assets, detailing a broad suite of industry-friendly policies that I have no doubt will go a long way toward realizing that vision.

But the golden age of crypto will begin when none of that matters.

Crypto will only be ascendant when it’s routinely exchanged peer-to-peer, not when “regulators provide clarity regarding BSA obligations and reporting.”

When people routinely pay for everything in crypto, without any need for on- and off-ramps “with built-in AML and KYC protocols.”

And when DeFi is sufficiently self-sovereign that it can safely operate without studying the “AML/CFT obligations of actors within the decentralized finance ecosystem.”

blockworks.co

blockworks.co