Several key macroeconomic and technical indicators are aligning to create what analysts are warning could be the biggest “altseason” in crypto history. With a massive $3.3 trillion U.S. spending bill freshly signed into law and Federal Reserve liquidity on the verge of turning positive for the first time in two years, the stage is being set for a potential parabolic rally in altcoins.

This comes as Bitcoin dominance declines and altcoin charts flash strong breakout signals offering investors a rare opportunity to reposition before a potential parabolic rally.

Repeat of 2020’s 600% Altcoin Surge?

According to AltcoinGordon, the current market setup closely mirrors conditions from late 2020. Back then, a $1.4 trillion stimulus package preceded a 600% surge in the altcoin market. Today, the crypto market (excluding Bitcoin) is consolidating just below $1.14 trillion near its former resistance.

If history repeats, the potential upside could dwarf previous rallies. Consequently, AltcoinGordon expects this cycle to outperform prior ones, fueled by deeper liquidity and heightened retail interest.

We’re on the verge of the biggest Alt season in HISTORY

— Gordon (@AltcoinGordon) July 5, 2025

Trump just signed a $3.3 TRILLION spending bill.

He did the same in Dec 2020, alts pumped 600% afterwards.

This is how you go from cash flow problems

To private jet Wi-Fi problems.

Do you understand? pic.twitter.com/hFaCBUGa35

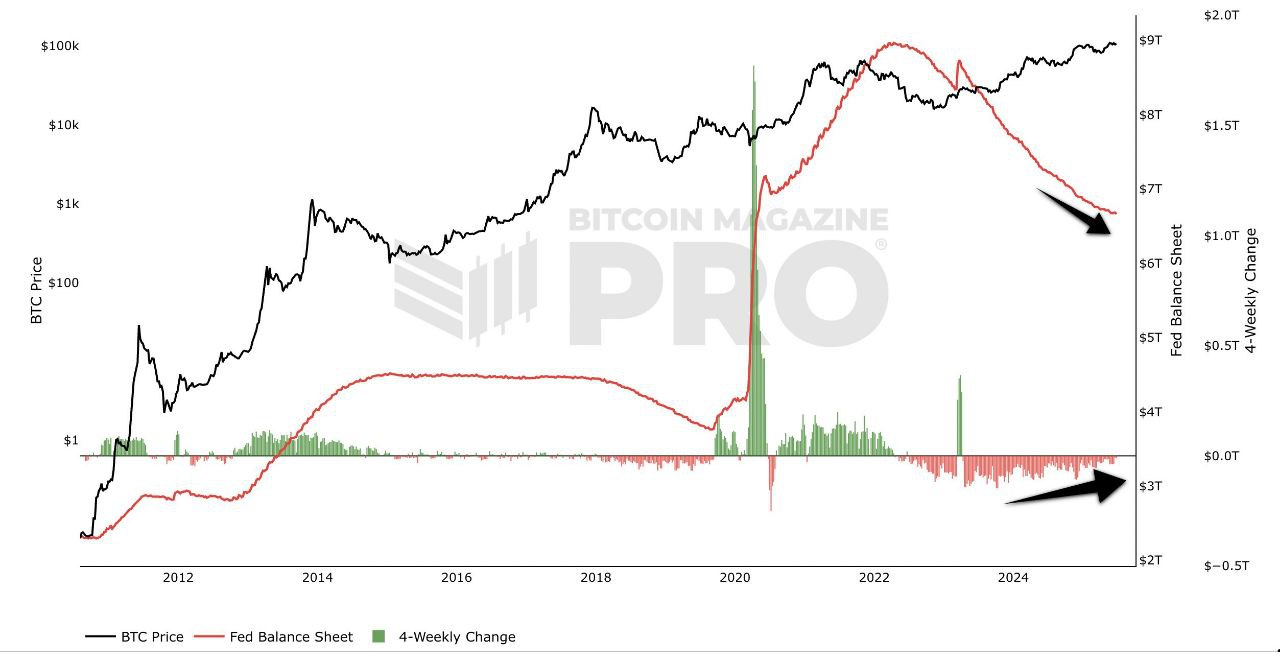

Shift in Federal Reserve Policy

Meanwhile, BitBull highlights the importance of the Federal Reserve’s balance sheet. His analysis shows the 4-week change in the Fed’s assets is nearing green for the first time since 2022.

Every time liquidity increases, speculative assets like altcoins have historically led the way. Moreover, with Bitcoin stabilizing near critical support at $30,000 and resistance at $65,000, conditions appear ripe for capital rotation into alts.

Related: The Biggest Altseason Is Coming. Here’s Why

Charts and Seasonality Align for a Summer Altcoin Rally

Wimar.X notes that altcoins have consistently rebounded off key support before each major rally. Based on historical trendlines, he projects the altcoin market cap could soar toward $15 trillion by the peak of this cycle.

TODAY, THE FINAL #ALTSEASON HAS BEGUN🚨

— Wimar.X (@DefiWimar) July 4, 2025

Historically, altcoins have bounced off the support line every time before an altseason.

Altcoins' market cap will hit $15 TRILLION this cycle.

Here’s a list of low-caps with 1000x potential 🧵👇 pic.twitter.com/9oqOYsPon9

Notably, July has historically delivered strong returns for altcoins, averaging 35% gains amid rising volumes and declining Bitcoin dominance. This seasonal pattern, combined with the upcoming US election cycle, could further boost market sentiment.

Related: Analyst Forecasts Imminent “Altseason” Fueled by Key US CPI Data and Bitcoin Strength

Top Altcoin Picks with Breakout Potential

With market momentum building, attention is turning to high-potential altcoins. ARC, priced at $0.08, is leveraging AI for decentralized infrastructure. AethirCloud ($ATH) powers AI/ML via GPU-as-a-service.

Virtuals Protocol ($VIRTUAL), at $0.63, bridges the metaverse and real-world integration. Synthetix ($SNX) enables synthetic asset trading with deep liquidity. SonicSVM ($SONIC) focuses on gaming economies using Solana tech.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com