The crypto market saw a major crash last weekend as tensions between Iran and Israel escalated. Bitcoin, Ethereum, and many altcoins dropped sharply, with traders rushing to sell as global markets remained closed.

However, most of the market has recovered since then. Bitcoin is now back above $105,000, Ethereum has rebounded over $2,400, and several top altcoins like XRP have also bounced strongly.

According to an analyst, several altcoins are showing strength and this could be a good time to slowly start accumulating promising projects for the long term.

Altcoins Showing Relative Strength

A few altcoins have stood out for showing “relative strength” while most of the market was down.

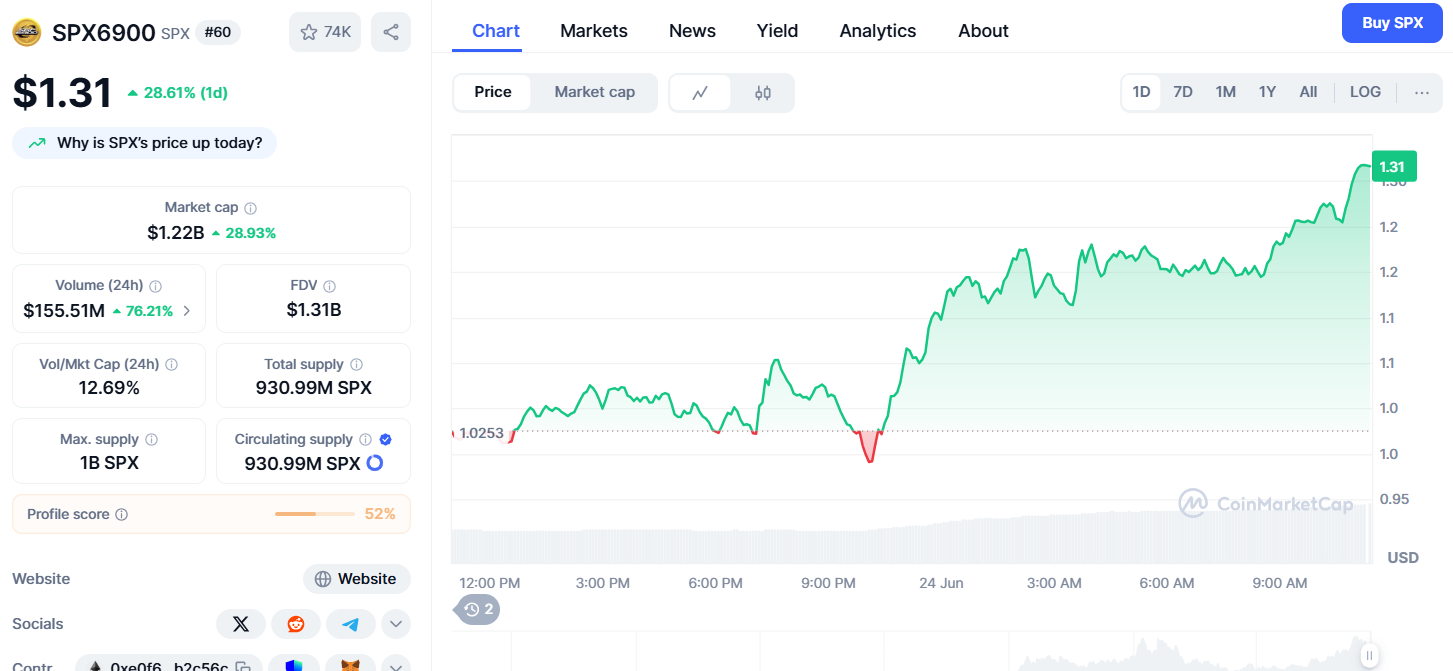

SPX is one of them.

It recently pumped to $1.77 and has since retraced about 46%, landing in a good price zone for long-term buying. It is currently up by more than 25% and is trading at $1.25.

