- Solana reaches five-month profit high triggering potential sell-off concerns

- RSI enters overbought territory above 70 signaling correction risk ahead

- SOL must sustain $200 support or could drop tp $176-$188 levels

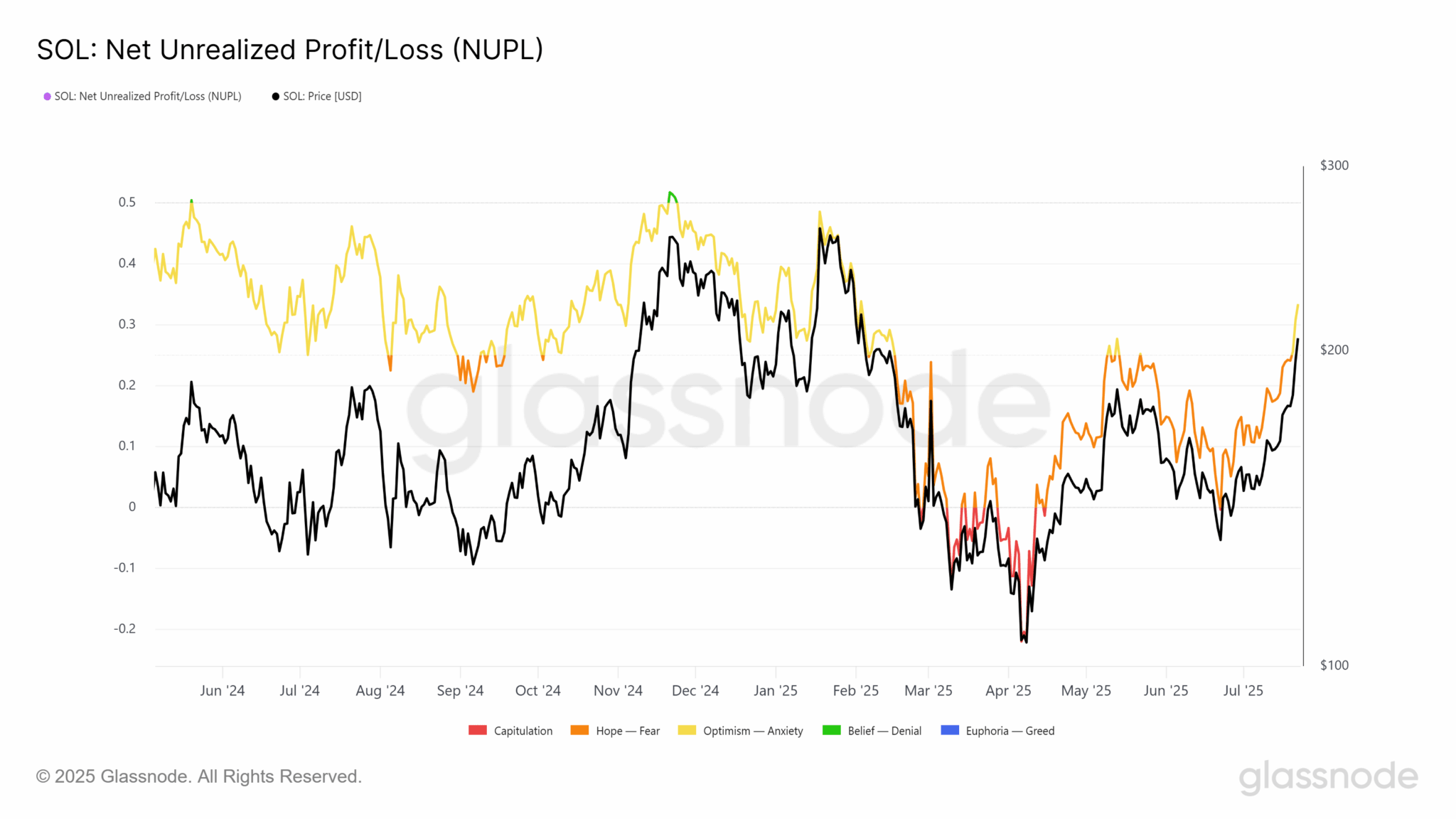

Solana has achieved a multi-month price peak above $200, but the cryptocurrency now confronts mounting pressure from investors looking to secure gains. The altcoin’s recent 21% weekly surge has created conditions that historically precede major corrections in digital asset markets.

Net Unrealized Profit/Loss data reveals Solana holders have accumulated their highest profit levels in five months. This metric typically signals increased selling pressure as investors become tempted to lock in returns, particularly when values enter what analysts call the Optimism zone.

Solana Technical Indicators Flash Warning Signals

The Relative Strength Index for Solana has climbed above 70, placing the cryptocurrency in overbought territory. This technical condition often precedes price pullbacks, as previous instances of elevated RSI readings have coincided with correction phases for the token.

Solana’s current trading price of $199 sits just below the psychological $200 resistance level that proved difficult to maintain during recent attempts. The failure to establish stable support above this threshold has created uncertainty about the sustainability of current price levels.

Market dynamics suggest two primary scenarios for Solana’s immediate future. Continued profit-taking behavior could drive the price toward support zones at $188, with further weakness potentially extending declines to $176.

The cryptocurrency’s ability to reclaim and hold $200 as support represents the key factor determining short-term direction. Success in establishing this level as a floor could enable additional gains toward the $221 target zone.

Broader market conditions will influence whether Solana can overcome current headwinds. Sustained bullish sentiment across cryptocurrency markets could provide the buying pressure needed to absorb profit-taking activity and maintain upward trajectory.

Historical patterns show that overbought conditions can persist during strong bull markets, allowing prices to remain elevated for extended periods. The duration of Solana’s current overbought state will depend on investor appetite for continued exposure at current valuations.

Trading volume and on-chain activity metrics will provide additional clues about whether the recent rally has sufficient foundation for continuation. High participation rates could offset profit-taking pressure and support price stability above key levels.

thenewscrypto.com

thenewscrypto.com