Summers have turned from bullish catalysts to a period of indecisiveness for the global crypto market. The month of June has been no different, continuing the see-saw effects of May, with the Crypto Fear and Greed Index reading a rating of 46 out of 100. This signals a slight shift towards fear, as the global geopolitical landscape has only worsened since last month.

Major decisions and political shifts happen a dime a dozen in the modern world, which leaves little room for investors, crypto or otherwise, to adjust to changing dynamics and their effects on market performance.

Bitcoin’s digital gold status has been further reinforced by investor activity throughout June, as BTC has crossed the $110,000 mark. However, other currencies have been less fortunate, as June has plenty of gainers and losers to showcase.

To take advantage of market volatility and indecisiveness, more speculative traders have resorted to prop trading crypto at TradeXMastery and other prop trading platforms using funded accounts.

Top 5 Gainers in June

June has been a mixed bag in terms of gainers. While most meme coins underperformed, several smaller projects posted considerable gains, with Aerodrome Finance leading the charge with over 50% in monthly price appreciation.

However, it is also worth noting that the sideways markets were evident over the course of the month, which saw a relatively equal number of winners and losers.

Aerodrome Finance (AERO) +55.88%

The automated market maker built on the Coinbase Base L2 blockchain, AERO has enjoyed its best month in recent memory. The coin jumped by over 55% in the middle of June, before slightly declining toward the end of the month.

The annual returns of the coin are much more modest at 18% over the past 12 months of trading. While not a market-beating coin, AERO has emerged as a relatively positive option in a sea of market volatility and lost gains.

Despite recent positive price action, Aerodrome Finance will require a broader shift in market sentiment to continue on its upward trajectory in the coming months. Otherwise, traders who were lucky enough to buy the coin before the pump, are better off cashing in on their positions, at least partially.

Sei (SEI) +49%

Sei has been one of the most active cryptocurrencies in recent months and has come into the limelight again, gaining roughly 50% throughout June, placing among the top gainers of the month.

There are several reasons behind the massive rise of Sei’s market price in the past few weeks. Some of such factors include:

-

Daily network transactions have tripled to $590 million by the end of June

-

The state of Wyoming has selected Sei for its fiat-backed WYST project. Among the candidates were Solana, Ethereum, and Ripple

-

Circle’s IPO filing has revealed Sei as its largest holding, which quickly spread through the market

-

Price broke above the $0.27-$0.28 resistance level on high volume, signaling bullish momentum and adding to the overall gains

Similarly to Aerodrome Finance, a market shift towards a firmly bullish attitude could propel Sei’s market price toward new heights. However, whether this is likely to happen depends on forces outside of the crypto market.

Pudgy Penguins (PENGU) +47.3%

The filing for a PENGU NFT fund staged a bullish push for the coin toward the end of June, which saw Pudgy Penguins gain over 47%, with the bulk of the price action hitting the market in the last week of the month.

Whale buying, media spotlight, and a bullish breakout contributed to the double-digit growth seen on the price chart of PENGU.

However, this growth is unlikely to be sustainable over the long run, as many of the factors that played into PENGU’s gains have been entirely speculative, which increases the chances of traders locking in their gains and exiting the market fairly quickly.

Kaia (KAIA) +46.3%

The native token of the Kaia blockchain, KAIA surged through a short squeeze, breaking above the RSI and triggering a bullish reversal. Momentum surged, and the coin gained over 45% in total, making Kaia one of the top-performing coins of June.

Due to the technical nature of Kaia’s gains, whether the coin can maintain its momentum is doubtful, unless the market shifts toward a broadly bullish sentiment. However, while the Crypto Fear and Greed Index stands at a sluggish 46/100, sustained growth is generally unlikely.

Regardless, traders will be on the lookout for new momentum shifts in Kaia’s price, or for some short-selling opportunities.

Maple Finance (SYRUP) +40%

June has been an active month for Maple Finance, which posted major milestones toward the end of the month, gaining 40% over the past 30 days of trading.

