This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

As is the case with economic data these days, the devil is all in the details.

Today we received the latest jobs report, and the topline data looked fantastic.

- Non-farm payrolls came in at 147k vs. consensus estimates of 100k.

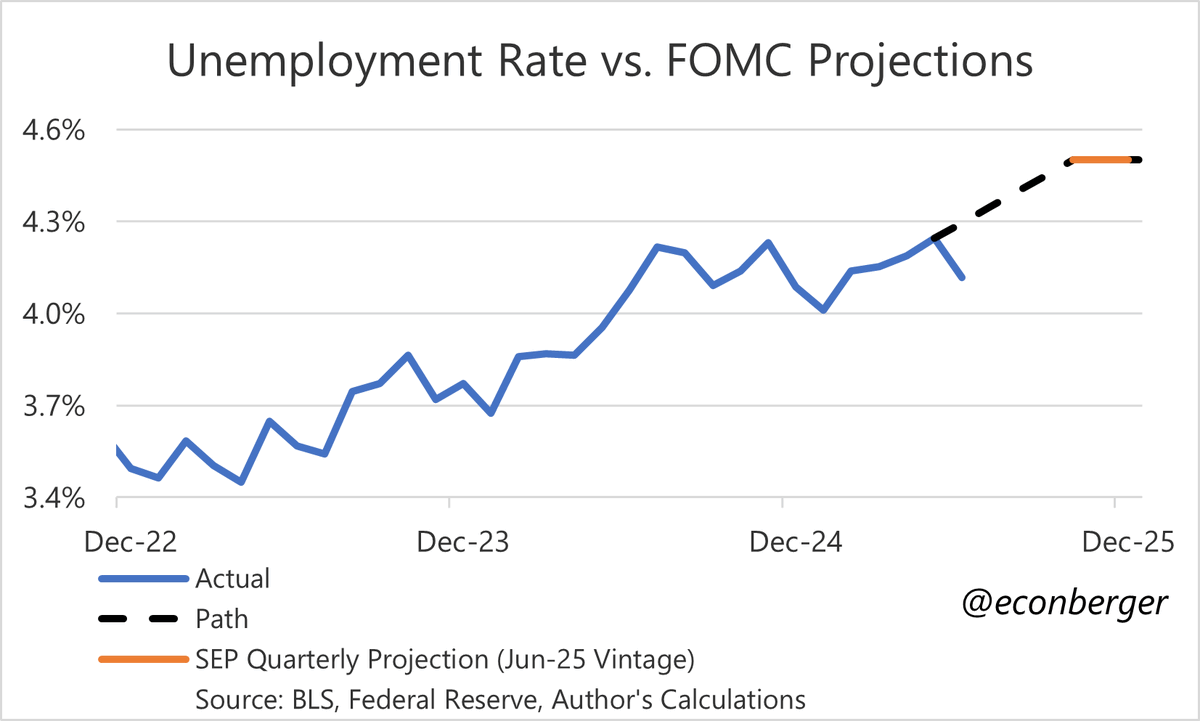

- The unemployment rate ticked down to 4.1%, below forecasts of an increase to 4.3%.

The 4.1% unemployment rate is much stronger than the FOMC’s recent estimates in their June Summary of Economic Projections, and likely takes any possibility of a July cut off the table:

