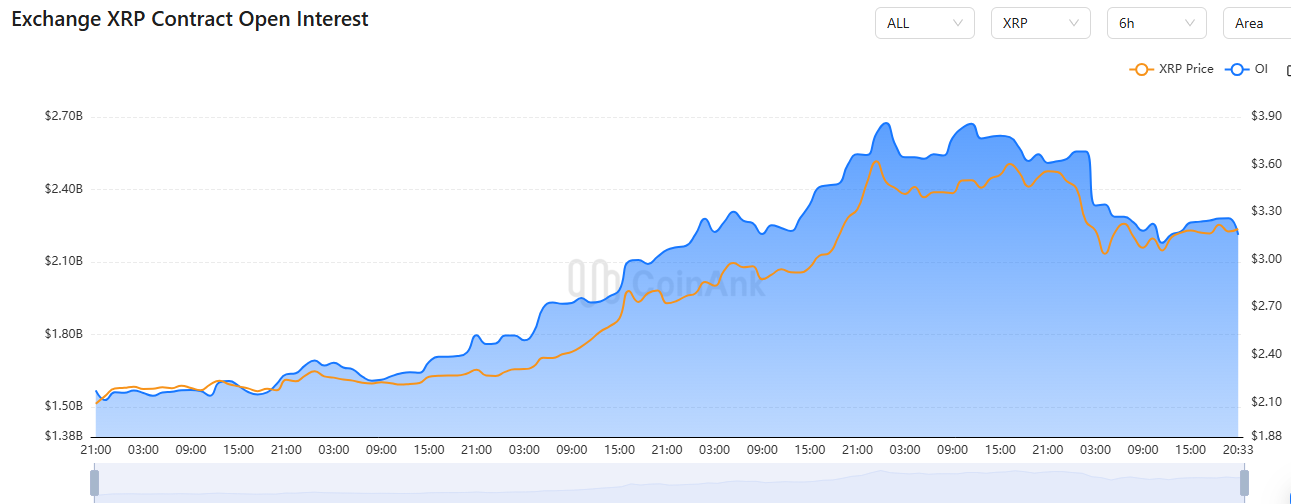

- XRP is also showing signs of perking up after experiencing a pullback, with the open interest standing at high levels.

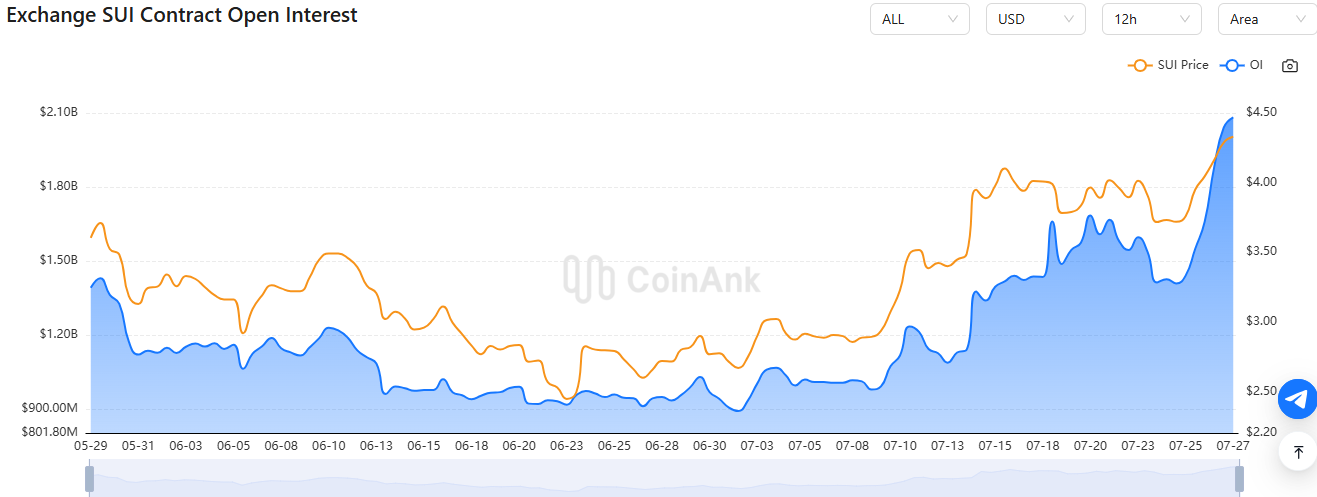

- Both the price and open interest of SUI have gone above $4.40 and over 2 billion, respectively, and the coin is projected.

