As the crypto market continues to trade in volatile territory, investors remain uncertain about what August has in store. This sentiment extends to crypto-linked stocks as they have often mirrored major moves in the digital asset market.

Heading into August, GLXY, CIFR, and RIOT stand out as three US-listed crypto-related stocks to watch, driven by key ecosystem developments that could impact their share prices.

Galaxy Digital Inc (GLXY)

Galaxy Digital is in the spotlight after playing a central role in one of the largest Bitcoin transactions in recent history. The firm executed the sale of 80,000 BTC on behalf of a long-term client—a move that immediately sent shockwaves through the crypto market.

The sheer size of the transaction triggered a brief but sharp drop in BTC’s price, sparking speculation and heightened volatility.

During the July 25 trading session, GLXY shares closed at a low of $30.59 as sentiment soured. However, the stock has since shown signs of recovery, trading at $31.99 in pre-market activity today. If bullish momentum returns when markets open, GLXY could climb toward the $33.17 mark, a potential resistance level in the short term.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the flip side, if selling pressure intensifies, GLXY may slip below the $30 support zone.

Either way, with Galaxy Digital at the center of high-impact crypto moves, its stock remains one to watch closely in the coming weeks.

Cipher Mining (CIFR)

Cipher Mining’s stock is one to watch in August. The company is set to release its Q2 2025 financial results and provide a business update before US markets open on August 7. The announcement will be followed by a live conference call and webcast, which could serve as a key catalyst for the stock.

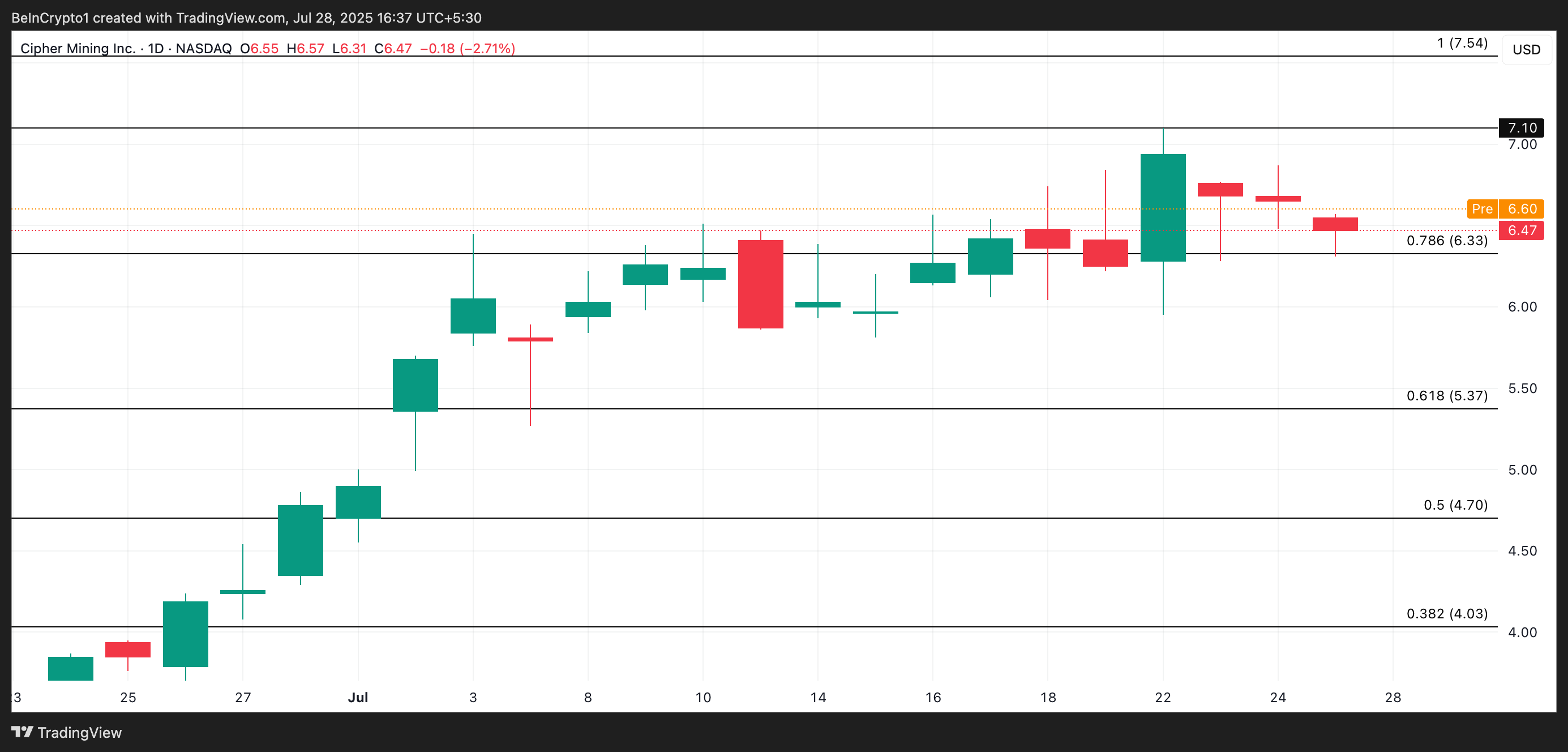

In the last trading session, CIFR closed at $6.47, marking a 2.71% decline on the day. However, in pre-market trading today, the stock has shown early strength, rising to $6.60.

