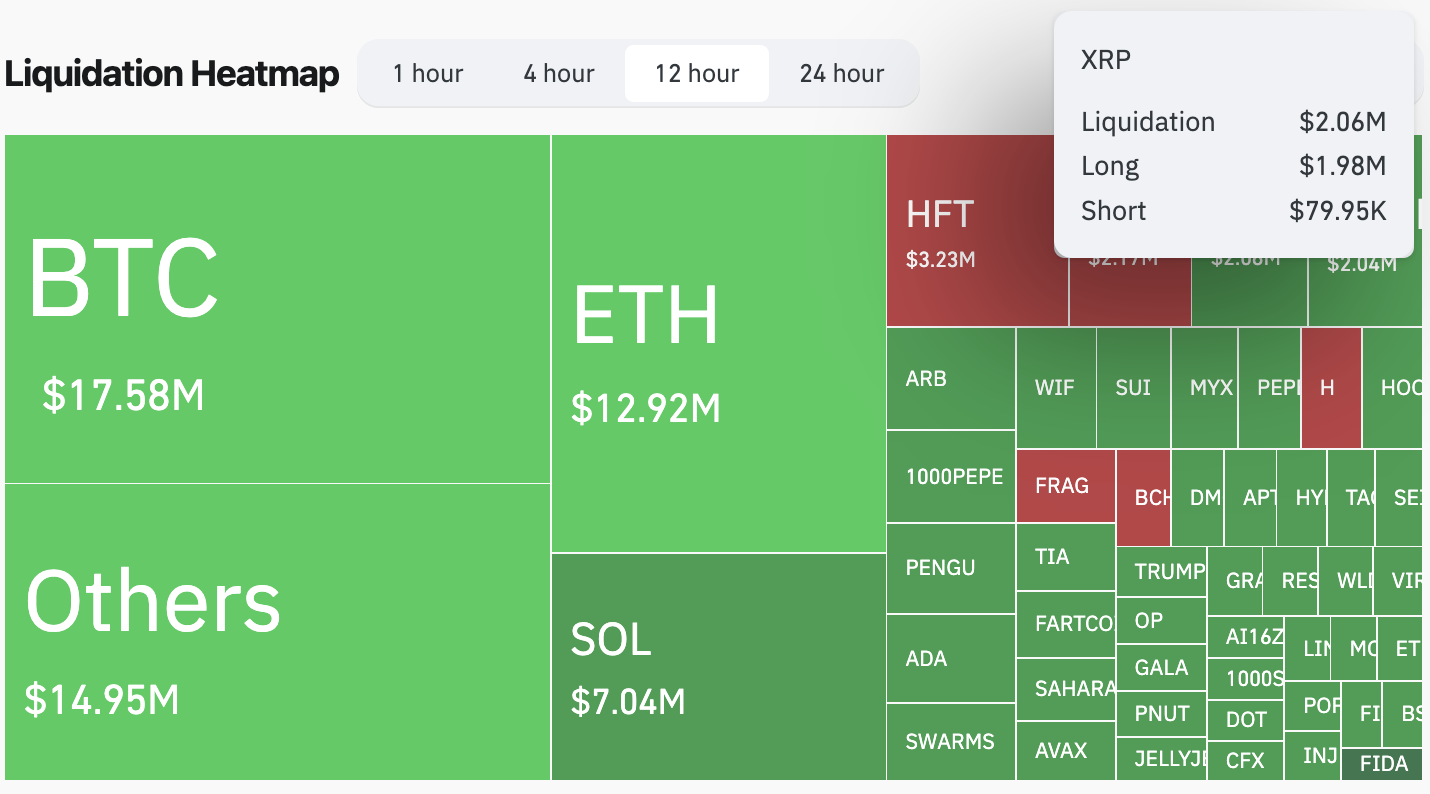

XRP bull traders were hit hard in the last 12 hours as long positions saw a sudden spike in liquidations, reaching $1.98 million — a 2,475% imbalance compared to just $79,950 in shorts, per CoinGlass data. The move came during a quick rally toward $2.33, followed by a painful drop that forced overleveraged long positions to reset.

The timing caught a lot of people off guard. When the XRP price broke through the local resistance, the market saw a surge in bullish exposure.

But the push did not last. In just a few hours, the price did a U-turn and led to a lot of liquidations all over the place, causing a one-sided rush on long trades. When the market catches FOMO, and then a sell-off happens, liquidations start hitting one side more than the other — a sign of imbalance.

XRP's sell-off happened at the same time as a lot of other coins are being liquidated. On the last day, over $208 million in positions were wiped out, affecting over 88,000 traders. Bitcoin and Ethereum had the highest totals, at $17.58 million and $12.92 million, but XRP was the one with the most extreme long exposure.

As of now, XRP is sitting at around $2.18. Things could be a bit rocky for a while as buyers reposition, and this kind of liquidation pattern usually leads to thinner books and more cautious entries.

u.today

u.today