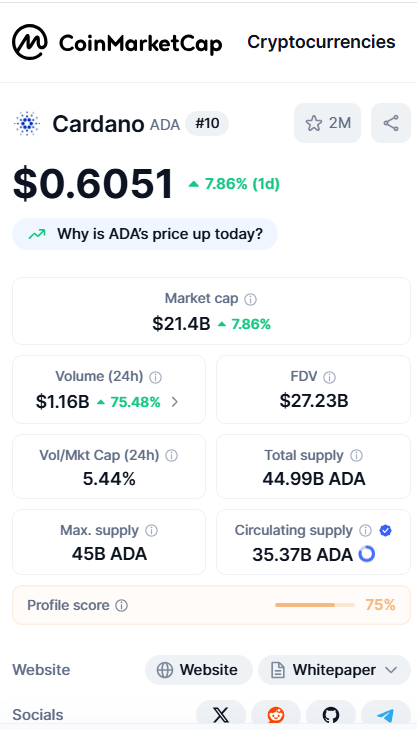

Cardano (ADA) has seen an increase in trading activity, with its 24-hour trading volume rising by 75% to $1.15 billion, according to CoinMarketCap data. The spike comes as the broader crypto market experienced $284 million in short liquidations, shaking out over-leveraged bearish bets.

According to CoinGlass data, liquidations totaled $352 million throughout the market, with shorts accounting for 80% of the total.

The cryptocurrency market surged in the early Thursday session, with Bitcoin reaching a three-week high. The significant short liquidation forced many bearish traders to exit their positions, contributing to upward pressure on asset prices.

Cardano increased nearly 8% in the last 24 hours, according to crypto ranking platform CoinMarketCap, to $0.601. The ADA volume rise might reflect a surge in trader interest as short sellers were forced to exit their positions as prices rebounded.

Cardano rose from a low of $0.538 on Wednesday to an intraday high of $0.611, its highest level since June 19. The 10th-largest cryptocurrency by market capitalization has reclaimed some of the ground lost in the previous month.

What's next?

Cardano has formed a "golden cross" on its hourly chart, confirming the recent bullish momentum.

On the upside, if buyers push the price above $0.61, ADA might reach its 50-day SMA of $0.663. Buyers might drive ADA above its daily moving averages of 50 and 200 at $0.663 and $0.765, respectively, signaling a trend change.

On the other hand, if the price falls and breaks below $0.54, Cardano could fall below the critical support level of $0.50. Buyers are likely to defend the $0.50 level with all their might, as a break below it would complete a descending triangle pattern. That might signal the start of a decline to $0.40.

u.today

u.today