Analyst Tardigrade highlights a forming Golden Cross on the Dogecoin weekly chart, a setup that has preceded major rallies in past cycles.

Dogecoin (DOGE) is trading at $0.17 today, reflecting a 0.16% price dip over the past 24 hours and a 2.77% decline over seven days. While the short-term performance shows a downward trend, technical patterns suggest the possibility of a new bullish phase.

A recent analysis by Tardigrade on X highlights a key development: the formation of a Golden Cross on Dogecoin’s weekly timeframe. Historically, such patterns have preceded major upward price movements for the asset.

Dogecoin Golden Cross Pattern

Tardigrade’s analysis focuses on the interaction between Dogecoin’s 10-week and 20-week simple moving averages (SMAs). The chart shows the 10-week SMA (purple line) nearing a crossover above the 20-week SMA (orange line).

This crossover forms what is known in technical analysis as a golden cross, often interpreted as a sign of potential upward momentum. Notably, two previous golden crosses in DOGE’s recent history resulted in sharp rallies.

The first event took place in November 2023. At that time, DOGE surged from $0.06 to $0.229 by March 2024, yielding a 232.45% gain. The second Golden Cross occurred around October to November 2024. DOGE rose from $0.10 on October 14 to $0.48 by December 2024, a 313.57% increase.

Potential Outlooks for DOGE

The historical performance following Golden Cross formations suggests possible price targets. If DOGE were to mirror previous rallies, the chart projects a potential increase of 200% to 300%. This would place the next price range between $0.51 and $0.68.

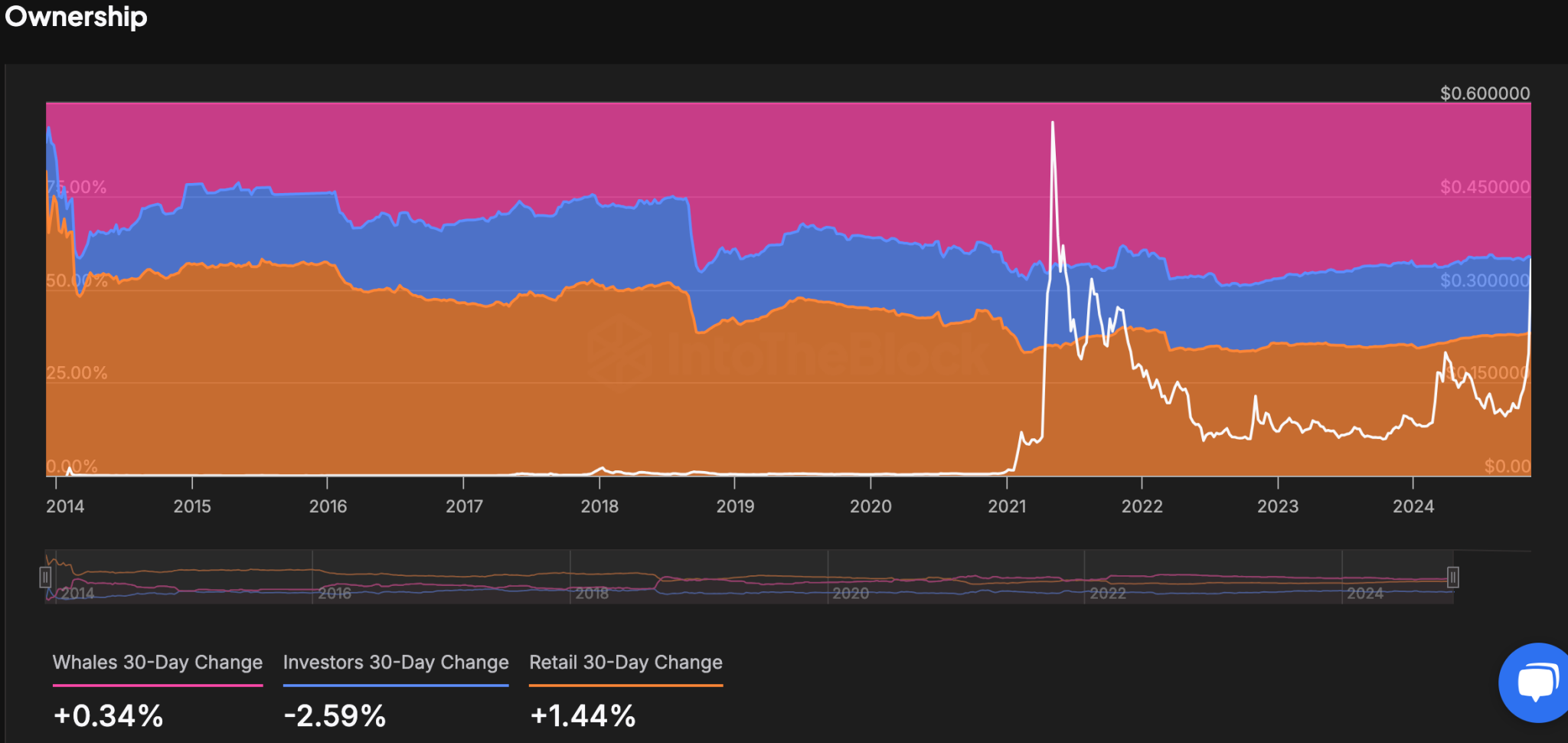

Ownership Trends Align With Technical Developments

Notable movement in Dogecoin’s ownership distribution supports the chart setup. Retail investor ownership has grown by 1.44% over the past 30 days, suggesting increased interest at the grassroots level.

Meanwhile, whale accounts, large holders of DOGE, increased their holdings by 0.34% during the same period.

In contrast, mid-tier investors showed a 2.59% reduction in holdings, indicating redistribution across investor classes. The current distribution data and 30-day trend suggest a renewed bullish momentum for DOGE.

thecryptobasic.com

thecryptobasic.com