The XRP fair value calculator indicates that XRP price could reach ambitious levels if XRP handled USDT’s peak daily volume this year under the right conditions.

XRP has been at the center of attention among critics and supporters. While some believe its price is on the verge of collapsing, others insist that the market still undervalues it at the $2 price range.

After reaching an all-time high of $3.84 during the 2018 bull run, XRP fell. So far, it hasn’t surpassed this price in recent years. Still, many see XRP as more than just a token.

Notably, they often regard it as a bridge asset for global payments, with the potential to change how value moves across borders. That belief has continued to influence efforts to calculate what XRP might truly be worth when institutions use it at scale.

XRP Fair Valuation

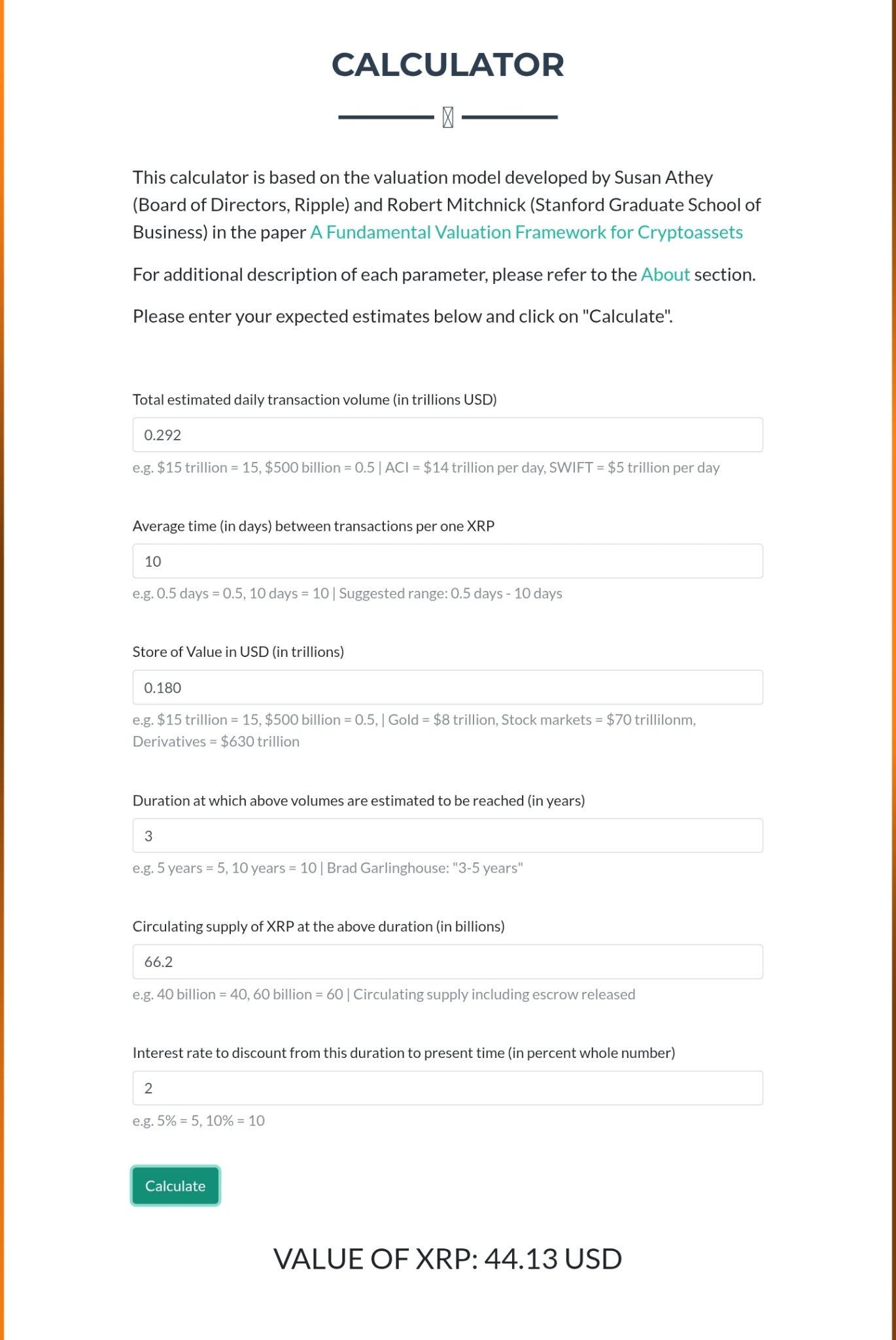

To get a fair valuation, we recently leveraged a calculator based on a research model from Robert Mitchnick and Susan Athey. Notably, the model doesn’t rely on hype or speculation. Instead, it values digital assets by measuring how much real-world utility they can deliver.

Using this tool, we conducted a new analysis to see what XRP could be worth if it processed the highest daily transaction volume that Tether (USDT) reached this year.

For context, USDT consistently dominates daily trading volume across the crypto market. As the leading stablecoin, it supports countless trading pairs, including Bitcoin and Ethereum.

This widespread use drives its volume higher than any other single crypto asset. Specifically, on Feb. 3, USDT peaked at $292 billion in daily volume. In contrast, XRP’s peak daily volume in recent years is $51.7 billion, a height it attained last December.

The Right Parameters

In our assessment, we used $0.292 trillion ($292 billion) as the expected daily volume. This indicates the level of activity XRP would need to reach to match USDT’s peak. Also, we set the average time between transactions per XRP at 10 days, assuming financial institutions actively use XRP to settle transfers multiple times per month.

For the store of value, we used $180 billion. Meanwhile, we chose a three-year time frame for these conditions to materialize. This window gives enough time for new partnerships, clearer regulations, and wider adoption to take XRP into heavier usage.

Furthermore, we also projected that XRP’s circulating supply would grow to 66.2 billion, which includes expected releases from escrow. For context, Ripple often leaves 200 million new XRP in the market each month, translating to 7.2 billion tokens in three years. Adding this to the current supply of 59 billion leads to 66.2 billion XRP.

Meanwhile, to adjust the future price back to present-day value, we applied a 2% interest rate. This represents an average return someone might expect each year over the next three years.

XRP Price at a $292B Daily Volume

Interestingly, after we plugged in all the numbers, the calculator delivered a projected value of $44.13 per XRP. Notably, this is a massive leap from its current price of $2.24, representing a growth of 1,870%. Notably, last August, pundit Mickle predicted XRP to reach $44. Also, in March 2025, EGRAG Crypto projected a possible rally to $44.

However, this assessment does not particularly suggest XRP will hit this price in the future. Rather, it shows what could happen if XRP starts handling the kind of activity stablecoins like USDT already see under the right conditions.

thecryptobasic.com

thecryptobasic.com