After rallying to a 2025 high near $3.60 earlier this month, XRP price today has entered a consolidation phase, currently hovering around $3.15. The asset is stabilizing just above the 0.786 Fibonacci retracement level, with key support from the July breakout still holding. Traders are watching closely as momentum indicators cool and structural levels tighten.

What’s Happening With XRP’s Price?

XRP broke out of a long-standing descending triangle in early July, triggering a surge that lifted the token from $2.20 to $3.60 in under two weeks. Since then, price has pulled back and is now testing the $3.10–$3.15 demand zone. On the daily chart, the structure remains bullish, with XRP holding above previous resistance zones near $2.80 and $3.00.

The weekly Fibonacci retracement levels place $3.081 as the 0.786 marker, which has served as a pivot since July 25. This area is now functioning as a near-term magnet for price action. As long as XRP remains above this line, the broader trend bias remains intact.

Why Is XRP Price Going Down Today?

Why XRP price going down today is tied to a confluence of rejection signals and weakening momentum. The 4-hour chart shows price repeatedly rejecting the $3.33–$3.34 Supertrend resistance. The Bollinger Bands have tightened around current levels, suggesting suppressed volatility following the sharp July spike. Directional Movement Index (DMI) readings have also declined, with ADX falling toward 22.6 and +DI and -DI lines converging, signaling a fading trend environment.

Meanwhile, the 30-minute RSI sits near 49.90, hovering around neutral, and VWAP resistance is just overhead near $3.15–$3.16.

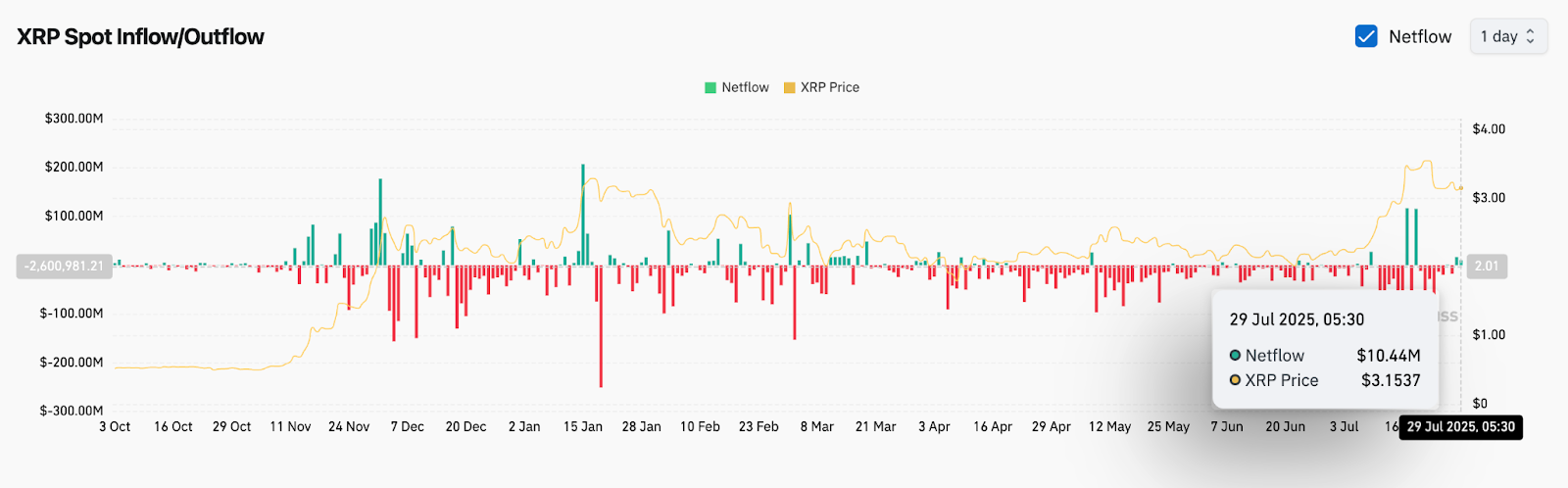

Despite this cooling, spot inflow data is relatively positive. According to recent netflow metrics, XRP registered +$10.44M in exchange inflows on July 29. This suggests some dip-buying or rotation behavior, although not yet strong enough to reclaim upward momentum.

XRP Price Structure Shows Critical Holding Pattern

Price is currently balancing on a layered support structure between $3.10 and $3.00. The 4-hour EMA cluster (20/50/100) is stacked just beneath at $3.11, $3.12, and $3.18, forming a critical short-term defense zone.

The Bollinger Bands on the 4-hour chart are compressing with lower wicks bouncing off $3.11, showing buyer interest. However, until XRP closes above $3.21, this may remain a mid-range chop zone. The presence of VWAP resistance and lower highs reinforces this.

The daily chart confirms this bias. XRP still trades well above the descending trendline break from June and above the $2.83 Fib 0.618 level. However, the broader breakout structure risks becoming vulnerable if price fails to bounce above $3.20 with volume support.

XRP Price Prediction: Short-Term Outlook (24H)

If XRP price can reclaim the $3.20–$3.22 area on a clean 4-hour close, bulls may initiate a short squeeze toward $3.34 and possibly $3.50. That would require clearing Supertrend resistance and closing above the upper Bollinger Band.

Conversely, failure to hold above $3.10 risks pushing XRP toward the $3.00 mark, with stronger support near $2.88 (200 EMA on 4H) and $2.83 (Fib 0.618). These levels could serve as accumulation zones if the current retracement deepens.

The RSI and MACD show weakening bias but no firm reversal, so traders should watch volume and VWAP behavior around $3.15 to determine the next breakout or breakdown leg.

XRP Price Forecast Table: July 30, 2025

| Indicator/Zone | Level / Signal |

| XRP price today | $3.15 |

| Resistance 1 | $3.22 (VWAP + EMA) |

| Resistance 2 | $3.34 (Supertrend top) |

| Support 1 | $3.10 (Local base) |

| Support 2 | $2.88 (200 EMA 4H) |

| Weekly Fib 0.786 | $3.081 (current magnet) |

| Bollinger Bands (4H) | Tightening |

| DMI (14) | Weak Trend, ADX near 22.6 |

| RSI (30-min) | 49.90 (Neutral) |

| VWAP (30-min) | $3.15–$3.16 |

| Supertrend (4H) | Bearish under $3.34 |

| Netflow (Spot) | +$10.44M (mild bullish bias) |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com