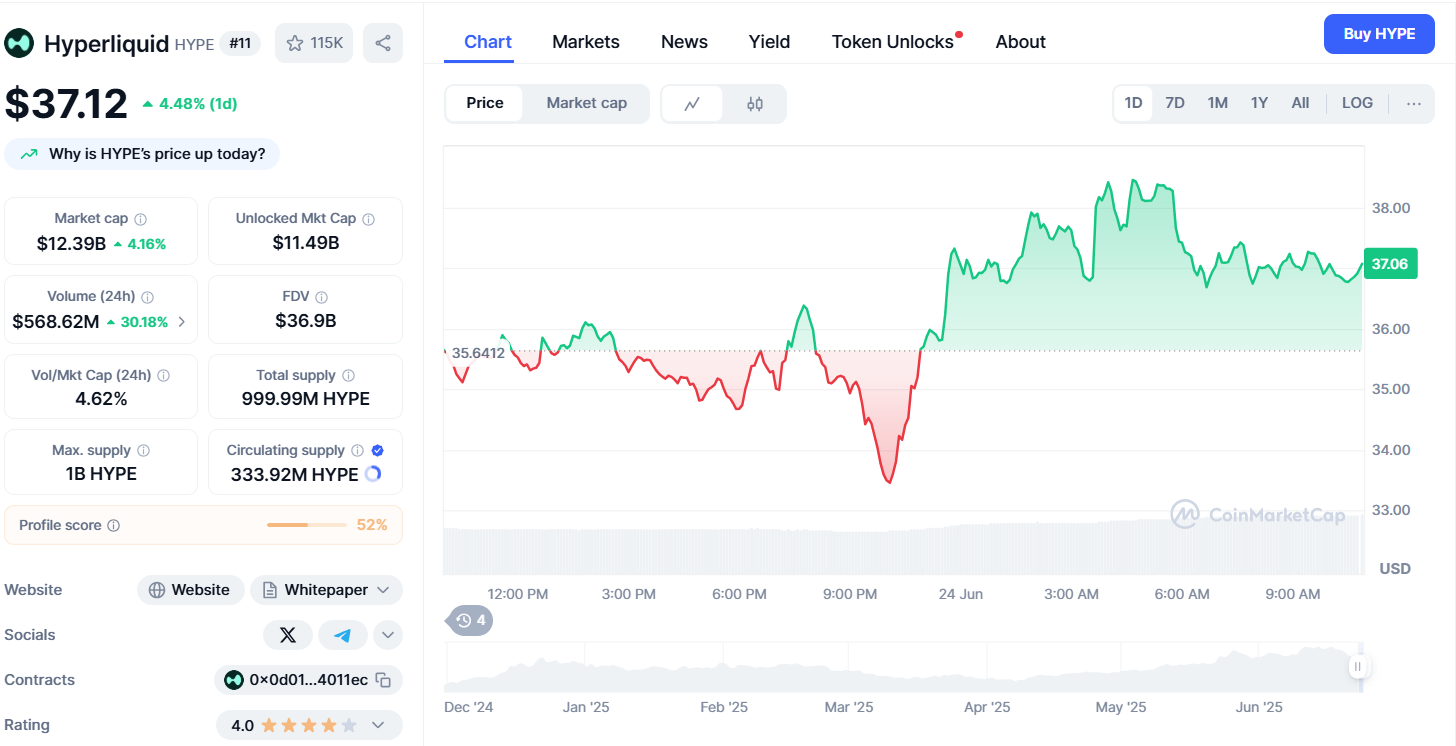

Hyperliquid is another name to watch, with a strong uptrend even in tough market conditions. It has finally pulled back after a long rally, offering a buying opportunity for those looking to add during dips.

