Toncoin (TON) price has been struggling to regain bullish momentum for the past few weeks. With prices hovering just under $3 and showing consistent weakness across both the daily and hourly charts, many traders are asking the big question—could Toncoin price really crash to 0? Let’s analyze the charts and project what lies ahead.

Toncoin Price Prediction: What Does the Daily Chart Reveal?

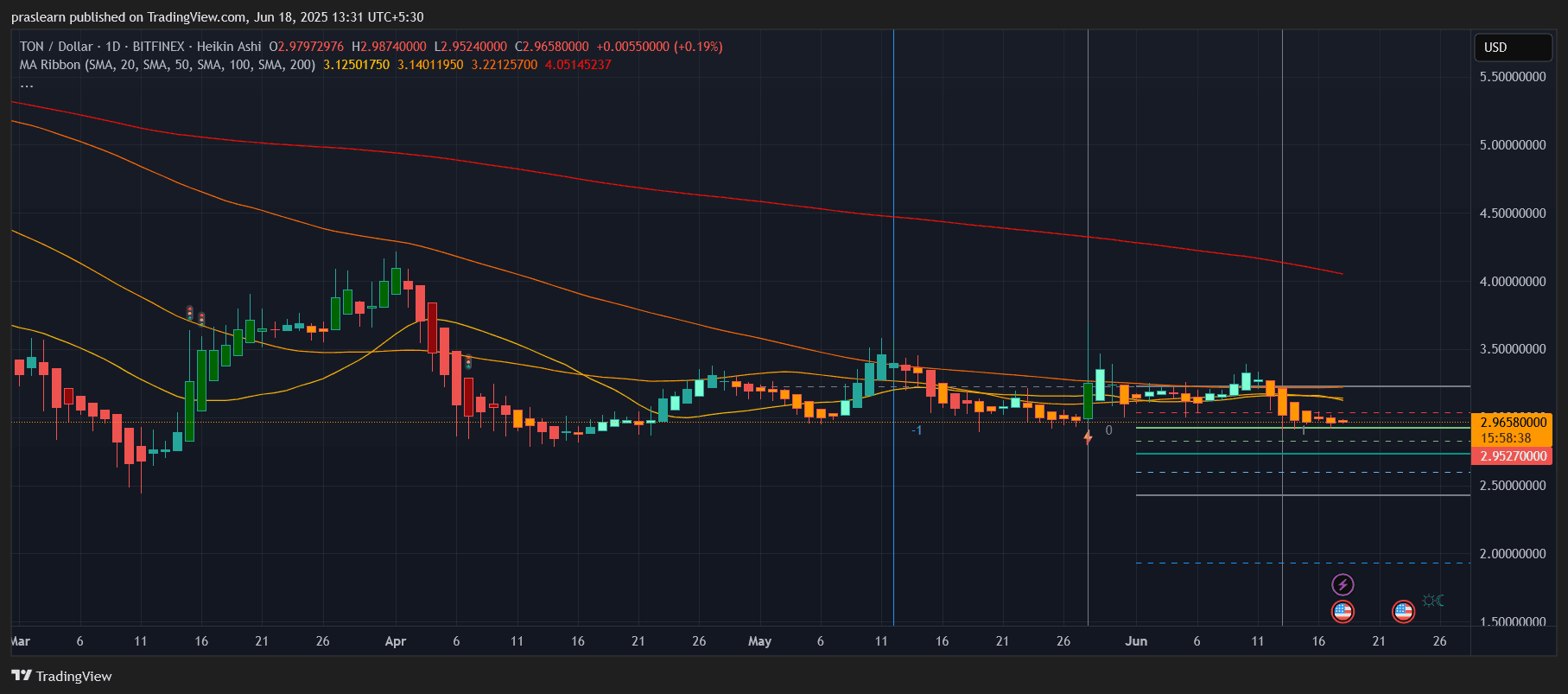

The daily Heikin Ashi chart shows a steady downtrend since mid-April, when Toncoin price hit a local high near $5. The moving average ribbon is clearly stacked in a bearish order. The 20-day SMA ($3.12) and the 50-day SMA ($3.14) are both above the current price of $2.96, and the 100-day and 200-day SMAs are even higher, suggesting that long-term momentum has turned bearish.

Recent candles show small-bodied formations, signaling indecision in the market. The price has been unable to close above the $3 psychological level, which now acts as a stiff resistance. Additionally, Toncoin price recently failed to sustain a brief rally in early June and has since formed lower highs and lower lows—a textbook bearish continuation pattern.

If we calculate the recent trading range, Toncoin price dropped from approximately $5.20 (April peak) to $2.96 today—a loss of 43% in just two months. That’s a significant erosion of value, and unless a strong bullish reversal kicks in, this trend may persist.

Is the Hourly Chart Any Better?