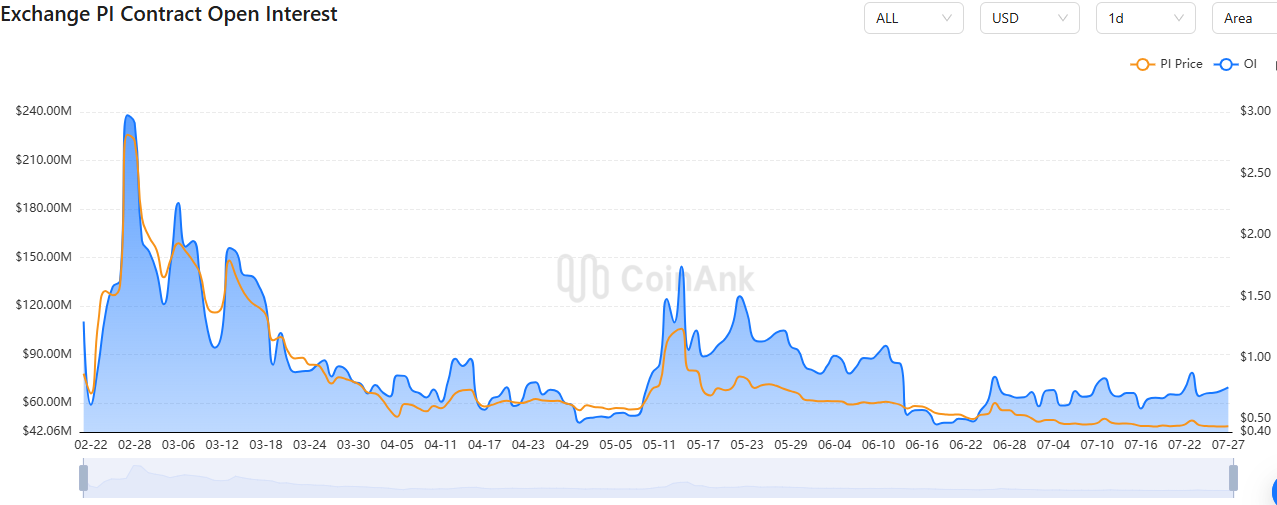

- Since reaching its high point in March, the stagnating price and level of the open interest indicator show declining public interest.

With the increased volatility of altcoin markets, the leaders in the past two months have changed in July. XRP and SUI are gaining the attention of traders due to increased prices and open interest, whereas Pi Coin bottoms out and fails to achieve the necessary development. With liquidity, volatility, and participation varying across projects, active traders are narrowing their attention to the tokens showing strong signs of movement.

XRP Price and Open Interest Indicate Active Market Behavior

XRP has shown a notable pattern in the past 6-hour interval. Both its price and open interest (OI) moved upward consistently before reaching a peak. This trend reflects growing trader activity and increasing speculative interest. The rise in open interest, particularly alongside price increases, often suggests that new positions are entering the market. In many cases, leveraged traders contribute to this upward momentum.

But, once it hit the ceiling, XRP saw a concurrent decline in both figures. Any sudden drop in OI and price is normally an indication of either a liquidation wave or a broad-based profit taking. These tend to happen when price levels are trying to overcome a form of resistance, and these situations are when overleveraged positions start unwinding. In as much as the decrease was steep, the level of the OI in XRP is at the moment higher than before. This is an indication that a large group of traders are still in the market and may trigger another change once market volatility is out of its current pattern.

Pi Coin: Fading Market Interest and Weak Price Action

The open interest and price trend for Pi Coin tell a different story. Both measures have gradually plummeted since the end of February. Pi Coin has already had a price and open interest jump, reaching its high in the last days of February to begin March. This trend assumed a high-speculation stage. Nevertheless, the impetus never continued.

Since that high, the price and the OI decreased drastically. This kind of fall is generally meant to be a failed bullish move in which leveraged positions roll over easily. Positioning by players in the market is likely to have occurred after failing to have met the expectations. Both of these metrics have been stagnating since April. The price stabilized at a lower range than the $0.50 price point and open interest has been moving between 40 million and 60 million dollars

SUI Rallies with Rising Price and Open Interest

In contrast, SUI has demonstrated a strong uptrend in both price and open interest. The trend began building in mid-July and has accelerated into the final week of the month. Both the price and OI have moved in sync, rising steadily and suggesting confident trading activity. The sharp increase in OI reflects fresh capital entering the market, likely from leveraged traders positioning for upside.

SUI’s price recently climbed past $4.40 while open interest crossed the $2 billion mark. This indicates a high level of participation and suggests that traders are supporting the rally with significant volume. The synchronized movement of both metrics generally points to strength in the trend.

newsbtc.com

newsbtc.com

cointelegraph.com

cointelegraph.com