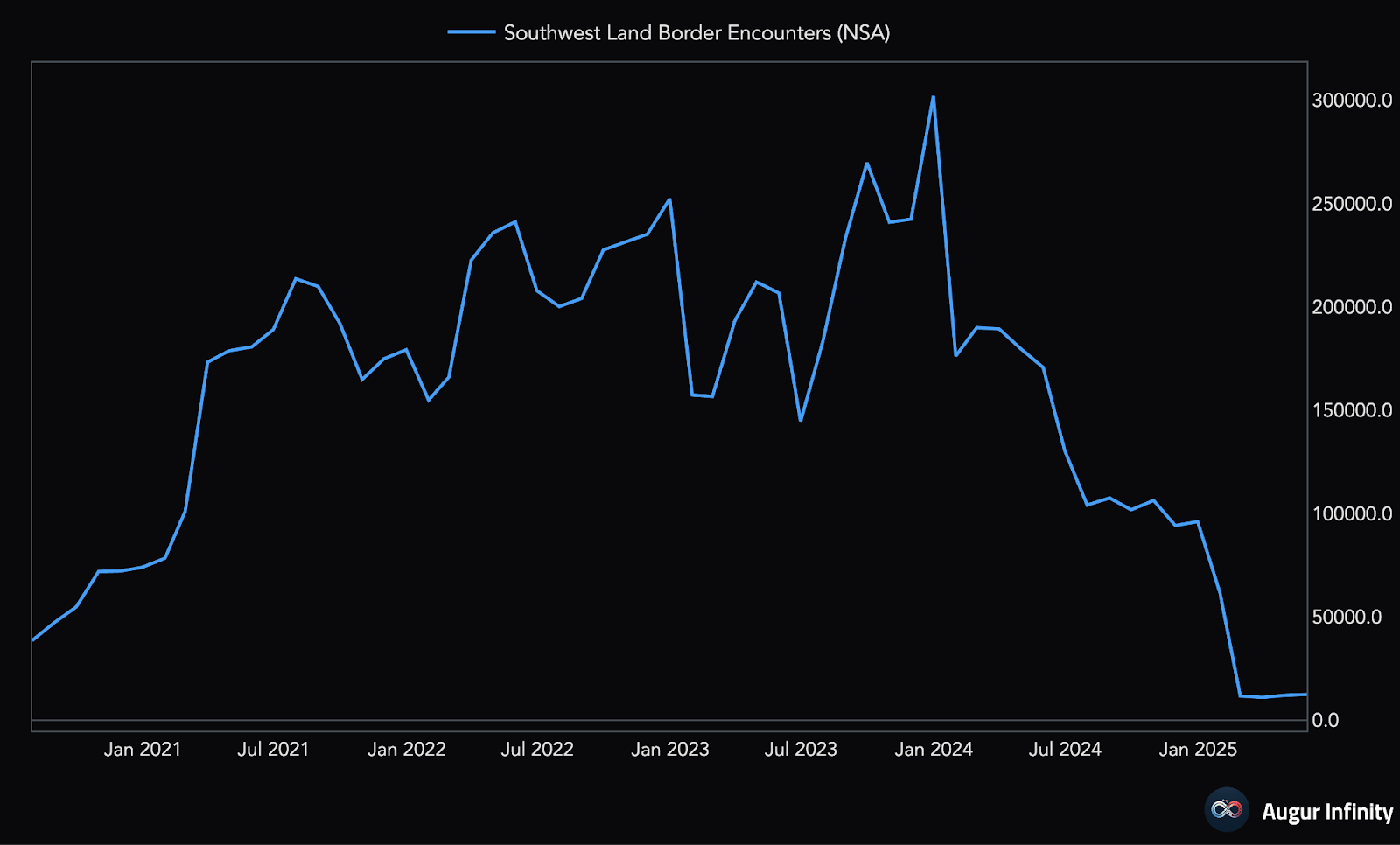

The key vector of what is driving this topline strength in the labor market is a decreasing labor force. This is due to plummeting immigration ever since Trump took office.

Looking at land border crossings, we can see these have cratered.

One year ago, we saw this dynamic in reverse:

- Huge levels of immigration under the Biden administration grew the labor force, which mechanically increased the unemployment rate, since it took time for those new entrants to get a job. And, in the meantime, those new entrants are considered unemployed in BLS data.

- This was what caused the false-positive signal of the Sahm rule that led to the Fed cutting 50bps in quick order.

Putting it together: In the same way that immigration was causing a mechanically weak labor market last September, we now see a mechanically strong labor market.

This dynamic shrouds what’s happening deeper in the data.

