The Sui (SUI) ecosystem continues to show impressive fundamental strength, even as its native token has seen a notable price correction. A deep dive into the data reveals a significant disconnect between the network’s booming on-chain activity and its recent price action, a dynamic that some analysts see as a potential long-term opportunity.

Renowned market analyst Michaël van de Poppe recently highlighted Sui as one of the most promising non-EVM blockchain projects, citing its rapid growth and signs of technical resilience.

Sui’s On-Chain Growth Accelerates as Key Metrics Soar

Sui has shown remarkable expansion across multiple on-chain metrics. Stablecoin holdings on the network have tripled since January, surging from $400 million to nearly $1.2 billion.

This tripling in supply reflects growing user trust and liquidity flowing into the ecosystem. Moreover, total value locked (TVL) now stands at $1.8 billion, placing Sui third among non-EVM chains a significant achievement in a competitive landscape.

Wallet adoption is also gaining momentum. The Sui ecosystem has seen notable integration with Phantom, a popular multi-chain wallet. Additionally, the native SUI wallet has undergone a rebrand to Slush, bringing a more user-friendly identity and interface to the platform.

Lending activity is booming too. SuiLend, the protocol’s native lending platform, now secures over $600 million in TVL. This marks a 90% increase in just one month.

$SUI remains super interesting as an ecosystem.

— Michaël van de Poppe (@CryptoMichNL) June 16, 2025

Fundamentally, they have been adding updates:

– The amount of stablecoins on the chain has gone vertical, as it was $400M in January and is now close to $ 1.2 B.

– Total value locked has reached $1.8B, which is the 3rd among… pic.twitter.com/D2PZhhy2Dg

Market Correction Presents a Potential Opportunity

The market’s recent dip has pulled SUI’s price to $2.94, down 13.71% over the past week. However, this decline may offer opportunity. According to van de Poppe, Sui is mirroring a previous pattern where a breakout above $3.30 could trigger a major rally. Liquidity above this level may act as fuel for bullish momentum, should buyers step in at key supports near $2.50.

Technical indicators support a cautious but watchful stance. The MACD shows bearish momentum with a negative histogram reading of 0.0308. The RSI sits at 38.39, approaching oversold territory but not quite there yet. Historically, such levels have preceded rebounds.

Watching the Next Move

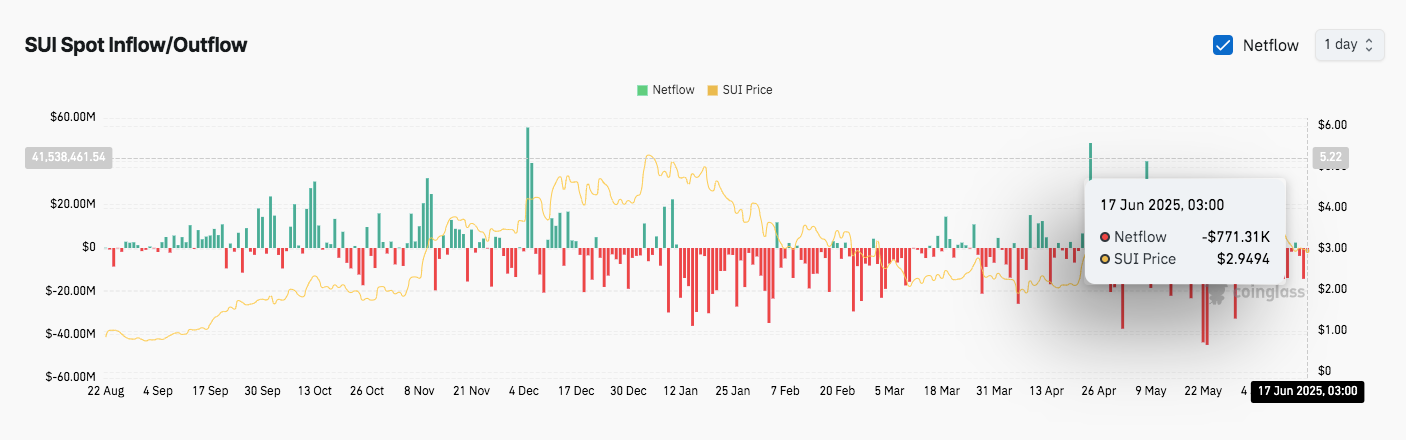

The SUI Spot Netflow chart indicates strong outflows since April, pointing to potential profit-taking or cautious sentiment. On June 17, net outflows totaled over $770,000. While this adds short-term pressure, such trends often reverse if technical support holds and fundamentals stay strong.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com

u.today

u.today

cointelegraph.com

cointelegraph.com

beincrypto.com

beincrypto.com