Some notable SYRUP news in June included:

-

The announcement of a lending deal secured by BTC with Canton Fitzgerald, sparking a rally

-

Total value locked skyrocketed from roughly $300 million to $1.6-$1.7 billion by late June, which is a major signal of institutional adoption

-

The volume of active on-chain loans jumped to $377 million by June, which is a tenfold increase since January

-

Maple’s May revenue exceeded $1 million for the first time, boosting the demand for the coin throughout June

-

New listings on exchanges like Coinbase, dYdX, and Bithumb, have further added to the bullish sentiment

Top 5 Losers in June

On the other hand, several notable crypto projects lost considerable amount of market value throughout June, which can be attributed to a mix of technical indicators and project-specific factors.

DeXe (DEXE) -47.6%

The strong May rally backfired in June for DeXe, as traders locked in gains and sold off their DeXe holdings over the past 30 days of trading.

A combination of mixed market sentiment and prior gains made DeXe the worst-performing coin of the past month, losing over 47% in market value over the period.

This puts DeXe’s annual returns at a 15% loss, which is far from ideal for long-term DeXe bulls.

Celestia (TIA) - 32%

Similarly to DeXe, Celestia also fell into the bearish trap after a successful month of May, losing over 30% of its market value over the past 30 days of trading.

Technical indicators have also painted a grim picture for the coin. TIA broke below key supports within a descending channel, with bearish RSI and MACD trends confirming seller dominance. A death cross pattern and the breakdown toward $1.3–$2 prompted further downside.

Uncertainty in the broader crypto market has also played its part in TIA’s downfall, as most investors are not bullish on crypto at current valuations and trading volumes.

