The jury is out on Avalanche performance in Q2 2025, during which it was one of the blockchains that recorded a burst of activity. Multiple data points captured growth across key metrics during the quarter.

But just how good did Avalanche have it in Q2? According to Messari, daily active addresses surged by 210% in Q3.

Average daily transactions on the network rallied by 169%, while total value locked was up by 37% during the three months.

The performance was a culmination of robust address activity as a result of major network changes.

Avalanche experienced more transactions ever since it implemented the Octane upgrade, which lowered its transaction costs.

The Octane upgrade made the Avalanche network more attractive to users, and that became quickly evident by higher DeFi activity within its ecosystem.

According to reports, the network activity was characterized by both institutional and organic retail adoption.

Avalanche DEX Volume Surpassed December 2024 Levels

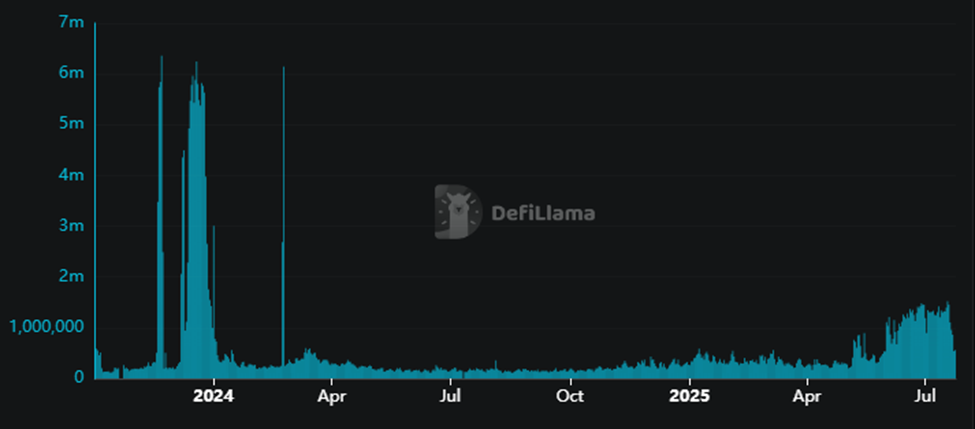

The surging transaction activity on the Avalanche network resulted in a significant upside, especially in terms of DEX volume. For context, the lowest daily DEX volume that the network recorded in June was around $77.72 million.

The DEX volume on Avalanche surged as high as $675.4 million on Tuesday, which was the highest volume achieved in the last 12 months.

The last time the DEX volume was higher was in March 2024, during which the highest daily volume observed was above $921 million.

The surge in DEX volume went up about 8-fold during those few weeks. TVL also achieved a sizable recovery from as low as $1.35 billion at its lowest point in June to as high as $1.92 billion on Tuesday.

Transaction growth recently demonstrated drastic progression in response to the recent market excitement and recovery. The lowest daily transactions on record were close to the 202,000 level in early May.

Daily transactions peaked as high as 1.52 million transactions on 18 July. The figure has since declined slightly to below 558,000 transactions as of 24 July.

Although the transaction surge between May and July was undeniable and significant, it was still a fraction of the activity observed in November and December 2023.

Is AVAX price action still considered undervalued?

The Avalanche network activity indicated that it was one of the top blockchains benefiting from the latest market excitement.

The surging network popularity was also reflected in its native coin AVAX, whose dominance surged by more than 25% in the last 4 weeks.

Consequently, AVAX demand surged during the same duration, and it received a healthy flow of liquidity. The crypto bounced from $15.6 (its Q2 support level) to as high as $26.5 earlier in the week.

That price move delivered an impressive 68% upside.

AVAX price exchanged hands at $23.5 at press time, courtesy of a 10% discount from its latest weekly top. This pullback occurred after the price ventured into overbought territory according to the RSI.

Avalanche bulls achieved significant gains from the June lows at its latest price point. However, it was still trading at a massive discount compared to its past performance.

For context, it was still down by about 58% from its December 2024 top. It was also down by a whopping 83% from its historic ATH achieved in November 2021.

The massive discounts may indicate that investors might still find AVAX attractive despite its latest rally.

For reference, the cryptocurrency market could potentially achieve a 137% upside if it were to rally back to its December 2024 peak.

Even more impressive would be a retest of its historic top, which would be equivalent to a 523% upside.

beincrypto.com

beincrypto.com

invezz.com

invezz.com