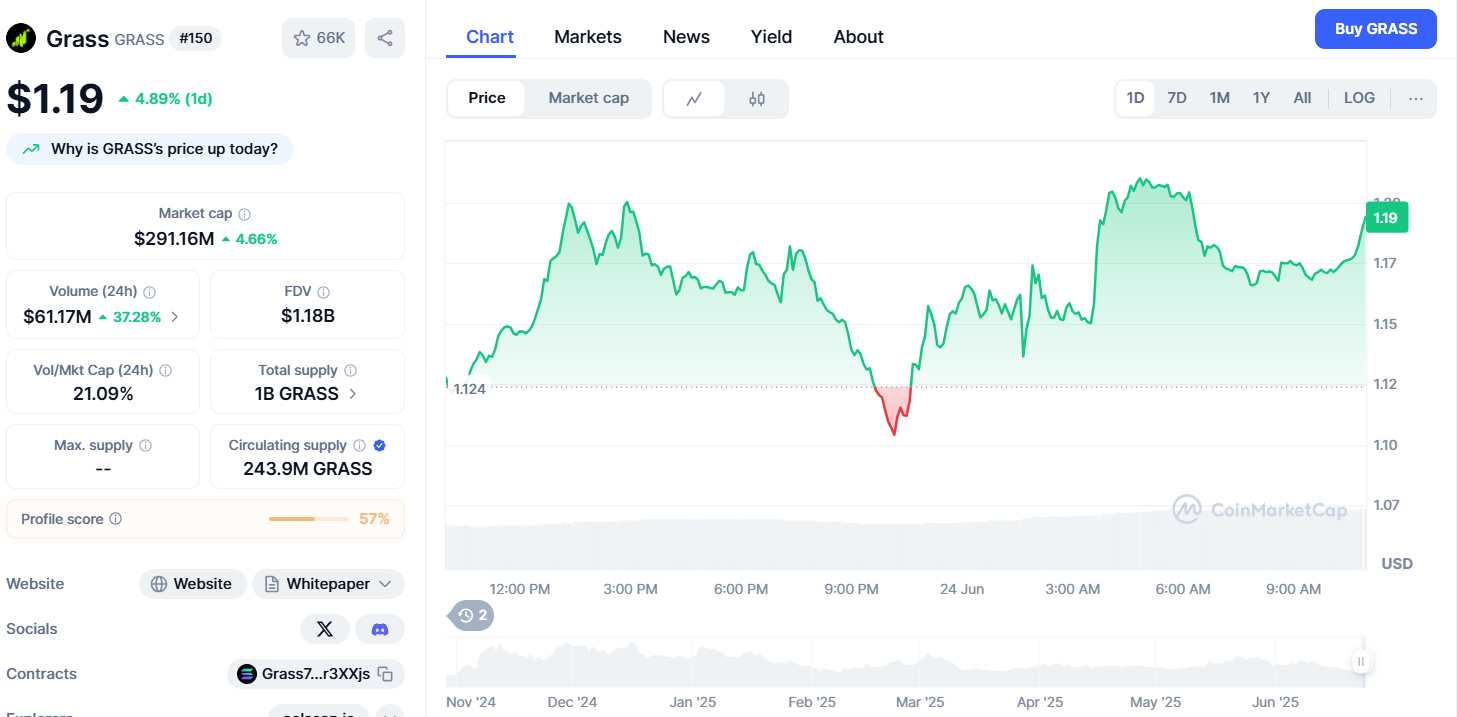

After trading near the $39 levels, HYPE has slightly dipped and is now hovering near the $36 mark. Next up is Grass, an AI-related token, which faced some negative news recently.

Related: Crypto Analysts Applaud SEI Bullish Momentum in a Bearish Market, Set a $0.30 Target

The token could soon hit the $2 mark, making it a decent option for accumulation around its support zone of $1.15.

Opportunities in AI and RWA Sectors

The analysis also points to opportunities in the AI and RWA sectors. Two coins worth keeping an eye on are Syrup and CHEX. Syrup rallied from $0.35 to $0.54 and has now pulled back 10% — making this a good chance for accumulation.

Related: Smart Money is Pouring Into ETH, XRP, HBAR, and SUI

CHEX has had a rough time, dropping sharply due to market sell-offs and possible exchange-related sell pressure, but the analyst said that remains one of the stronger long-term projects in the RWA sector.

Ondo token, often called the “BlackRock coin,” is also on the watchlist, although it’s currently a little off its ideal buying zone.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com