If buying momentum accelerates once markets open, CIFR could climb toward the $7.10 resistance level.

Conversely, weakening sentiment may drag the stock below $6.33, opening the door for a deeper pullback ahead of its earnings release.

Riot Platforms, Inc. (RIOT)

Riot Platforms, Inc. could draw investor attention this August following notable sale activity and strong year-to-date momentum.

On July 21, CEO Jason Les sold 100,000 shares of common stock, totaling approximately $1.51 million, at prices ranging from $15.00 to $15.245 per share.

The timing of the sale is noteworthy, as it occurred with RIOT trading close to its 52-week high of $15.87. The stock has surged 40% year-to-date, supported by broader crypto optimism and Riot’s ongoing infrastructure expansion.

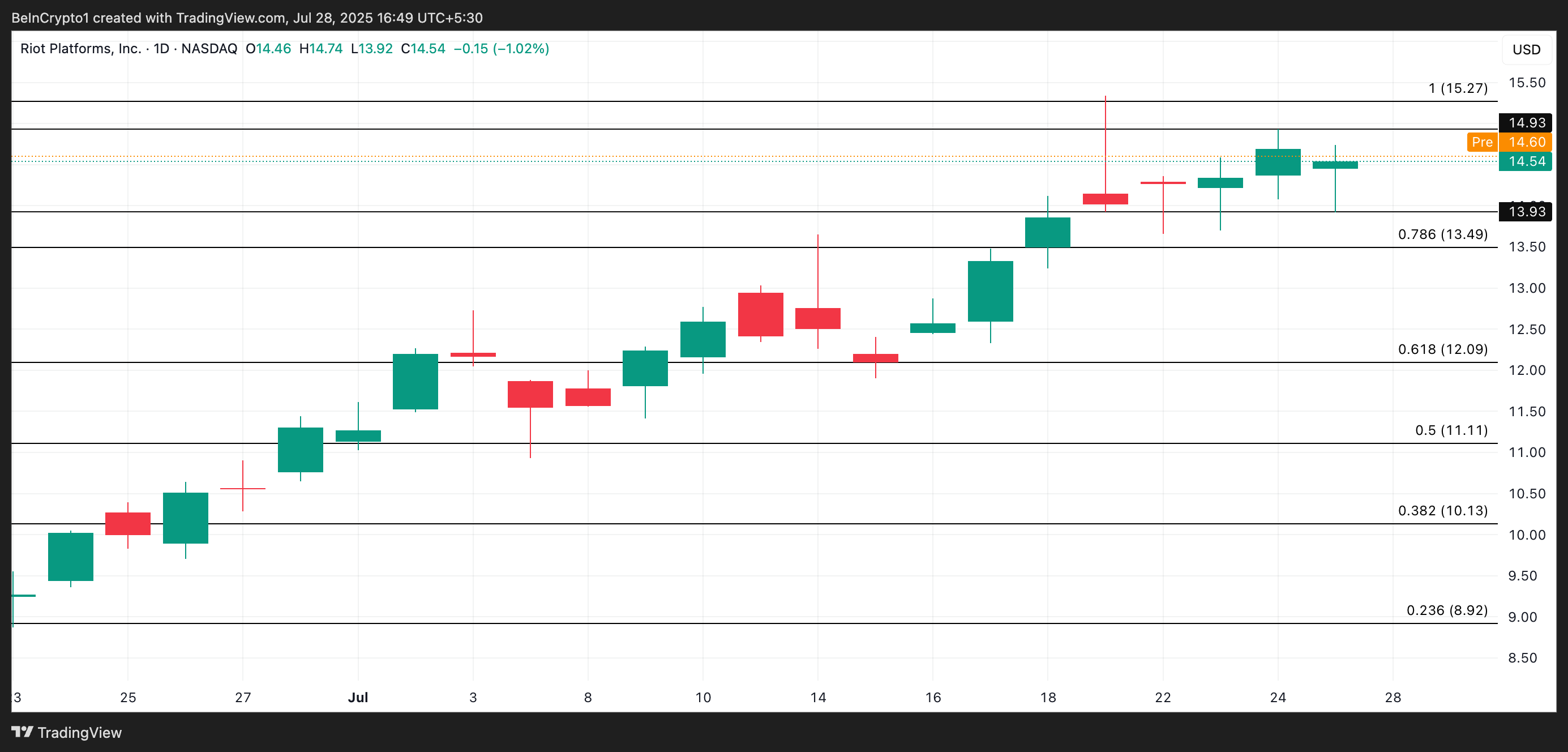

During the last trading session, RIOT closed at $14.54, down 1.16% on the day. However, in pre-market trading today, the stock has inched up to $14.60. If buying pressure builds once the market opens, RIOT could jump $14.93.

However, failure to hold bullish pressure may see the stock dip below $13.93.

beincrypto.com

beincrypto.com