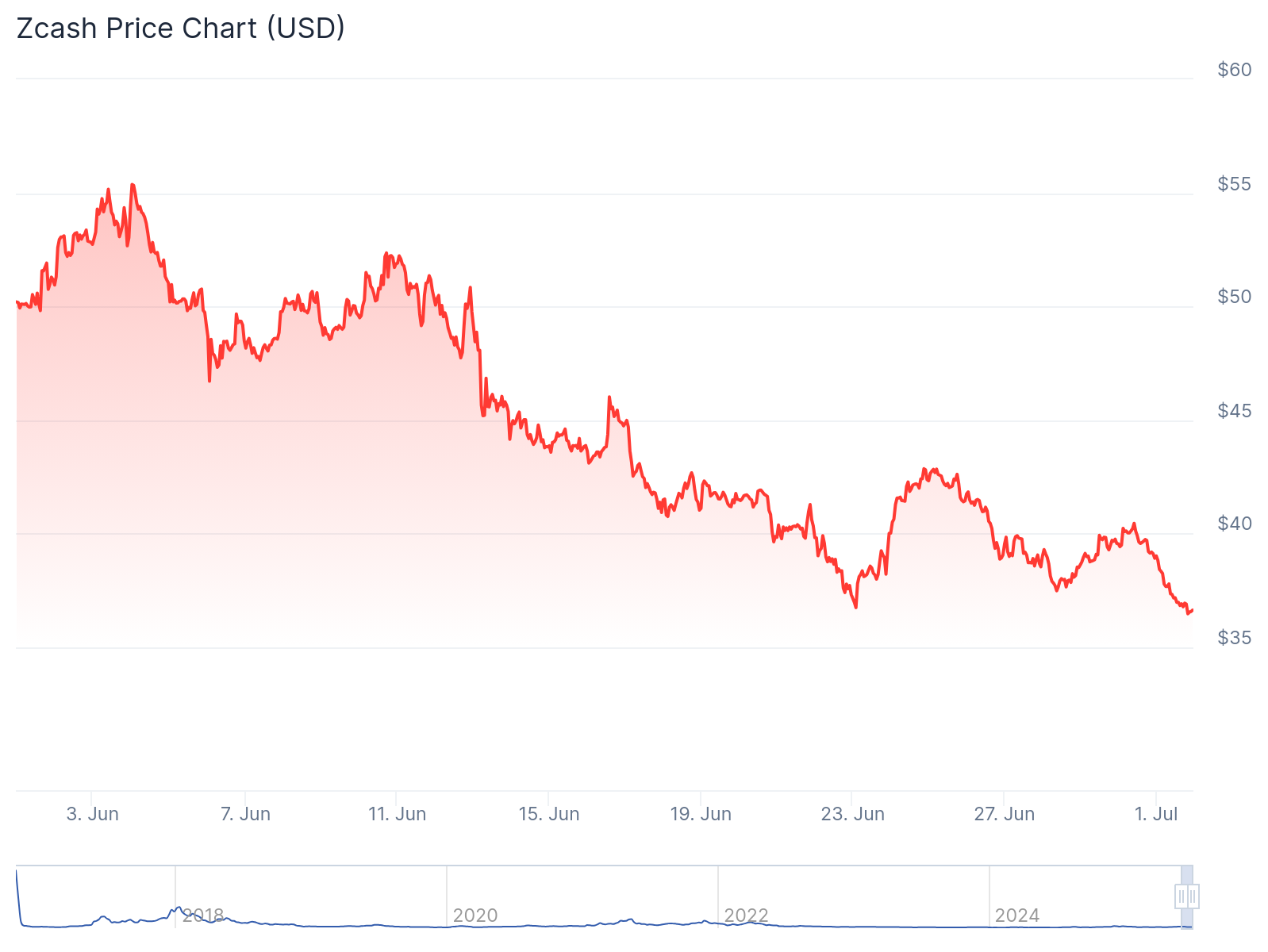

Zcash (ZEC) -26.2%

Zcash started the month of June with a speculative push after positive regulatory clarity from the OFAC. However, as traders locked in their gains, the coin quickly started to spiral downward.

A technical correction from excessively overbought conditions meant that Zcash was in freefall for most of June.

Even as privacy coins like ZEC briefly rallied, the broader crypto market was under strain, with capital shifting away from risk-on assets. That left ZEC vulnerable to continued selling pressure

Many major exchanges are still apprehensive about listing privacy coins, which does not allow for much confidence in the short term. Traders sold their positions as soon as the coin rallied, leaving long-term Zcash holders carrying the losses.

The concern of delisting constantly looms over the likes of ZEC, which makes them speculative assets for most crypto traders.

Pi (PI) -23%

Pi has continued its seemingly never-ending freefall with an additional 23% in losses in June. The constant introduction of additional supply has diluted the price of Pi significantly, and June was no exception in this regard. Around 276 million Pi tokens were issued in June alone, which was the main catalyst behind the significant drop in price for the token.

Technical indicators also turned bearish, as the coin fell into a bearish descending-triangle/wedge with declining volume, RSI/MACD signals turning negative, further reinforcing the downtrend.

Overall, if the issuance of new tokens continues at current levels, the price of Pi is likely to decline even further in the coming months.

Vaulta (A) -22%

Vaulta was another coin that dropped by double-digits over the past 30 days of trading, with a 22% decline in total. Several notable reasons played into the price decline for the token, which include:

-

Bearish technical indicators: The weekly RSI hovered in bearish territory, and price repeatedly bounced off the pivot at roughly $0.505 before testing support near $0.455. Sellers remained in control, and the coin continued to decline

-

Altcoin market weakness: While Bitcoin continued to grow steadily, altcoins fell behind in the broader market, which explains why many altcoins like Vaulta suffered while traders and investors favored BTC

-

EOS rebranding: As EOS rebranded to Vaulta, investors cashed out post-launch, which started Vaulta’s market presence with a loss

Conclusion

June 2025 has proven to be a turbulent month for the crypto market. While Bitcoin continued to grow, most altcoins suffered due to market uncertainty, translating to a Crypto Fear and Greed Index value of only 46 out of 100, signaling a mix of indecisiveness and fear.

Sell-offs in global equities further enforced the bearish sentiment on the crypto market, leading to considerable declines for major altcoins.

In some cases, traders simply locked in their gains from May and started to wait for the opportune moment to re-enter the market and buy at lower levels.

Technical market indicators have also been broadly bearish, which explains the number of losing cryptocurrencies against a handful of gainers.

cointelegraph.com

cointelegraph.com

u.today

u.today