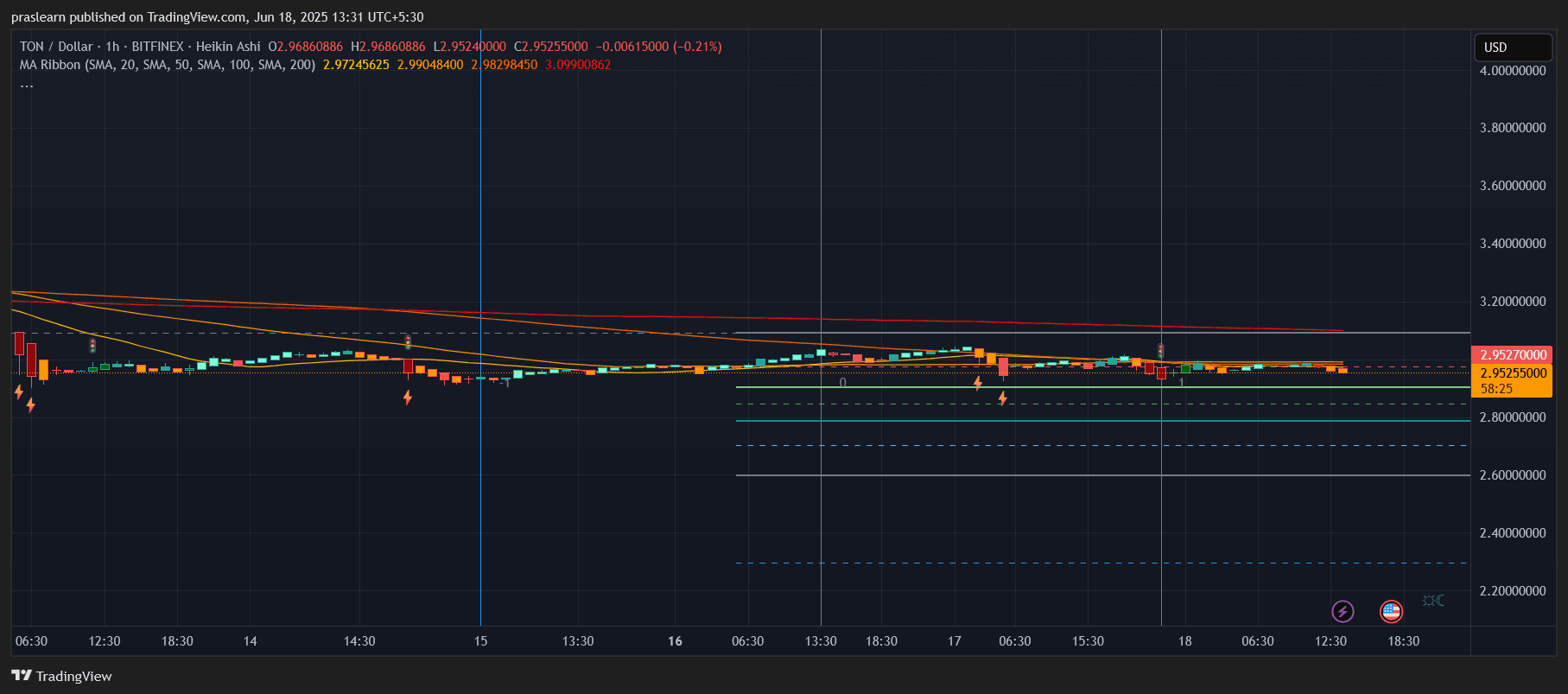

Looking at the 1-hour chart, the picture remains weak. The TON price is trading under the 20, 50, 100, and 200 SMA levels. The 200 SMA stands near $3.09, and with TON price stuck below $2.97, it’s clear that bulls have no real control in the short term.

Volume has also dried up, and the presence of flat consolidation over the last 48 hours suggests that buyers are hesitant while sellers are gradually dominating. There’s no breakout structure, and even minor rallies are being sold into quickly.

Short-term support zones appear near $2.90, $2.85, and $2.75. If Toncoin price breaks below $2.85 convincingly, we could see a further slide towards the $2.60–$2.40 region, with $2.20 acting as a worst-case local support.

Toncoin Price Prediction: Could Toncoin Price Really Crash to Zero?

A complete crash to $0 is highly unlikely under normal market conditions. Toncoin price is backed by The Open Network ecosystem, which has been gaining traction in messaging and smart contract development. However, from a trader’s perspective, the risk of a prolonged bearish phase remains high.

Let’s run a simple scenario. If Toncoin price continues to drop at its current average monthly rate of -20%, it could fall like this:

- End of June: ~$2.40

- End of July: ~$1.92

- End of August: ~$1.54

- End of September: ~$1.23

By this calculation, TON price could lose more than 50% of its value by September if the bearish trend persists and the network doesn’t introduce any bullish catalyst.

However, crashing to zero would require a massive fundamental collapse—such as the project being abandoned or delisted from major exchanges—which is not on the horizon as of now.

What Needs to Happen for a Recovery?

TON price must reclaim the $3.10 level first to break back above the short-term resistance and invalidate the bearish SMA structure. If it breaks above the 100-day SMA at $3.22, it could attract some bullish momentum. For a real reversal, a strong move above $3.50 would be needed, paired with rising volume.

Until then, the trend is clearly downward, and any bounce may just be a bull trap unless supported by news or ecosystem growth.

Final Verdict

No, Toncoin price is not going to crash to $0 unless something catastrophic happens. But based on the current charts, the price is in a steep decline, and there is no bullish structure visible in either timeframe. Caution is advised. Traders should watch the $2.85 support closely—if that breaks, further downside becomes increasingly likely.

If you're a long-term believer, this may look like an accumulation zone. But for traders, the trend is down, and momentum indicators support a bearish view for now.

$TON, $Toncoin

cryptoticker.io

cryptoticker.io