Cryptocurrency analyst Joao Wedson has published a comprehensive analysis of the competition between Ethereum and Tron blockchains over the USDT supply.

Wedson made important inferences based on the USDT supply rate, supply gap, and the relationship between these metrics and the Bitcoin (BTC) price.

USDT Supply on the Ethereum Network Increases During Bullish Periods

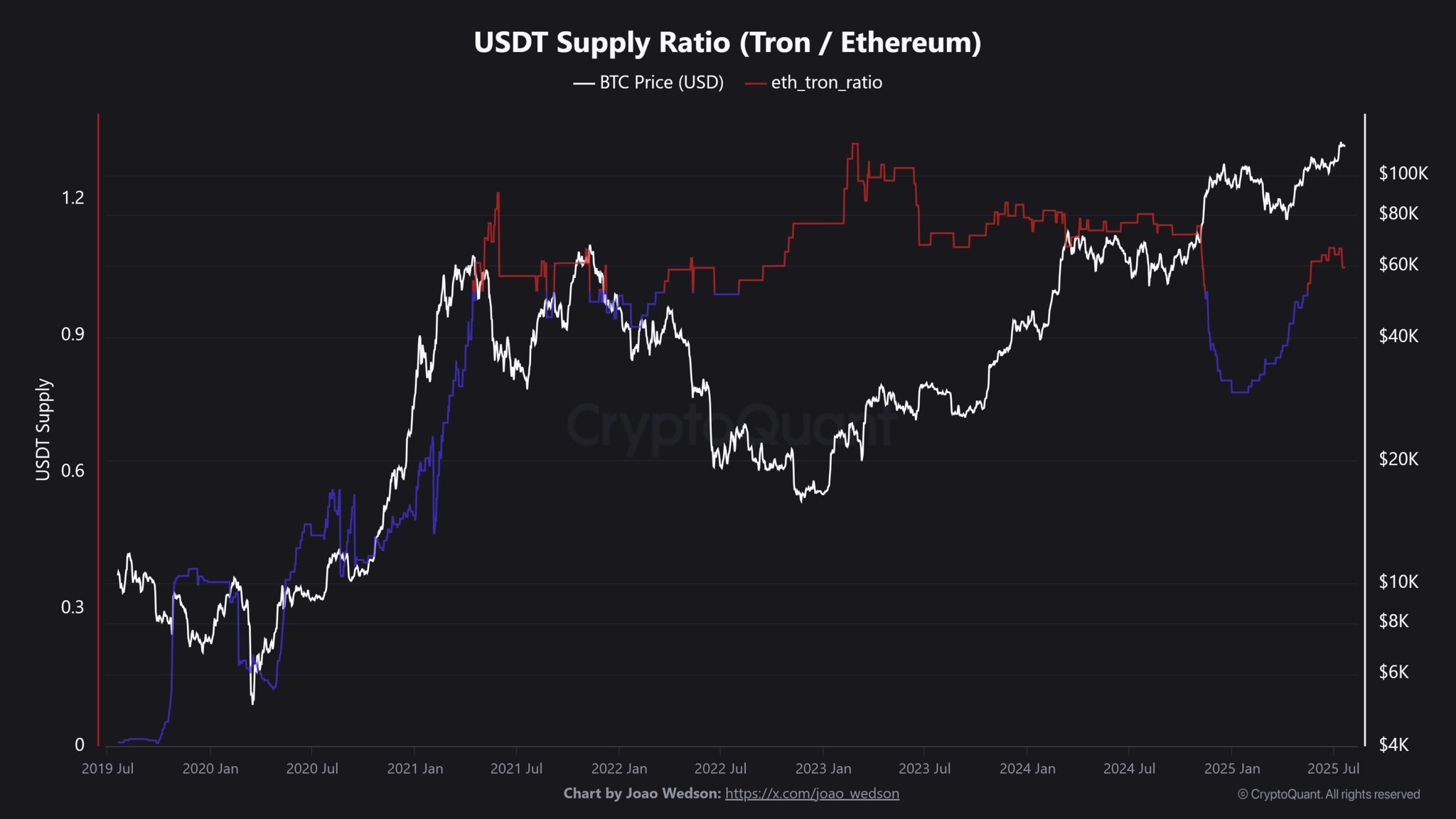

According to Wedson's assessment, the USDT supply ratio between Tron and Ethereum rose from 0.3 in 2019 to over 1.0 in 2022-2023, demonstrating that Tron is gaining significant momentum thanks to its low transaction fees. A particularly striking pairing was seen in 2021, when Tron's USDT supply surpassed Ethereum's for the first time, and BTC's peak of $64,000.

While the rate will fall again in 2024-2025, it coincided with BTC's peaks above $100,000. According to Wedson, this suggests that in bull markets, investors tend to take advantage of the security offered by Ethereum, despite its higher transaction fees. However, recent data suggests that Tron is regaining the upper hand.

Stating that the USDT supply has increased significantly on both Tron and Ethereum since 2019, Wedson said that Ethereum was initially the leader, but Tron achieved a strong position by first exceeding $60 billion and then $80 billion by 2025.

According to Wedson, supply increases on both chains generally coincide with increases in the BTC price, while Ethereum maintains its appeal to investors thanks to its DeFi infrastructure, especially during periods of market volatility.

The supply gap remained negative until 2021, reflecting Ethereum's dominance. However, in 2022-2023, this gap reached a positive level of $3-8 billion, marking Tron's rise to the top. The gap returned to negative in 2025, with recent data showing that Tron holds approximately $3.9 billion more USDT than Ethereum.

*This is not investment advice.