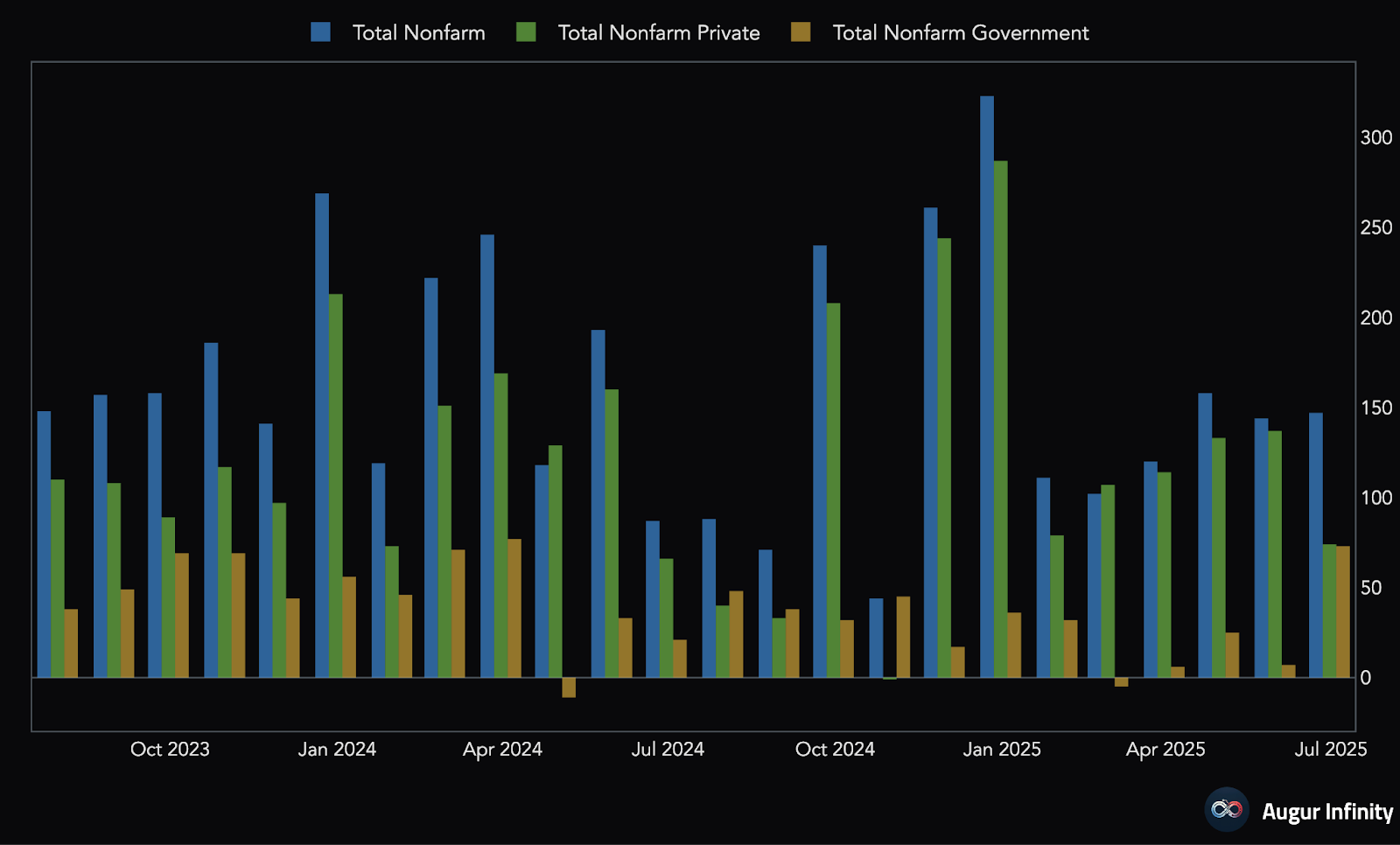

Private payrolls came in at 74k, below expectations of 105k. The reason for the significant upside surprise came from government payrolls, which surged to 73k — up from 7k the previous month:

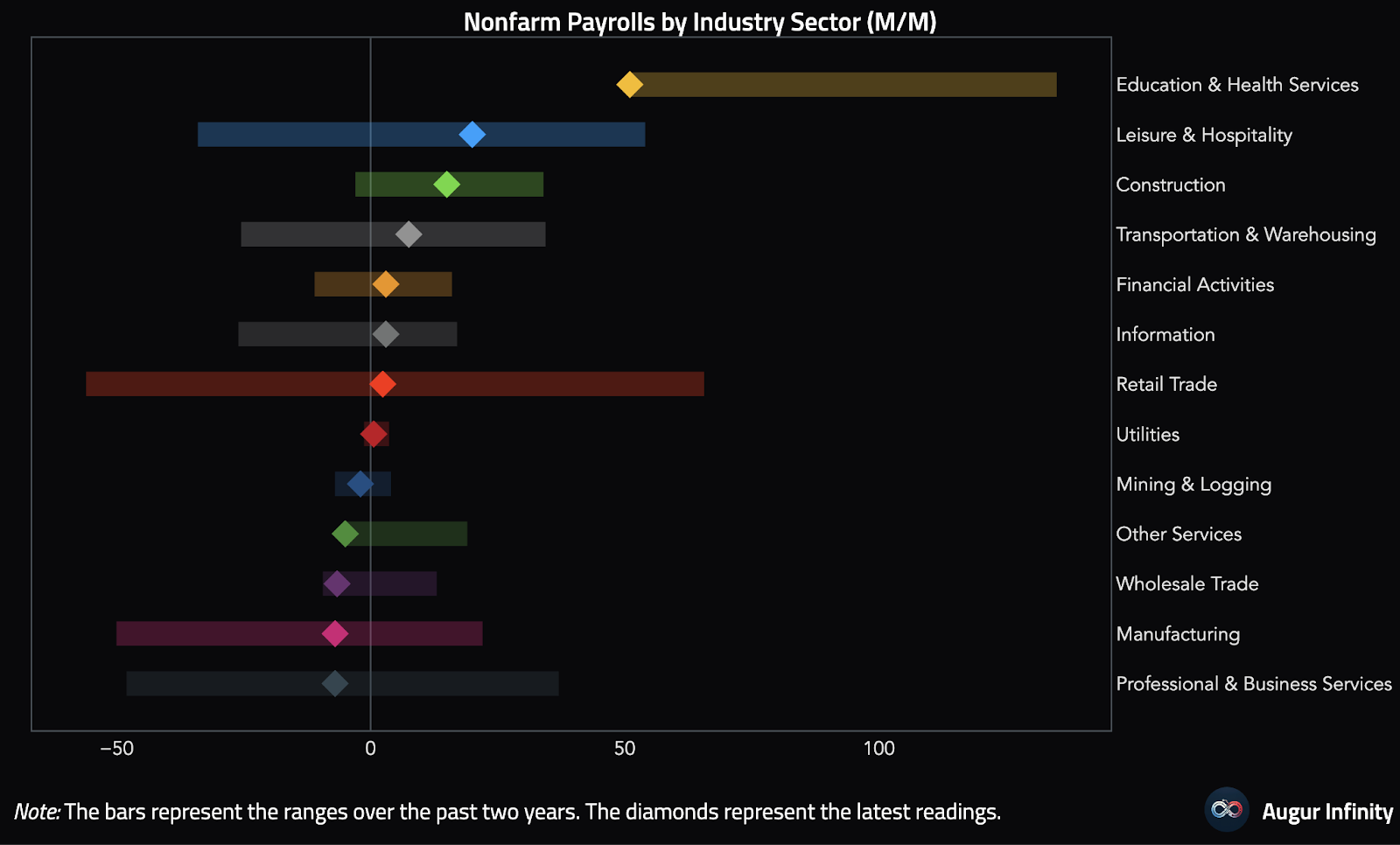

Looking at the industries that drove payroll growth, education and health services continue to bleed lower, which is notable, as these have been the primary driver of payroll growth in recent years.

This delicate balance in the labor market is mostly felt by those who are currently unemployed and finding it extremely difficult to get a new job.

Continuing jobless claims are grinding higher every week amid a labor market that punishes job seekers.

