- AVAX price struggles near $18.50 support as long liquidations and bearish pressure grow quickly.

- Open Interest, funding rates, and weak indicators suggest capital is leaving while sellers hold control.

Avalanche (AVAX) saw its price drop 2% on Wednesday, trading at $18.67. This placed the token just above a crucial support that had remained intact since mid-April. The pressure at this level has increased, and any close below it could push the price even lower.

A weakening presence in derivatives markets shapes the current outlook. Data from Coinglass shows Open Interest (OI) has fallen to $445.03 million, its lowest point in the past month. The 1.80% dip in OI in just 24 hours signals declining capital inflow into AVAX-related positions.

This fading interest is further reflected in liquidation numbers. Over the same 24-hour period, $1.38 million worth of long positions were wiped out. In comparison, only $107,210 in shorts were liquidated. That brings total liquidation to $1.49 million, clearly reflecting the loss of bullish bets.

Bearish Bias Strengthens Amid Technical Signals

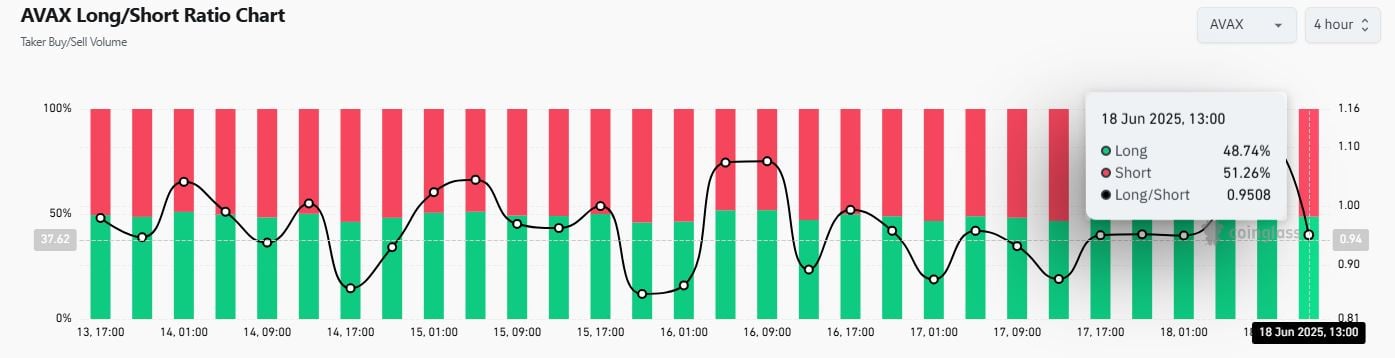

The shift in sentiment is visible across multiple indicators. The long-short ratio on the four-hour timeframe has fallen to 0.9508, suggesting bears are slightly ahead in active positioning. Meanwhile, the Open Interest-weighted funding rate has been hovering near the neutral line, last recorded at 0.0045%.

On the charts, the MACD indicator continues to point downwards. It has not been able to cross above the signal line, and growing red bars below the zero line suggest sellers remain in control. The RSI sits at 37, above the oversold zone but still far from signaling strength. There’s space for further downside if current pressure continues.

Supporting this case is the Chaikin Money Flow (CMF), reading -0.08, which means more capital is leaving AVAX than entering it. A similar pattern comes from the Balance of Power (BoP), which is at -0.14, signaling dominance of selling activity over buying pressure.

Avalanche Risks Slipping to $16.14 or Lower

AVAX has recently bounced from a low of $18.13 recorded on Tuesday, but price action remains under strain. Long upper wicks on recent candles suggest sellers are rejecting higher levels. If AVAX breaks the $18.50 support line, next downside levels sit at $16.14. This area was mentioned by trader Ian Cooper, who added that a fall in Bitcoin might drag AVAX further toward the year’s low of $14.66.

Cooper pointed out that AVAX is nearing a key support level at a descending trendline and that it might offer buying interest depending on Bitcoin’s next move. This underlines the current dependence of altcoin momentum on Bitcoin’s broader direction.

However, there’s also a scenario in which AVAX holds the $18.50 support. If the broader market stabilizes and buying interest recovers, the token could test the 50-day EMA located at $21.11. That would require a shift in sentiment, which remains fragile at the moment.

u.today

u.today

crypto-economy.com

crypto-economy.com

newsbtc.com

newsbtc.com