Layer-1 blockchain coin IP is in the spotlight today. With an over 10% price surge, it has emerged as the market’s top gainer over the past 24 hours.

The move comes amid a broader market lull, where most assets have remained flat or posted modest losses. However, this rally comes with an increase in short interest, hinting at the likelihood of it being a dead cat bounce.

Traders Bet Against IP’s Double-Digit Rally

IP currently trades at $2.89, noting a 15% rally over the past day. While this price performance bucks the broader market decline, IP derivatives traders do not seem convinced. On-chain data show many are positioning for a price drop, even as the coin pushes upward.

According to Coinglass, IP’s funding rate has plunged to -0.62%, its lowest level in over four months. This marks a sharp shift in sentiment, suggesting that many traders are now betting against the rally.

Funding rates are periodic payments between long and short traders in perpetual futures markets. When funding rates are positive, long positions (those betting on a price increase) outnumber shorts, and longs pay shorts to hold their positions.

Conversely, a negative funding rate means that short positions dominate. This trend signals bearish sentiment, as traders expect prices to fall.

IP’s funding rate decline to a multi-month low indicates a significant spike in bearish conviction. It means many market participants are betting heavily on the downside in the near term, even as its price shows signs of recovery. The reason is clear: many traders believe the rally is unsustainable, especially amid growing geopolitical tensions in the Middle East.

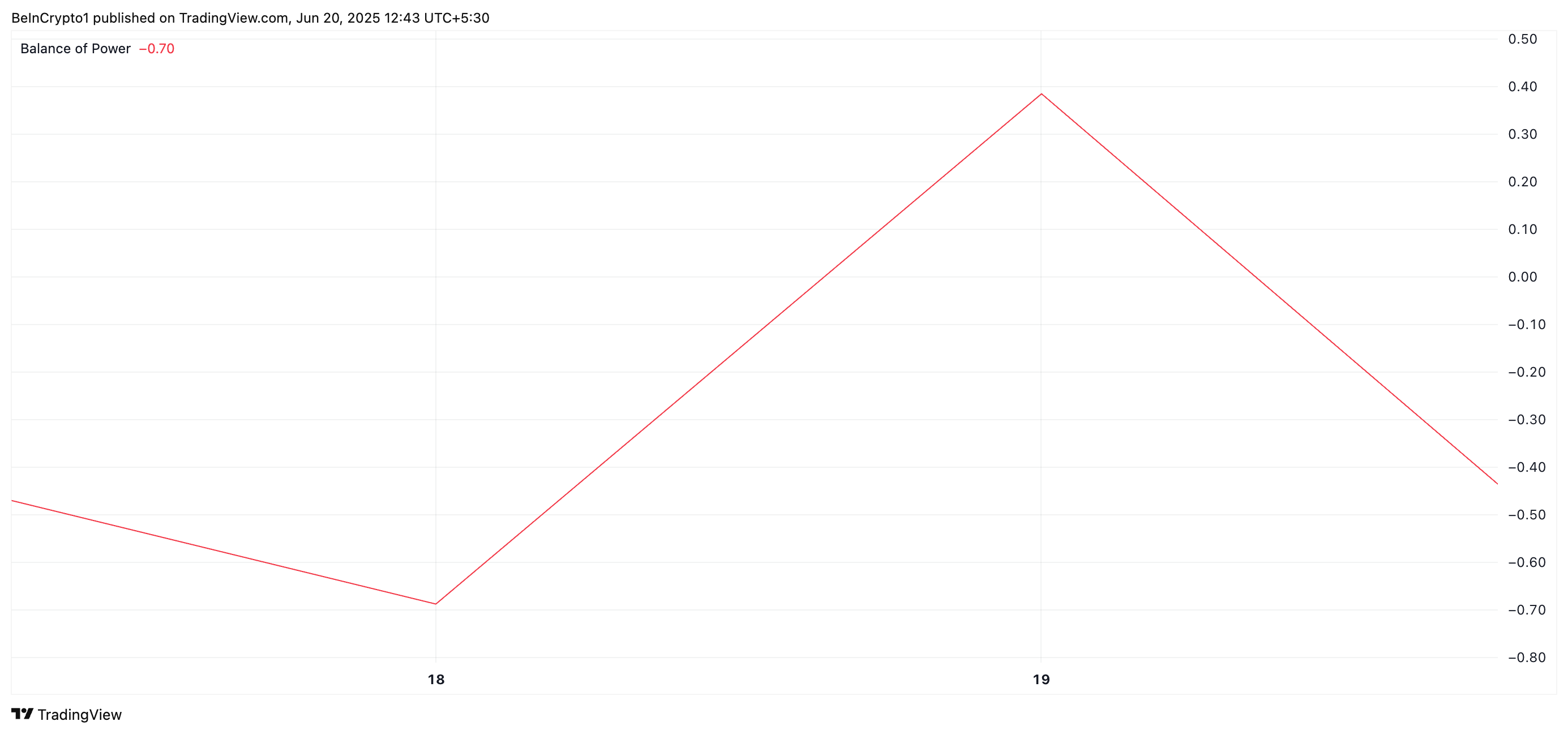

Moreover, the coin’s negative Balance of Power (BoP) on the daily chart supports this bearish outlook. As of this writing, this momentum indicator stands at -0.70 and is in a downward trend.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. Negative readings suggest buyers dominate the market over sellers, driving further price dips.

Will Bulls Defend the Line or Give Way to Bears?

At its current value, IP trades above a key support floor formed at $2.78. If demand stalls and the coin experiences a pullback, it could break below this level and slide toward $1.90.

Should the bulls fail to defend this threshold, the IP token price could revisit its all-time low of $1.36.

IP Price Analysis. Source: TradingView

However, if the coin sees a resurgence in new demand, it could reinforce its current rally and push toward $3.89.

beincrypto.com

beincrypto.com