The crypto market cap has recorded a sharp uptick today led by large-cap altcoins such as Ethereum (ETH) and Ripple Labs-backed XRP, thus reaching a new all-time high of about $4.03 trillion. According to market data from Coingecko, Ether price has surged over 8% in the last 24 hours to trade above $3,640 for the first time since the first week of January, this year.

XRP has gained over 16% in the past 24 hours to trade at about $3.60, above its prior all-time high of about $3.4 set in January 2018. According to market data from Binance-backed CoinMarketCap, XRP recorded a 122% surge in its daily average traded volume to about $22.4 billion.

Related: XRP Breakout: Price Rally to $4.35 Begins

Ethereum’s daily average traded volume soared by 12% to about $54 billion at the time of this writing. Consequently, the combined ETH and XRP daily average traded volume surpassed that of Bitcoin (BTC), thus signaling the onset of the much-awaited 2025 altseason.

Factors Showing Altseason 2025 Has Begun

The cryptocurrency market has recorded a huge spike in cash inflow from retail and institutional investors in the recent past. According to market data analysis from Coinglass, the net crypto Open Interest (OI) has surged exponentially to a new all-time high of about $200 billion.

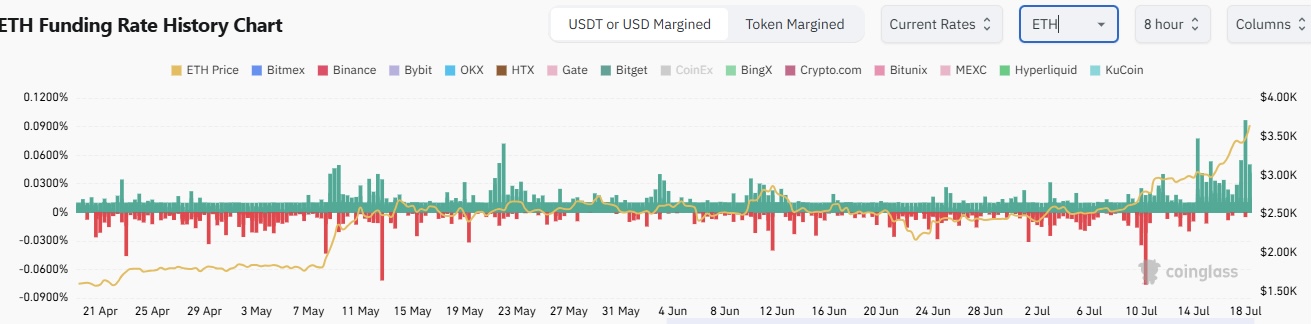

As a result of the heightened crypto speculation, the ETH OI-weighted funding rate has surged to 0.0129%, signaling bullish sentiment. Historically, a sustained positive funding rate is an indication of bullish sentiment and vice versa.

The demand for altcoins by institutional investors was evident on Thursday after the U.S. spot Ether ETFs surpassed Bitcoin’s counterpart in net cash inflows. According to market data from Sosovalue, the U.S. spot Ether ETFs recorded a net cash inflow of $602 million while Bitcoin’s reported about $522 million.

Related: The “Genius Act” Is on a Fast Track, and Tether Is in Its Crosshairs

As a result, the BTC dominance has dropped over 5% since the beginning of this week to hover around 61%. Historically, a sustained drop in BTC dominance has resulted in major altcoin summers, as recorded in 2021 and 2017.

#Bitcoin Dominance [2W] is breaking down from a 3-year Rising Wedge — a major structural shift.

— Gert van Lagen (@GertvanLagen) July 17, 2025

Very similar to the 2020–2021 Altseason playbook:

🔵 Initial wedge breakdown

✅ Actual top confirmed with bearish divergence

🚀 Altseason ignition pic.twitter.com/qiX2FTtJaY

The altcoin summer has been kicked off by the passage of the three crypto bills, the GENIUS Act, the Clarity Act, and the Anti-CBDC Act, in the United States. Furthermore, clear crypto regulations will open floodgates of institutional capital to the wider cryptocurrency market in the near future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com