Dogecoin, the largest meme cryptocurrency by market cap, experienced low volatility trading on Thursday, with its price plunging 0.4% to hit $0.17. This downtick likely followed the broader market uncertainty amid the escalating military action between Israel and Iran. While DOGE’s derivative market accentuated the continuation of the current correction, the coin’s price is positioned close to a high accumulation zone, signaling an opportunity for a bullish reversal.

Derivative Market Weakness Signals Bearish Continuation

Over the past week, the Dogecoin price has declined from $0.26 to $0.170, resulting in a 17.16% loss. The bearish momentum was primarily driven by escalating military action in the Middle East, now intensified with rumors that the United States could potentially get involved in the Iran-Israel conflict.

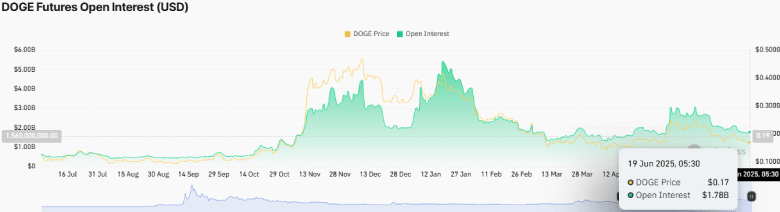

Along with price correction, the Dogecoin futures open interest recorded a notable decline. According to CoinGlass data, the DOGE-OI value has plummeted from $3.07 billion in late May to $1.78 billion, representing a 42% loss.

As this decline coincides with escalating geopolitical tensions in the Middle East, it reflects a broader shift toward market caution, with investors actively reducing their exposure to high-risk assets, such as meme coins.

If the trend continues, the bullish momentum behind DOGE could weaken, leading to a sluggish or prolonged correction.

Dogecoin Price to Test Major Support for Reversal

In May 2025, the DOGE showed a notable reversal from the $0.254 level, which pushed the price 33% down to its current trading of $0.17. This downswing displayed a fresh lower high formation in the daily chart, indicating the traders continue to follow its sell-the-bounce sentiment.

The Dogecoin price trading below the 100-and-200-day exponential moving average further reinforces the seller’s dominance in the asset. If the bearish momentum persists, the memecoin could tumble another 13.5% to test the multi-month support trendline at $0.15.

Since August 2024, this support trendline has acted as a dynamic support for buyers, bolstering a bullish reversal that extended from 44% to 440%.

Thus, the DOGE price could regain its bullish momentum at the bottom support trend and re-challenge the downsloping trendline that carries the current correction trend. A potential breakout from this barrier would confirm trend reversal and drive an initial surge to the $0.26 mark.

cryptonewsz.com

cryptonewsz.com