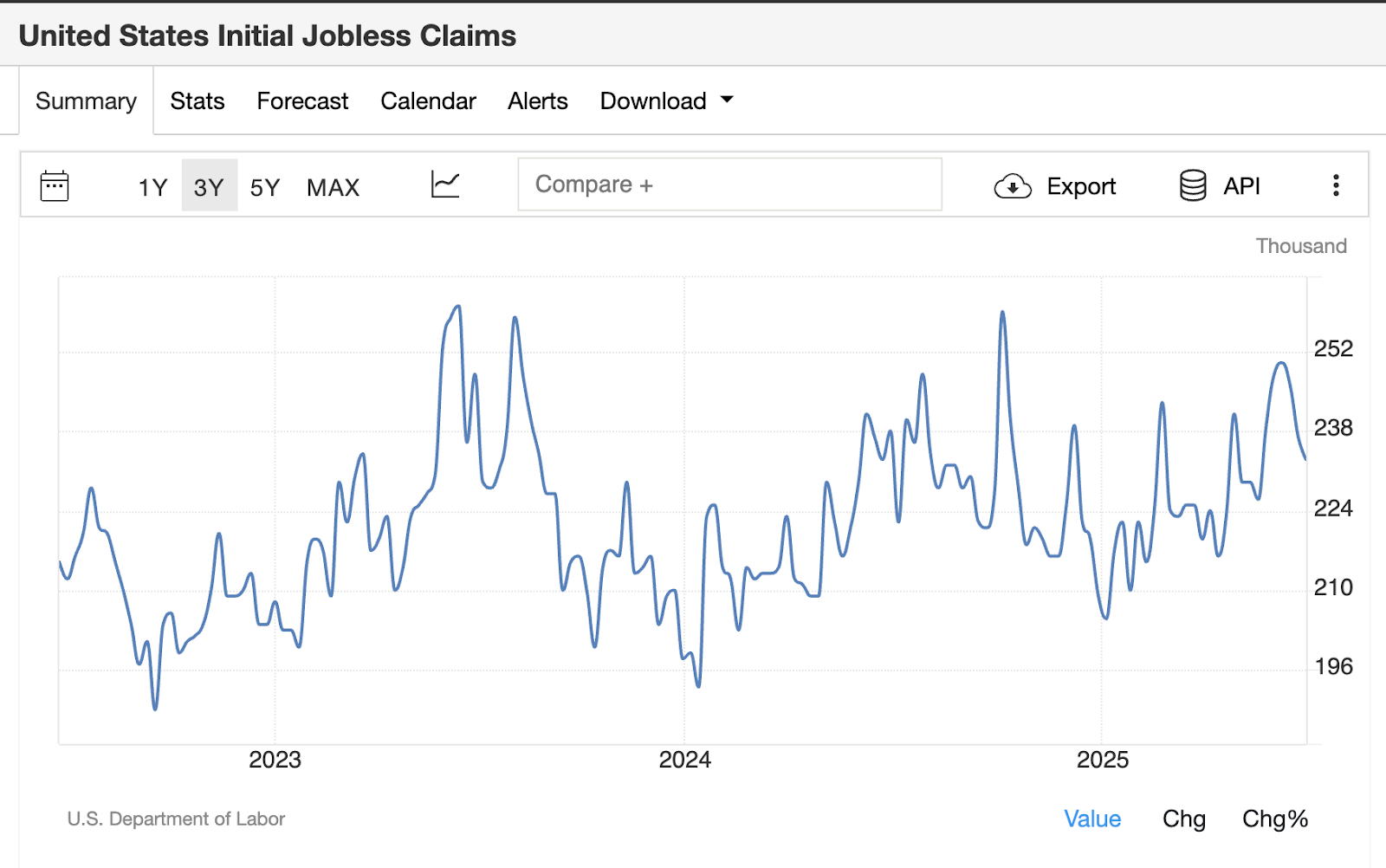

What’s interesting is that the economy isn’t rolling over quite enough to trigger any meaningful layoff cycle. And so, we see that initial jobless claims continue to chop around aimlessly:

blockworks.co

blockworks.co